Suppliers choose BMW and Porsche as preferred customers despite their increasing demands on price reduction

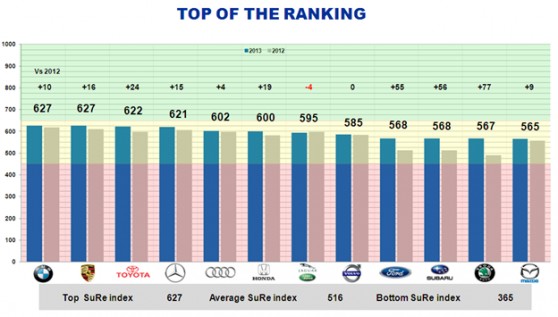

- BMW and Porsche advance in the annual IHS study on OEM-supplier relations as competition for the top position intensifies. Ratings of top-4 carmakers BMW, Porsche, Toyota and Mercedes are concentrated in a small range.

- Premium carmakers are becoming more price-conscious in purchasing parts from suppliers. Suppliers’ profit opportunity gap between selling to premium OEMs and volume carmakers is reducing.

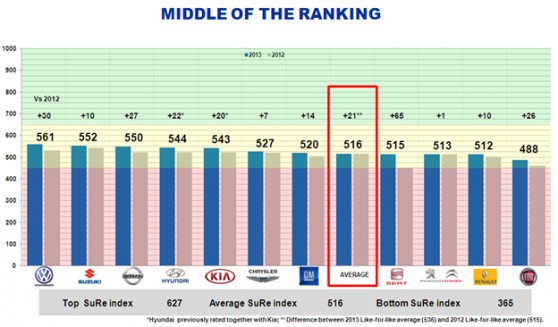

- IHS has recorded an overall improvement of OEM-supplier relations according to its metrics, despite OEMs’ pressure on suppliers to deliver significant purchasing efficiencies. The higher average ratings are driven by OEMs’ attempts to address some long-standing issues in the area of “Trust” and “Organisation”, examples of this being Hyundai and Ford, which have emerged as more trustworthy customers than in previous editions of the study.

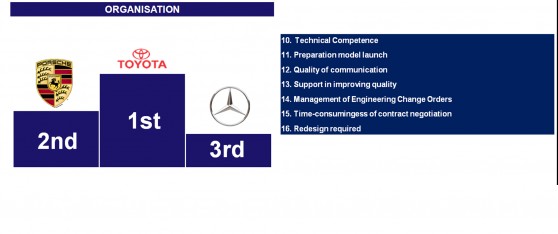

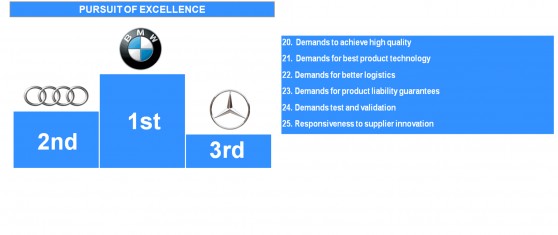

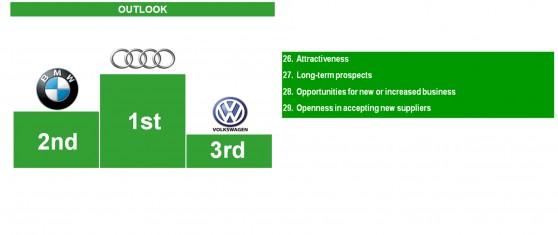

Automotive suppliers globally have chosen BMW and Porsche as their customers of preference, despite both premium OEMs becoming tougher in price negotiations, according to suppliers taking part in IHS annual OEM-supplier relations study. Both BMW and Porsche have scored 627 in the SuRe (Supplier Relationship) index scale, a performance metric of the quality of relationship between suppliers and OEMs, based on 29 criteria, allocated in five categories: Profit Opportunity, Trust, Pursuit of Excellence, Organization and Outlook. BMW leads the “Pursuit of Excellence” category, which gives an assessment of how demanding OEMs are with regards to product technology, quality and operations. Another German premium OEM, Audi, leads the “Outlook” category of the SuRe index, which assesses the overall level of attractiveness of OEMs and the perceived long-term opportunities with such customers.

BMW and Porsche have dominated the top positions of the ranking since 2011, following a period in which Toyota and Honda lost favour among suppliers. The top of the SuRe index ranking sees stiffer competition than in previous years with the ratings of the first four carmakers separated by only six points in the SuRe index scale. Porsche’s improvement compared to last year has allowed it to reach BMW at the top of the ranking, while Toyota stages a partial comeback after three years of decline and grabs the third position held by Mercedes in 2012.

Average ratings have improved by 21 points compared to the 2012 results, excluding new OEMs added to the study in 2013. The drivers of such improvements are improved long-term prospects in the case of some customers who are becoming more attractive for profit reasons to supply to (e.g. Chinese OEMs which started from a low base). In a similar fashion, OEMs which have historically had lower ratings in the “Trust” area, for example Hyundai and Ford, have improved significantly.

Premium OEMs giving fewer profit opportunities to their suppliers

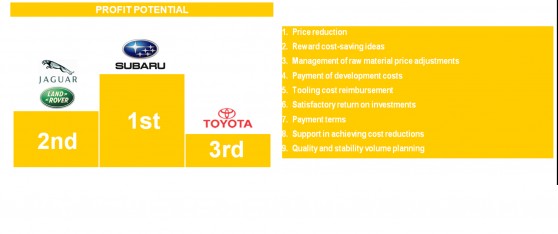

A more general trend hinting at a greater awareness by the OEMs of the importance of good OEM-supplier relations seems to emerge. However this does not seem to be linked to more favourable commercial terms for suppliers. Despite improving their overall ratings, as many as 11 carmakers out of the 35 ranked by suppliers have recorded lower scores in the “Profit Potential” category, which reunites criteria related to pricing and commercial aspects such as payment terms, reimbursement of tooling and development costs. Most of the drops affect premium carmakers such as BMW, Daimler, Audi, Porsche and even Jaguar Land Rover, which distinguished itself last year as the automaker giving more profit opportunities to its suppliers.

“It is clear that as premium OEMs start to see their profit dip, they will push suppliers to deliver critical savings to prop up their bottom lines. What matters is the magnitude of the purchasing savings they try to achieve and whether suppliers are supported in finding ways to achieve these savings or they are asked to achieve them single-handledly”, said Matteo Fini, author of the study and senior consultant at IHS Automotive.

Some volume carmakers that were perceived as extremely price-focused seem to have eased a bit their approach, such as Fiat and Nissan, which record an increase of their “Profit Potential” ratings by 7% and 6% respectively. Such movements combined the more aggressive stance on price from premium carmakers like BMW and Mercedes suggest that the gap in profit potential for suppliers between supplying premium OEMs and volume carmakers is getting smaller than in the past.

Ratings differentiations across component sectors

A single OEM may get differing scores across the component sectors it purchases parts from. Results actually show distinctive approaches of the OEMs towards the different component sectors with marked variations of the SuRe index rating. For example BMW emerges as more price focused for powertrain components than for electrical and electronic parts.

“Significant dispersion of SuRe index ratings across different purchasing areas indicates the presence of inconsistencies in how Purchasing departments and other vendor-facing personnel handle the relationship with suppliers”, Fini commented. BMW recorded a SuRe index rating of 698 in the Electrical area, while only 559 in body-in-white. Nissan also records among the highest deviations of ratings across the different sectors, while Ford has the most consistent results.

The component area of body-in-white shows consistently lower SuRe index ratings than other component areas for all OEMs, suggesting this is one of the supply areas with less collaboration between OEMs and suppliers.

Detroit Three: Ford accelerating, GM and Chrysler stalling

This year’s study tells a mixed story on the Detroit Three. Ford emerges as one of the big winners of this year’s study, as its overall SuRe index rating by increased by 55 points to 568, recording also a 4% improvement in its “Profit Potential” ratings. Ford’s cross-town rivals GM and Chrysler, which had had made great strides in establishing more collaborative relationships with their suppliers, record only marginal improvements in 2013.

“Ford shows bold commitment to improving supplier relations, with a few interesting initiatives reinforcing the idea that it is trying to establish relationships for the longer-term, one being pre-sourcing for performing suppliers” Fini said. GM and Chrysler have both backpedalled particularly in the “Profit Potential” category, meaning that they have a more aggressive stance on pricing. “GM and Chrysler have addressed some of the deepest flaws in their relationship with the supply base, but still have major issues. For example both appear weak in giving credit to suppliers’ cost reduction efforts”.

European volume OEMs not losing the cost focus

European mass car makers still struggle to establish fruitful and long-term collaborations with their suppliers, as they post sub-optimal and less consistent performances on a year on year basis. Volkswagen and more prominently its sister brands Seat and Skoda have recorded some decent improvements in 2013, however it remains to be seen whether this is the beginning of a new trend suggesting Volkswagen group invests more in OEM-supplier relations. Fiat also manages to increase its ratings by nearly 6% compared to 2013. However both Fiat and Volkswagen are still among the most demanding customers in terms of price reduction according to suppliers that participated in the study. PSA’s position in particular appears critical as its improvement in the SuRe index rating is rather limited in 2013, while its competitors are all advancing. “PSA seems to be looking rather aggressively for additional ways to reduce its costs base through suppliers. This can lead to a long-term deterioration of its relationship with suppliers”. Renault is on a similar journey, with suppliers rating the French automaker as the one requiring the highest annual price reduction to its suppliers.

Emerging OEMs’ issues

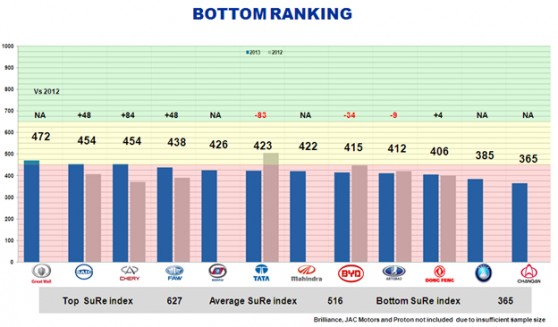

This year’s study also marks the addition of BYD, Geely, Great Wall, Changan, SAIC-GM-Wuling and Mahindra to the coverage of IHS study. Domestic carmakers in India and China do not seem to have supplier relations at the top of their agenda, although some positive signs are becoming apparent. Chinese carmakers Chery, FAW and Shanghai Auto record some of the most significant improvements this year. However their track record on supplier relations is unproven and they are still in critical territory in the SuRe index scale, represented by a rating lower than 450. The degree of development of these OEMs’ technical capability does not seem to be linked to the awareness of the importance of good OEM-supplier relations. “Geely is among the most technically capable OEMs in China but seems less concerned about establishing good relations with suppliers when compared to other developing Chinese OEMs” says Fini.

Other aspects compensating OEMs’ cost focus

While OEMs’ obsessive cost focus seems to have sparked attrition with the supply base, OEMs have managed to improve in other areas of the relationship by establishing greater trust-worthiness with suppliers or providing a more cooperative organization. IHS has recorded an average increase of ratings in the “Trust” category of 5% compared to 2012. Ratings in the “Organization” category show a similar momentum with a 4% improvement over 2012 results. Some automakers that had historically attracted disappointment from suppliers with regards to sensitive issues, such as providing little protection of suppliers’ intellectual property or being inclined to switch suppliers in search of better prices, have made strides in this area; for example Hyundai and Ford.

Suppliers have also indicated that Volkswagen and its sister brands Skoda and Seat, as well as premium automakers BMW and Mercedes, have proved more supportive to their suppliers. OEMs have launched initiatives to improve communication with suppliers and provided more help to achieve their quality targets. Such initiatives have been recognised and appreciated by suppliers, and can be an enabler towards the establishment of long-term and mutually benefitting relationships between automakers and suppliers.

About the SuRe index

IHS Automotive’s SuRe index is based on a survey programme of the automotive supply industry which started in 2005. From its inception, the survey has seen the participation of more than a thousand senior to middle managers working at automotive suppliers and directly interfacing with OEMs' personnel. In 2012, 49% of the 280 respondents were based in North America, 32% in Europe, 15% in Asia and 4% in Africa and the Middle East. The 2013 study covers 50 of the world’s top 100 automotive suppliers.

A variety of suppliers’ organisational functions are surveyed in order to include the different perspectives on the business relations and practices of OEMs. Respondents are active in marketing and sales, engineering, program management, research and development, quality and manufacturing. The 29 questions are organised under five categories: Profit Potential, Organisation, Trust, Pursuit of Excellence and Outlook. The questions cover the different phases of interaction, from request for quotation through development to warranty liability management. These result in a numeric value, ranging from 0 to 1,000. A SuRe index higher than 650 is considered a satisfactory result, while anything below 450 indicates the state of relations is poor.

Contact:

Matteo Fini

Senior Consultant

IHS Automotive

+44 203 1593 478