Transmission uses advanced materials to save weight

Ford has announced that the F-150 will take the second-generation 3.5-litre Ecoboost V-6 engine, mated to its new 10-speed automatic transmission, for the 2017 model year. Although horsepower and fuel economy ratings have not been disclosed, the new engine's torque increases to a best-in-class 450 lb/ft – whether gasoline (petrol) or diesel units. The engine gets dual-fuel injection systems, using both dual-direct and port fuel-injection systems, with two injectors per cylinder for improved power output, efficiency and emissions, Ford powertrain engineers told IHS and media at an event in Dearborn, Michigan. GM will offer the new 10-speed automatic transmission in eight models by 2018, with the 2017 Chevrolet Camaro ZL1 sports coupe being the first model to adopt the technology.

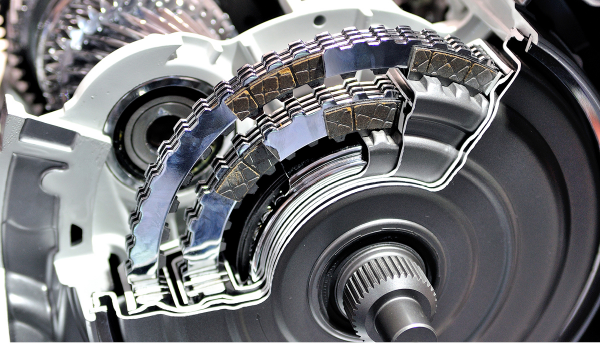

The engine is mated to an all-new 10-speed automatic transmission, which Ford and General Motors (GM) developed together, although Ford is building it for its own applications and putting into production first. The transmission uses advanced materials to save weight, and is Ford's first transmission to not use any cast-iron components. Ford promises a smarter shift logic, including real-time adaptive shift-scheduling algorithms. Instead of adjusting to driving inputs over a period of time, the logic monitors more than a dozen powertrain and driver-control signals to get the right gear at the right time.

Ford's V-6 programme is of significance for the F-150 as it helps to improve emissions and fuel economy figures, and Ford also noted that about 60% of F-150 sales in 2016 were of the 2.7-litre or 3.6-litre Ecoboost V6 engine options. The 10-speed automatic transmission had already been announced for the Ford Raptor performance variant, although these vehicles will not come on the market until the third quarter of 2016. The company also announced investments in its Cleveland engine plant and its Livonia transmission plant to support production of the new V-6 and the new automatic transmission.

The overall trend is that the industry is moving towards automatic transmissions use even in areas with traditionally high use of manual transmissions, such as Europe. OEMs chasing down emissions and fuel economy targets are only too aware of the impact automatic transmissions will have in achieving these goals. Competition for this growth is already underway, with a number of recent investments by transmissions suppliers of automatic transmissions. ZF Friedrichshafen has started production of its 9-speed automatic transmission at the newly expanded Asia-Pacific regional headquarters in Shanghai and is ramping up production at its Grey Court plant in South Carolina over the next few years. General Motors (GM) is also said to be working in-house on a continuously variable transmission (CVT) for the US market. The new CVT will be used in several "high volume" products by 2019 and will be mated to GM's new small gas engine (SGE) family of 3- and 4-cylinder.

IHS Automotive forecasts that production of transmissions with 8/9/10 speeds is to increase from 2.18 million in 2015 to 9.17 million in 2019. By 2019 IHS Automotive forecasts that 10-speed transmissions production will be 2.87 million.