Recent moves by Qualcomm, Infineon Technologies and International Rectifier suggest increasing consolidation in the industry

Capped by the announcement that Qualcomm Inc. would buy CSR PLC, the automotive semiconductor industry has recently been undergoing a wave of merger and acquisition (M&A) activity that has shaken up the competitive order of the market, according to IHS.

In two major deals announced in August, Germany’s Infineon Technologies AG said it would acquire US-based International Rectifier Corp., while On Semiconductor Corp. sealed a deal to acquire fellow American firm Aptina Imaging Corp.

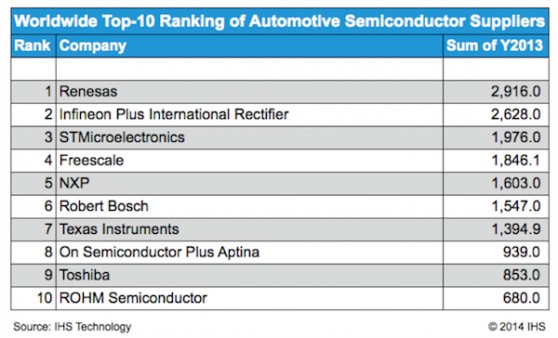

With the International Rectifier deal, Infineon bolstered its No. 2 rank in the global automotive semiconductor business and helped it to close the gap on the market leader, Renesas of Japan. Following the acquisition, Infineon trails Renesas by just USD288 million, down from nearly USD500 before Infineon bought International Rectifier, based on ranking data from 2013.

Meanwhile, the Aptina acquisition expanded On's automotive semiconductor revenue by USD183 million, allowing On to move up one position to eighth place in the market, also based on 2013 ranking data.

The purchase of the UK’s CSR will allow California-based Qualcomm to enhance its market share. Qualcomm ranked No. 43 in 2013, while CSR came in at 23. The two companies combined would have ranked at No. 19 in 2013.

“While these three M&A deals differ in their specific goals and benefits, all have the same strategic objective: expanding market share in the lucrative business for semiconductors used in automobiles,” said Ahad Buksh, analyst for automotive semiconductors at IHS. “The automotive supply is adding new infotainment, communications and driver-assist functionality at a rapid pace, causing related semiconductor revenue to rise 5% to reach USD26 billion in 2013. Suppliers are buying up competitors to gain scale in the market, to add key capabilities and to capitalize on established customer relationships.”

Clash of the top 10 titans

The attached figure presents the IHS ranking of the world’s top 10 suppliers of automotive semiconductors in 2013, showing the impact from the recent acquisitions.

All of these 10 companies are increasingly investing in automotive, having identified the area as a strategic field of expansion. At the same time, most of these companies are divesting from other markets, such as wireless and consumer electronics.

The strong positions held by the top 10 suppliers are the result of decades of investment to meet the specific requirements of leading customers. These requirements include high product quality and strong service support. IHS believes that automotive manufacturers will tend to maintain long-term relationship with these established semiconductor suppliers.

To Infineon and beyond

Infineon’s acquisition of International Rectifier will not only diversify the former’s product portfolio but also make it a bigger threat to Renesas.

Last year was great for both Infineon and International Rectifier, with automotive-related revenue at the two companies rising by 11.7% and 15.6% respectively. In contrast, the declining exchange rate of the Japanese yen versus the U.S. dollar meant that Renesas suffered a 14.2% drop in automotive revenue in 2013. What used to be a lead of more than USD1.2 billion for Renesas over Infineon in 2012 eroded by 60%.

Once the International Rectifier acquisition is complete, Renesas’ lead will shrink further.

International Rectifier’s strong presence in low-power insulated-gate bipolar transistor (IGBT), power modules and power metal-oxide-semiconductor field-effect transistor (MOSFET) will project Infineon into the top spot in the discrete integrated circuit (IC) category. This particularly reinforces Infineon’s position in the fast growing hybrid and electric vehicle segment. Intelligent power switches, data converters and application-specific integrated circuits (ASIC) from International Rectifier will also complement Infineon’s portfolio and will generate economies of scale. Even though Infineon’s second position in analog ICs won’t change, the acquisition will help it close in on the top player in the segment, STMicroelectronics.

On the acquisition hunt

Aside from bringing On Semiconductor closer to the USD1 billion mark in automotive semiconductors, Aptina’s sensor business is of strategic importance, as it was a weak spot in On’s portfolio. Now, On Semiconductor can count itself the leading supplier of complementary-metal-oxide semiconductor (CMOS) imaging sensors, which serve as the eyes of advanced driver assistance systems (ADAS) in vehicles. The rapid adoption of ADAS will drive markets for automotive image sensors to attain 10% growth per year from 2013 to 2020, making it a good investment for On.

These moves could be seen as part of a trend towards consolidation across the whole automotive supply base, with the most high-profile being that of ZF’s acquisition of TRW.

Data in this article was derived from the report entitled “Competitive Landscaping Tool CLT - Automotive - Q3 2014” from the Automotive Semiconductor service at IHS Technology.