As with ZF’s acquisition of TRW last year, the potential synergies between the two companies are compelling

Magna International has announced an agreement to buy Getrag Group, one of the world's largest transmission suppliers. The proposed deal includes Magna's purchase of 100% of Getrag's equity for EUR1.75 billion (USD1.9 billion). According to a joint statement, the amount represents an enterprise value of EUR2.45 billion (USD2.67 billion), less proportionate net debt and proportionate pension liabilities assumed to be approximately EUR700 million (USD763.7 million). The two companies expect the deal to close near the end of 2015, "subject to a number of conditions including obtaining all necessary regulatory approvals."

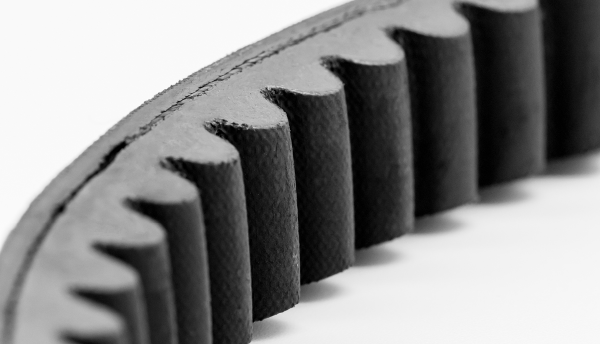

Getrag is predominantly a supplier of manual, automated-manual, dual-clutch, hybrid and other advanced transmission systems. Magna expects that the architecture of Getrag's product line is well-positioned "to support current and future automotive powertrain configurations. Getrag is a leader in the growing market for dual-clutch transmissions ('DCTs')," the statement read. Magna cited Getrag's various joint venture (JV) relationships as well, which include Ford, Chinese makers Jiangling and Dongfeng. Getrag's customer list is said to include BMW, Daimler, Renault, Volvo and Great Wall.

According to media reports, Getrag and Magna had been in talks for eight to nine years on a potenital deal, as well as Getrag speaking with other carmakers. Reports suggest that Getrag's brand and plants will be maintained, with savings expected from joint procurement.

Outlook and implications

The Magna-Getrag deal is another consolidation of first tier automotive suppliers following the notable ZF-TRW deal. In buying a significant automatic transmission supplier, Magna expects to become a complete driveline system supplier. Like the ZF-TRW deal, the long-term prospect for synergies between the two suppliers has a great deal of potential. Magna brings existing four-wheel and all-wheel driveline technology and experience to combine with Getrag's transmission portfolio. Getrag's joint-venture relationships also provide significant growth potential for Magna in China, the world's largest automotive market and the fastest growing market for DCTs.

The only true product overlap, according to IHS Automotive transmission analyst Chris Guile, is that both have activity in reduction transmissions used in EV products. Additionally, we expect that Magna is looking at opportunities to grow volumes at Getrag. We see an increasing number of automakers choosing to outsource some or all transmission production. As non-manual transmissions become increasingly complex and expensive for automakers to develop to meet a variety of needs, buying transmissions from suppliers can enable effective sharing of development costs. That effect can cascade into enabling choosing more expensive cutting-edge products, more simple and cheaper products, or some combination of both, depending on the varied market and consumer expectations.

Guile says that the impact on rivals may not be significant, as there are not many rivals. However, for a company which had been a family-owned company until now, it is possible that ownership by a global tier one may result in shifts in Getrag's strategic philosophy.

Over the past decade, Getrag took an early decision to invest heavily in dual-clutch transmission technology – and then suffered some setbacks in DCT acceptance, amplified by the recession. Guile says that Getrag's determination to stick with the technology has enabled it to begin to see benefits in Europe and China. Getrag supplies BMW, Renault-Nissan, Ferrari, Ford, Mitsubishi and Smart. As Getrag supplies manual and dual-clutch transmissions which American consumers have not warmed to, there is also a possibility for Magna to help Getrag reinvent the DCT for the North American marketplace.

The rise of the megasupplier

Since 2008, the traditional models of supplying to carmakers have fundamentally changed. It was the case that research and development was taken care of for them, and that they could offer process and material optimisations and innovations through volume manufacturing or specialist tooling. Now though, suppliers are increasingly the ones doing the necessary research and development as well. This has allowed them to move from a relatively weak bargaining position to a much stronger one. They are suddenly the ones offering the technical advances and the value creation in automotive that OEMs need.

This is not a new idea to the auto-industry. Despite the early failures of cross-border automaker tie-ups (no one wants to see another DaimlerChrysler), the idea is becoming almost common. From Renault-Nissan, Peugeot Citroën, and the most recent example in Fiat Chrysler, the idea is spreading and becoming successful. So much so that these tie-ups are now yielding considerable cost savings as OEMs combine their purchasing departments (Renault-Nissan claimed they made USD1.1bn of savings in 2012 purely through joint-purchasing).

A merger of this magnitude would create another purchasing giant for those down the automotive supply chain as well. Continental and Schaeffler’s joint purchasing passed USD20bn in 2013 allowing them to reduce costs and enjoy the close collaboration with their premium suppliers. The acquisition also helps Magna diversify away from its exterior and interior systems, an area where sales are declining across the industry. Sharing materials purchasing or manufacturing facilities could be a way of saving costs and heading off the challenges of localisation.

The IHS Automotive Transmission forecast data show Getrag and Getrag-Ford have increased from 1.17 million units in 2000 to 2.88 million in 2014, forecast to increase to more than five million units in 2020. Ford remains Getrag's largest customer, both through the core company and the Getrag-Ford joint-venture.