Japanese supplier is relying on its automotive business to boost sales and drive future growth

Last month, Panasonic announced it is acquiring an additional 20% stake in Spain-based auto parts supplier Ficosa, raising its ownership in the latter to 69%. Ficosa is a major supplier of rear view systems, command and control systems, advanced driver assistance systems (ADAS), communication systems, electromobility and underhood components. Ficosa reported sales of EUR1.1 billion (USD1.2 billion) 2016. Following the acquisition, Panasonic plans to make Ficosa a consolidated subsidiary.

Panasonic and Ficosa first announced plans to enter capital and business alliance in September 2014. Under the terms of alliance, Panasonic agreed to acquire 49% in the Spanish auto parts maker. The companies also agreed to merge their imaging technology and combine Panasonic’s display technology with Ficosa’s automotive mirror technology. The capital and business alliance between Panasonic and Ficosa became effective from 1 July 2015.

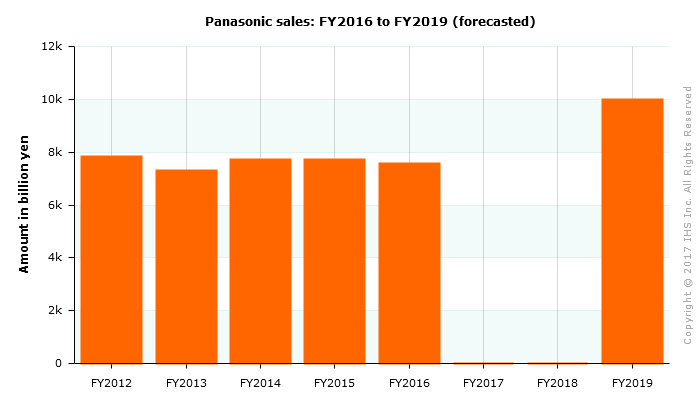

JPY10 trillion sales by FY 2019

Panasonic has set a goal to achieve sales of JPY10 trillion in fiscal year (FY) 2019 compared with JPY7.6 trillion (USD67.2 billion) in FY 2016. During this period, the Japanese supplier expects operating profit to grow to JPY450 billion, compared with JPY415.7 billion (USD3.7 billion) in FY 2016. Panasonic has earmarked investment of JPY1 trillion (USD8.9 billion) to achieve its FY 2019 financial goals.

The Japanese supplier expects its automotive business to play a vital role in meeting its FY2019 sales target. The company aims automotive sales to grow from JPY1.3 trillion (USD11.6 billion) in FY2016 to JPY2 trillion in FY2019. Panasonic’s decision to acquire Ficosa is expected to help the company close in on its FY2019 sales target.

Panasonic’s FY 2019 sales target of JPY10 trillion seems ambitious given the company’s rather stable top line performance in past five years. Stagnant demand in its mainstay consumer electronics business, weak global demand and unfavourable currency fluctuations have meant that In the past five years, Panasonic’s sales have hovered around JPY7 trillion. However, the company looks as though it will comfortably meet its operating profit target, thanks to its robust operating results in past five years.

Comfort, safety, environment

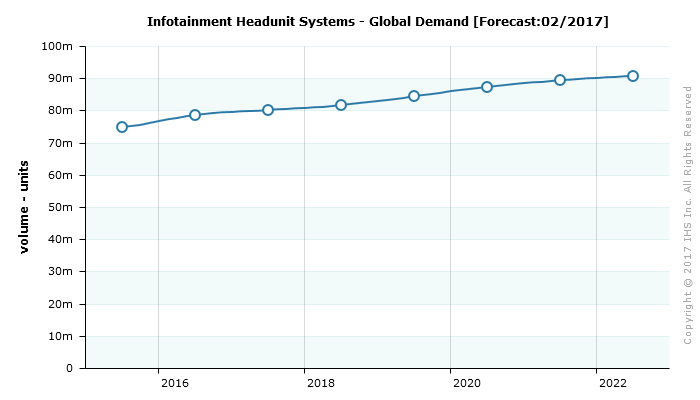

In automotive, Panasonic is targeting growth in three key areas; comfort, safety and environment. In Comfort, the company is mainly focusing on developing next-generation cockpit systems that ensure pleasant and safer driving. Panasonic plans to expand its cockpit system business through greater collaboration with carmakers on development for new products. In its cockpit business, Panasonic’s main focus is in infotainment systems, head-up display systems and centre information displays. Panasonic is a major supplier of infotainment head units, with global market share of 9.2% in 2015, according to IHS SupplierInsight. IHS forecasts global demand for infotainment head units to continue growing in coming years from 78.6 million units in 2016 to 90.7 million units by 2022.

Demand for Infotainment Headunit Systems is expected to grow from 74.8 million units in 2015 to 90.7 million units in 2022 Growth between 2015 and 2018 will be in the region of 2.9%, with an acceleration between 2018 - 2022. Compounded growth between 2018 and 2022 will be of 2.7%.

In Safety, Panasonic’s main focus is on advanced driver assistance systems (ADAS), by drawing on several years of experience in in-car camera modules. The Japanese supplier also intends to leverage its expertise in a wide range of sensing devices as well as in high speed image processing, image recognition, vehicle communication, deep learning and artificial intelligence.

In Environment, Panasonic is primarily focusing on lithium-ion battery products. Earlier the company was also present in nickel-metal hydride (NiMH) battery through Panasonic EV Energy, a joint-venture with Toyota. However, Panasonic exited the JV in 2010 and is mainly focusing of higher growth potential lithium-ion battery. IHS forecasts strong growth in global demand for battery cells from 3.3 million units in 2016 to 20.2 million by 2022, as automakers expands offering of alternate vehicles to meet stringent emission norms.

Panasonic’s move to gain controlling stake in Ficosa is expected to strengthen the Japanese supplier’s capability in area of comfort, safety environment. The Spanish supplier’s strong presence in rear-view systems, door and seat systems, and ADAS systems will expand Panasonic offering which enable greater driving comfort and safety. Ficosa also has presence in advanced vehicle communication including vehicle to everything (V2X) communication, which is expected to drive vehicle connectivity and enable autonomous driving in the future. In addition, Ficosa’s presence in battery management systems (BMS), e-box and AC/DC on-board charger substantially expands the Japanese supplier capability for fast growing alternate drivetrain vehicle segment.

Greater collaboration with Tesla

Panasonic is a major supplier of lithium ion batteries for electric cars. Although the Japanese company supplies lithium-ion batteries to electric car models by several automakers, the company has a strong relationship with Tesla Motors. Tesla has been sourcing batteries for its Model S and Model X from Panasonic and has retained the Japanese battery maker as its exclusive supplier for its upcoming Model 3. The US-based electric carmaker has 373,000 reservations for Model 3, delivery of which is expected to begin late this year.

Panasonic’s relationship with Tesla goes beyond supplying batteries. Last year, the Japanese supplier agreed to invest USD1.6 billion in Tesla’s Gigafactory in Nevada, United States. Tesla plans to invest USD5 billion in its battery Gigafactory. The electric carmaker can expand battery production capacity at its Nevada factory to 150 Gwh.

Panasonic is aware that it needs to look beyond organic growth if it wants to meet FY 2019 sales goal. Bearing this in mind, the Japanese supplier is looking for some selective acquisitions to strengthen its presence in strategic businesses where it foresees high growth potential. The company’s decision to take a controlling stake in Ficosa seems to be a part of this strategy. Like many other suppliers, Panasonic is also investing in start-ups who are working on innovative ideas. Last month, the company led investment in Drivemode, a California (United States)-based start-up specializing in developing hands-free app for Android-based devices. Late last year 2016, there were reports in media that Panasonic is in talks to acquire Austria-based automotive lighting supplier ZKW Group. A weak growth prospectus in consumer electronics is driving several companies to look for newer avenue for growth. Earlier this year, Samsung Electronics enhanced its automotive business by completing the acquisition of Harman International for USD8 billion.

Panasonic sales have hovered around JPY7 trillion between FY2012 to FY2016. However, the Japanese supplier aims sales to reach JPY10 million mark in FY2019.