With automakers planning to launch self-driving cars in the next 3-5 years, Lidar suppliers are expected to intensify their efforts on developing low-cost, easily integrable systems on a larger scale

From Google to Ford to Uber, companies working on developing self-driving cars are relying on Lidar sensors to help these vehicles better understand their environment and navigate on their own. One can easily see and recognize a Lidar system mounted on the top of test vehicles by these companies on public roads in the United States and elsewhere.

Lidar is a remote sensing technology that measures and maps the distance to targets as well as other characteristics of objects in its path. The sensor essentially maps its surroundings by illuminating its targets using laser lights and then analyzing that light to create a high-resolution digital image of more than 100 meters in all direction around a vehicle.

The Lidar technology has an edge over radar, which uses radio waves to determine velocity, range and angle of objects. However, while radar reflection is strongest from metallic materials, non-metallic materials produce weaker reflections and could potentially not reflect the radar waves at all. In contrast, Lidar is not dependent upon the metallic composition of the reflecting surface and can detect soft or uneven surfaces such as trees or foliage more accurately than radar.

By now most, if not all, companies developing self-driving vehicles agree that Lidar is a key component for such vehicles to enable highly precise and robust localization. Tesla is one notable exception, though. The electric car company has equipped all of its vehicles produced from November 2016 with second-generation ‘Autopilot’ driving assistance systems, which it claims would enable fully autonomous driving. The main hardware for Autopilot 2.0 includes eight cameras and 12 ultrasonic sensors which provide 360-degree visibility around the car up to 250 meters range.

Growing demand-supply gap

Growing focus on developing self-driving vehicles in the recent years has resulted in a strong jump in the demand for Lidar sensors. Apart from self-driving cars, mapping companies such as HERE and TomTom are using vehicles equipped with Lidar system to create 3D, high-definition (HD) map, which is another critical requirement for future self-driving vehicles. Lidar is also used in some advanced driver assistance systems (ADAS) such adaptive cruise control (ACC), forward collision warning (FCW) and automatic emergency braking (AEB). In addition to automotive, Lidar has been extensively used in security, robotics and industrial applications.

The sudden surge in demand from the automotive market has caught Lidar suppliers off-guard. According to media reports last month, some Lidar customers are currently facing waiting periods of as long as six months. Lidar suppliers, of whom there are currently very few, are working to increase capacity to meet strong demand for the system. Velodyne, whose Lidar systems are extensively used by the companies developing self-driving driving cars, opened a megafactory in San Jose, California (United States) in January this year. Mike Jellen, president and COO, Velodyne told IHS SupplierInsight that his company reported more than 200% jump in Lidar production in the first quarter ended 31 March 2017. The company aims to realise three to five times growth in volume production for 2017 and 2018 each.

New players entering Lidar market

Strong growth potential for Lidar for automotive applications is attracting new players in this emerging segment. These companies are looking towards starting commercial production and shipment of Lidar this year or 2018. Quanergy, for example, is gearing up to begin production of its solid-state Lidar sensor S3 for use in ADAS and autonomous driving applications this year. Last year, Quanergy raised USD90 million from investors to work with partners to ramp up production of its solid state Lidar sensors.

Most recently, Luminar unveiled a Lidar for self-driving vehicle which the company claims to have built from scratch. The company also claims that its Lidar has 50 times greater resolution and 10 times longer range than Lidar presently available on the market. Luminar is reportedly working with four companies that are developing self-driving vehicles. Luminar will supply 100 units of Lidar for testing to customers for beta testing. The company plans to start commercial production at its facility in Orlando, Florida (United States) with an ambitious target to ship 10,000 Lidar by end of this year.

Conventional automotive suppliers also seem to be attracted by the high growth potential for Lidar systems for ADAS and autonomous driving applications. Some of the suppliers are forming strategic partnerships or making strategic investment in existing Lidar suppliers to have quick access to the technology. Last year in August, ZF acquired 40% stake in Ibeo Automotive Systems, a Germany-based company specializing in Lidar technology. Continental acquired Hi-Res 3D Flash Lidar business from Advanced Scientific Concepts (ASC). Another German supplier, Bosch also made strategic investment through its venture capital unit in a Lidar startup TetraView. Japanese supplier Denso participated in fundraising round at Lidar start-up TriLumina. Magna has teamed up with Israel-based Innoviz Technologies to develop solid-state Lidar solutions; and French supplier Valeo has strategic tie-up with LeddarTech to develop low-cost solid-state Lidar for the same.

High cost of Lidar, a major challenge

While Lidar has an edge over radar and other sensors in providing a more accurate image of vehicle surrounding, the technology is currently prohibitively expensive for mass adoption. The first self-driving car prototype by Google Self-Driving Car Project, now Waymo, used Lidar from Velodyne that cost a staggering USD75,000 for each unit.

Lidar suppliers understand the need to develop low-cost affordable Lidar for its wider applications and are working in this area. Since its collaboration with Waymo, Velodyne has reduced the Lidar price to a range from USD8,000 to USD30,000, depending on how many laser it shoots out. In August 2016, Velodyne received an USD150 million investment of from Ford and Baidu to find ways to further lower cost of Lidar. One month later, Velodyne launched a new Lidar prototype VLP-16, also called Puck, for USD7,999. The company expects this price to further drop when it is mass produced.

In April this year, Velodyne unveiled a new low-cost Lidar sensor, called Velarray, which the company claims will cost hundreds of US dollars when mass produced. However, unlike the company’s other Lidar sensors, which offer a 360º horizontal field of view (FOV), Velarray provides FOV of 120º. This means that a self-driving vehicle will need more units of such Lidar to get similar FOV. Velodyne will begin production of Velarray at its San Jose facility next year.

Velodyne aims to come with Lidar which is even more affordable than Velarray. “Velodyne continues to advance its product roadmap to deliver products that meet applications specific performance, volume and price targets. Our cost-effective ASIC technology is at the core,” Jellen told IHS SupplierInsight.

Waymo, which has been using Velodyne Lidar sensor in its test vehicles, is working on developing an affordable Lidar in-house. In January this year, the company claimed it managed to lower Lidar costs by 90%. The company aims further reduction in Lidar price to make the technology affordable.

Size and design complexities

Apart from high cost, Lidar suppliers are working on reducing Lidar’s weight and size. Velodyne’s HDL 64E Lidar, currently used by most of the automakers and tech companies in their self-driving test cars, weighs 12.7 kilogram (kg) without cabling. The company has managed to substantially reduce the weight of three other Lidar sensors HDL-32E, Puck Hi-Res, and Puck Lite to 1 kg, 830 grams and 590 grams, respectively.

Lidar companies also need to work on Lidar size and its placing on self-driving vehicles so that it blends with the overall vehicle design aesthetics and dynamics. Most of the test vehicles have Lidar mounted on its top, something which cannot continue when such vehicles are mass produced. Last year, at the CES, Velodyne showcased solid-state, hybrid-ultra Puck Auto Lidar, which is compact in size and can be easily placed below a car’s side-view mirror. The company’s new Velarray Lidar sensor is also compact and can be seamlessly embedded into front, side and the corner of the vehicle.

At this year’s CES, Quanergy showcased a palm-size solid-state Lidar S3 which could be concealed into vehicle’s body, without compromising with vehicle’s design. The company teamed up with Japanese lighting supplier Koito to show how its S3 Lidar can seamlessly fit inside a vehicle headlight. The placing of Lidar under the headlight also protects the component from dust, dirt and water.

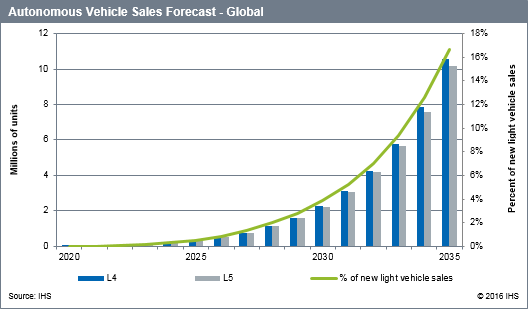

Most automakers, tech companies and start-ups developing self-driving vehicles are looking at launching their self-driving cars in the next 3-5 years. This means that Lidar suppliers have only a few years to iron out the current set of challenges relating to cost, weight, size and design as well as seamless supply. According to IHS Markit forecasts, published in 2016, self-driving vehicles sales are projected to reach 600,000 units a year by 2025, and grow rapidly over the next 10 years to reach 21 million units by 2035. Assuming each self-driving vehicle on average will have at least two Lidar sensors; this translates into tremendous growth potential for Lidar suppliers in the coming years.