Magna begins production of complete seat systems, body and chassis systems for Ford

Magna International has this month started production at two new manufacturing facilities in Sanand, Gujarat, India. Both plants are located in a supplier park next to Ford Motor’s assembly plant. The new facilities provide assembly and just-in-time delivery of complete seat systems for Ford. The company expects to produce 240,000 complete seat systems annually once the plant reaches full production. The second facility, spread across 356,000 square feet, manufactures body and chassis systems for Ford. Magna currently employs around 1,600 people in India and has 11 manufacturing locations and three engineering centres in the country, including the two new facilities in Gujarat. Magna expects that the investment in India will position the company well for expected future growth in the region.

In addition to this, Magneti Marelli’s joint-venture (JV) company with Maruti Suzuki and Suzuki Motor Company has inaugurated a new facility for the production of automated manual transmissions (AMT). Magneti Marelli aims to leverage the growing trend for AMTs and meet demand from local automakers with the new facility. The supplier has already equipped vehicles such as Maruti Alto, Maruti Celerio, Tata Nano and Tata Zest with its AMT gearbox in India. Magneti Marelli aims to double its revenues in India within three years’ time to EUR400 million (USD438.4 million). Bosch has also stated that it plans to invest a total of EUR100 million (USD112.2 million) in its Indian business in order to boost its market presence in the country. OEMs are also increasing production in the region, for example reports say that Renault is to double production of its Kwid model in India.

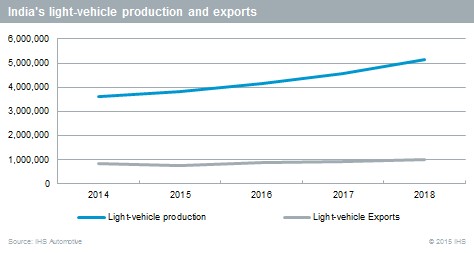

The announcements are part of a greater strategy amongst manufacturers of increasing India’s role as an export hub. The Modi government’s “Make in India” plan is encouraging automotive manufacturers to add production in the country for export markets. Maruti Suzuki and Ford plan to use some part of their future production capacity for exports from India, and Ford recently inaugurated its second plant at Sanand in India. Renault-Nissan and Hyundai already use their manufacturing plants in India for exporting to Europe and other markets. Hyundai's focus on exports is expected to decrease in the future, though, as the domestic market becomes more prominent, whereas models like the Maruti Suzuki Baleno, Chevrolet Beat, Ford Figo and Ford EcoSport are expected to reach good export volumes in the medium to long term. Mexico has also been added as a new export destination for Chevrolet Spark.

India’s domestic market will also continue to benefit from improved consumer sentiment due to lower crude oil prices, benign inflation and a series of interest rate cuts, expected to also offer tailwinds next year. Light vehicle production is expected to grow 6% y/y in 2015 to 3.81 million units, on the back of expected strong growth in domestic sales with new launches.