Announcements by Renault and BMW have shown the route that OEMs will be taking this year and beyond

With the dust settling busy 2014 for the automotive industry, it’s always tempting to take stock and guess as to ask what trends are likely to shape the automotive industry in 2015. IHS Automotive’s Senior Director Long Range Planning, Phil Gott identifies a number of issues for the industry to consider over the next twelve months, “Fuel price changes are going to turn the alternative fuels industry upside down. Growing use of ADAS and fledgling ITS systems will make urban traffic safer and navigation a bit easier.

“Elsewhere, urban transportation planners and regulators will continue to make non-motorized individual transport easier and more convenient, while increasingly regulating the types of vehicles that can be used on city streets. As investments in alternative technologies and the range of possible alternatives increases, people will begin to (finally) ask ‘What exactly is the problem we want to solve, and what is the Total Impact of the range of solutions we are considering?’. If they aren’t asking this question, it will become increasingly obvious that they should!

“The ignition switch and airbag recall experience will sensitize the market towards technology in general, making public acceptance of new innovations from the auto industry a bit more challenging.”

But the end of 2014 saw a couple of announcements by OEMs that are also set to shape the market this year and beyond. Renault revealed a range of technical innovations that look set to form part of its future model line-up. Among the innovations that are set to be introduced in 2015 is a new synchronous motor with wound motor for electric vehicles (EVs) which produces 65kW and 220 Nm of torque. Renault has said it is 10% smaller but gives the same level of performance, helped by the miniaturisation and integration of some modules. There have also been efforts to increase the simplification through air cooling for the electric motor. Changes to the electronic management and charging system have also seen an improvement in efficiency and low power charging.

On a more conventional powertrain front, the company will also launch a dual-fuel version of its three-cylinder, 900-cc turbocharged engine that will use both gasoline (petrol) and liquid petroleum gas (LPG). The automaker said that it has achieved a balance between turbo boost and LPG pressure that enables the factory fitted system to use LPG for the maximum time. It added that there is also an improvement of around 20% in fuel efficiency when compared to older systems.

Even more intriguing is the announcement that Renault is developing a new small diesel engine using a two-stroke cycle. It said that while the efficiency of a traditional four-stroke diesel is around 35%, a diesel using the two-stroke cycle stands at around 50%. Renault said that initial results are promising, even during the research phase, but that power remains low due to the technology being in an exploratory phase.

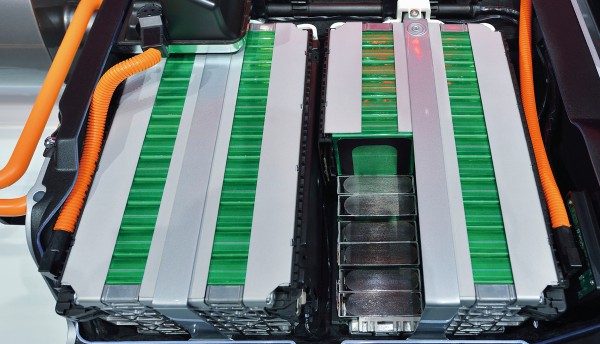

Meanwhile, BMW wants more consultation on regulatory changes and says battery technology advances may supersede fuel cell programme. BMW's head of sales and marketing, Ian Robertson, said we are near a tipping point where alternative powertrains will become increasingly popular.

Robertson was responding to the news that major cities such as Paris may turn their back on diesel and ban the fuel type from their centres. However, Robertson said that the potential for European cities becoming out of step with each other on a regulatory basis would not be beneficial for consumers or OEMs in the longer term, especially as the move to fleet-average CO2 emissions of 95g/km by 2021 and the move to Euro VI was already placing considerable strain on R&D budgets and resources.

Robertson also gave some insights into BMW's joint-venture (JV) hydrogen fuel cell programme with Toyota. He explained that BMW was very close to beginning tests with its own fuel-cell production but that the technology may never make it to production if there are major advances in battery technology for electric vehicles (EVs).

OEMs have made significant strides in packaging the fuel cell stack and hydrogen storage in recent years, which has traditionally been one of the issues with fuel cell cars. However, as Robertson pointed out the challenges of hydrogen production, storage and distribution for fuel cell passenger cars are still key.

Robertson's comments give an interesting insight into the concerns regarding future powertrain technology and the pace and factors leading to their commercial implementation. There is no doubt that regulatory factors act as a catalyst for change and push OEMs into introducing advanced technologies that reduce CO2 emissions and offer improved fuel efficiency across all their model ranges.

With regards to the proposed ban on diesels in Paris, this will not only hit premium OEMs like BMW and Daimler's Mercedes-Benz but also French OEMs Renault and PSA, which sell a high proportion of diesel cars in France. Although the French government is already planning to increase the duty on diesel as part of efforts to push drivers towards alternative fuel and powertrain types, the mayor of Paris is looking to take even more extreme steps. It remains to be seen whether these ideas will gain any support or whether a compromise will be reached. Paris is not alone in exploring such ideas; London is also undertaking a consultation on a new ultra-low emission zone (ULEZ) in the city to be enacted by September 2020.

A major advance in EV battery chemistry could solve many of these challenges and may also mean that fuel-cell will cars take a back seat in terms of being part of the solution to future mobility solutions. In his comments Robertson also predicted that the industry is reaching the tipping point when there will be a switch away from conventional ICE technologies and towards alternative powertrains: "At some point in the future the technologies will switch over," he said. "When the crossover comes and the focus becomes electricity, the rate of learning will accelerate even faster. Relatively, that time is not far away."