Will support anticipated demand for vehicles that will be fitted with its Ingenium diesel and gasoline engine family.

Jaguar Land Rover (JLR) has announced that it plans to add to the investment that it has already made in its Engine Manufacturing Centre (EMC) in Pendleford, outside Wolverhampton (United Kingdom). According to a statement, the premium automaker will spend a further GBP450 million (USD682 million) at the site, which will lift its operational footprint to 200,000 square metres and result in a further, unquoted capacity increase. Furthermore, the automaker has also said that it will lead to "several hundred new jobs" being created.

On the announcement, JLR chief executive officer (CEO) Dr Ralf Speth said, "The Engine Manufacturing Centre is a strategically significant facility for Jaguar Land Rover. The decision to expand our operations at the site provides a clear signal of our commitment to meeting customer demand for cleaner and more efficient engines, whilst developing the skills and capability that Britain needs if it is to remain globally competitive."

Outlook and implications

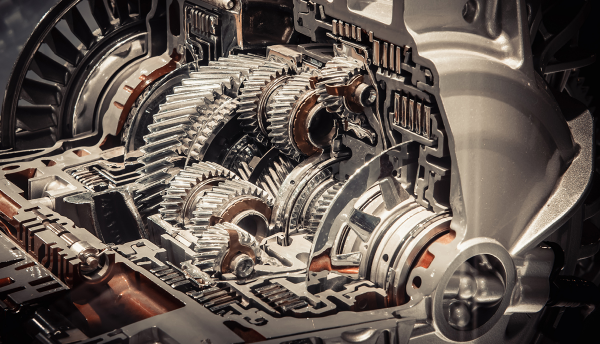

The announcement of the expansion of EMC comes just over a year after production of this site began in late October 2014. The site currently produces JLR's Ingenium engine programme, which comprises a 2.0-litre diesel four-cylinder engine, but will add production of a turbocharged gasoline (petrol) variant soon. These engines will form a key part of JLR's powertrain line-up going forward as they replace the four-cylinder engines supplied by Ford. It is already being used in the Jaguar XE and Land Rover Discovery Sport, and it will soon be added to more models, including the updated Range Rover Evoque and Jaguar F-Type, second-generation Jaguar XF and brand new Jaguar F-Pace crossover. IHS Automotive also expects that while it already supports JLR's engine downsizing strategy, it will also be part of the automaker's plug-in hybrid electrification programme. It will feature as the internal combustion component in larger models like the forthcoming Land Rover Discovery replacement and the new Range Rover model that will be positioned between the Evoque and Sport.

The considerable investment that is being made at the site – taking overall expenditure to almost GBP1 billion – further underlines the importance of this engine to JLR's future. IHS Automotive already sees engines produced at this site reaching 176,000 units next year in its second full year and reaching over 400,000 units by 2019. Furthermore, production of gasoline Ingenium engines will also be taking place at a site in Changsha (China) by this point, including possibly a three-cylinder 1.5-litre variant. It is expected to begin in 2017, and by 2019 production is forecast to hit around 125,000 upa. India is also expected to produce the diesel variants of this engine from 2016 for both JLR and Tata brand models. This would mean that the Ingenium engine family will be fitted to more than two-thirds of the vehicles that JLR builds in 2019, with this investment helping to meet the targeted sales expansion forecast for the company going into the next decade.