The consolidation in the automotive interiors industry will lead to emergence of a few major suppliers that will have more bargaining power with OEMs

Mergers and acquisitions (M&A) is set to remain a core strategy for value creation for automotive interiors suppliers over the next few years. Compnaies such as Magna realized it can make better margins in transmissions than interior components, so alongside acquiring Getrag to boost its position in the transmissions market, it also sold its non-seat interiors business to Spanish supplier Grupo Antolin. Moves such as this reflect a more general trend among tier-1 automotive suppliers, which is to acquire specific business units rather than make acquisitions of entire companies. Magna’s deal with Grupo Antolin and Johnson Controls deal with Yanfeng were in line with this trend. Visteon has progressively sold its interior business to Reydel, which is now owned by private equity company Cerberus.

Consolidation in seating segment

The seating industry has seen consolidation over the past few years, with the largest players such as Lear, Magna, and Adient vying for market share. In February this year, US seating supplier Lear entered into a definitive agreement to acquire Grupo Antolin's seating business for EUR286 million (USD308 million). The deal strengthens the company’s ties to European automakers. The acquired unit’s annual sales of approximately USD322 million are concentrated in five European countries. The transaction is expected to close in the first half of 2017, subject to regulatory approvals in Europe.

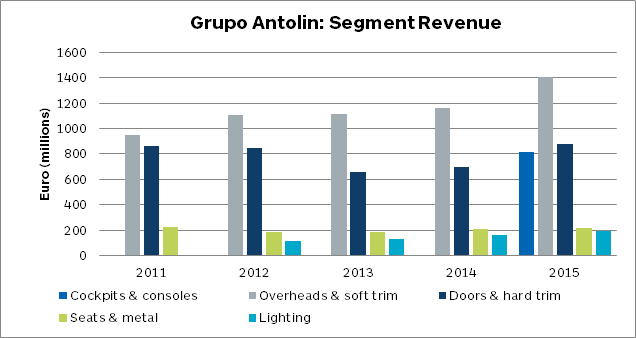

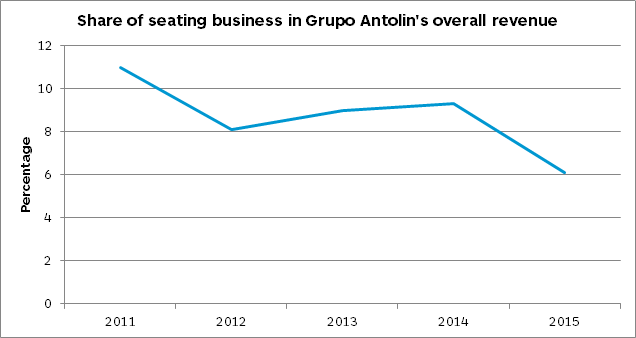

From Grupo Antolin’s perspective, the divestment will help it focus more on growth of its interior trim operations. The company saw value in selling its seating business as it represented just 6.1% of the group’s total sales in 2016, lower than 9.3% in 2014 and 11% in 2011. The company’s revenues from its seating segment have remained largely flat over the past five years. So it’s not difficult to see why the company has opted out of the seating market. The company’s interior trim business, however, has been growing, especially since its 2015 acquisition of Magna’s auto interior business.

Source: Company annual report

Source: Company annual report

Lear’s seating business poised to grow

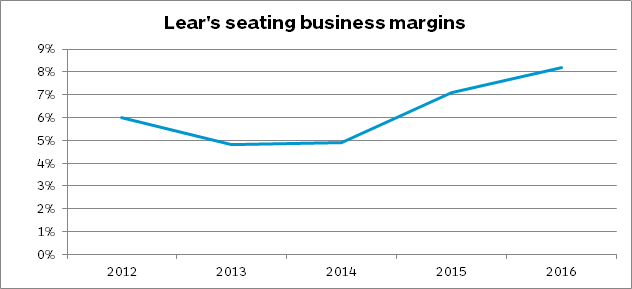

For Lear, which is one of the biggest seating systems suppliers globally, the acquisition makes perfect sense. Lear has witnessed consistent revenue and margins growth in its seating business over the past five years. Revenue for its seating business has grown from USD11 billion in 2012 to more than USD14 billion in 2016, at a compound annual growth rate (CAGR) of more than 5%. The segment’s earnings grew from USD661 million to USD1.1 billion over the same period and its margins; its margins have also improved from 4.8% in 2013 to 8.2% in 2016. In 2016, Lear had 22% market share in the global seating market, which it sees growing to nearly 27% in 2021. Lear says its seat assembly market share is growing in all major regions, including China.

Source: Company annual report

Currently, Lear holds 26% seat assembly market share in Europe, 34% in India, 27% in North America, 39% in South America, and 21% in China, according to the company. Lear sees huge growth opportunity in China, where it operates 36 manufacturing facilities. Lear expects its seating business to grow considerably, driven by the company’s complete seat component capabilities with expertise in fabric, leather and seat cover cutting and sewing. Also, Lear is one of the major players in luxury and performance seating and is well positioned to capitalize on mix shift toward crossovers and SUVs.

Since 2011 the company has invested more than USD350 million in new or expanding existing factories; 23 new facilities (including some non-seat operations) have been added to its global footprint. The company also sees value in developing standardized seat structures for multiple OEMs with similarly sized vehicles in a particular vehicle segment. In September 2016, Lear entered into a strategic partnership with Tempronics, securing exclusive rights to its thermoelectric seat heating and cooling technology for automotive applications.

To keep up with changing regulations on emission and fuel efficiency and new industry megatrends such as self-driving, car-sharing and connected cars, suppliers would need to invest significantly in R&D. This represents a significant challenge for lower-tier companies, which will have to eventually exit low-revenue, low-margin business segments. On the other hand, big suppliers such as Lear are expanding their interiors business hoping that acquisitions help them achieve economies of scale.

However, consolidation in the interiors industry will result in a reduction in the overall number of suppliers in each of the interiors segment, and the emergence of mega-suppliers. These mega-suppliers will be in a better position to bargain with OEMs, unlike previously when there were many smaller suppliers in each segment offering OEMs more flexibility in choosing a supplier. What will be interesting to see now is how these mega-suppliers and OEMs work together.