Both foreign and domestic players are looking at increasing manufacturing footprint, but both will need local engineering support

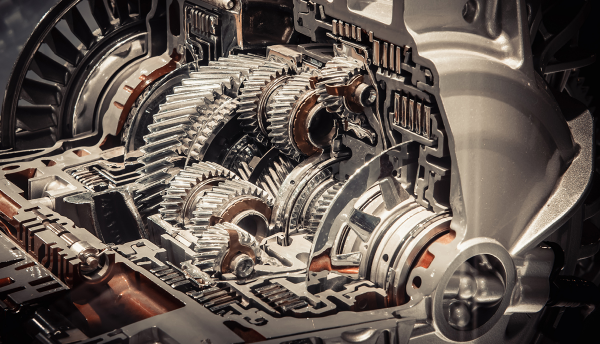

One of the major effects that Magna’s EUR1.75 billion (USD1.9 billion) acquisition of transmission supplier Getrag will have on the company is in helping to expand its footprint in China. The acquisition has already enhanced Magna’s powertrain segment, which manufactures transmissions, but Getrag is a major supplier of manual, automated-manual, dual-clutch, hybrid and other advanced transmission systems in the region, with a joint-venture, regional office and three manufacturing facilities in China. In October 2014, Getrag entered into a contract with DongfengGetrag Transmission to develop dual clutch transmissions for compact cars in China.

Transmission suppliers are currently looking to capitalise on the strong growth forecast in the region, which is largely a product of domestic market growth, followed by increased localisation of transmission builds from foreign to domestic OEMs. As a result, total annual transmission production volume will grow 8.5 million units by 2022 to reach more than 28 million units per year, representing 40% growth over 2016. In the longer term, China will most likely match its engine localisation strategy and increase its ambitions for both.

The establishment and growth of transmission manufacturing footprints in China by suppliers and OEMs together with the substantial growth of the automotive market in general have created the need for increased local engineering support. International engineering firms will enable the transfer of technology and knowledge to local Chinese manufacturers, thereby increasing local design activity. Substantial gains in volume and share in Greater China are mainly in support of domestic/local OEM growth in manufacturing.

Local players in China are also looking to capitalise. In January, reports emerged that FTE Automotive is set to be sold to Chinese bidders. Bain Capital bought FTE in 2013 for EUR400 million (USD436 million) and aims to raise EUR650-EUR750 million from the anticipated sale. FTE Automotive already has a presence in China. In 2013 the company opened a plant in Taicang in Jiangsu province. The plant produces actuation systems for manual and dual clutch transmissions for original equipment manufacturers in the Asia region.

It’s likely that CVT production will be the dominant technology used in Chinese light-vehicle production. The global trend is of an industry moving towards increased automatic transmissions use even in areas where there has been a traditionally high use of manual transmissions, such as Europe. Last year Jatco and Nissan unveiled a jointly developed new continuously variable transmission (CVT) CVT7 W/R (wide range) for front-wheel-drive (FWD) compact cars. Jatco started production of the CVT7 W/R in August 2015 at its Jatco, Guangzhou Automatic Transmission Ltd plant in China. The move sees Jatco moving outside of its traditional OEM customer base with whom it has longstanding keiretsu relations as it looks to become the world’s largest automatic transmissions supplier by 2020.

IHS Automotive forecasts that global CVT production will increase from 9.2 million this year to 13.1 million in 2019. Growth should be strongest in Asia, particularly China, where production is forecast to grow from 1.2 million units produced in 2014 to 3.2 million in 2019. The global demand for CVTs is rising as the technology delivers improved fuel economy compared with step-geared automatics.