The supplier’s decision to divide its business in two independent businesses is a good strategy, but it remains to be seen if the move will be able to turnaround the fortunes of its powertrain business

The powertrain segment has become one of the most dynamic segments in the automotive sector owing to the ever-changing technology requirements. The segment is expected to see a further consolidation in the near future as companies try to adapt to the changing requirements and demand for more efficient internal combustion engines (ICE) and powertrains with different levels of electrification.

One such development, indicative of the impending shake-up in the sector, was Delphi’s decision earlier this month to spin off its ‘Powertrain Systems’ business unit into a independent publicly traded company. The separation is expected to be completed by March 2018. Explaining the intent behind the decision, Kevin Clark, president and CEO of Delphi, said, "Today's announcement represents an exciting opportunity for our businesses by creating two independent companies, each with a distinct product focus, a proven business model, and the flexibility to pursue accelerated investments in advanced technologies that solve our customers' most complex challenges."

While the company believes that the move will help it raise its focus and investments on the powertrain segment, many believe that Delphi’s move is a major shift in its focus towards more profitable emerging segments such as autonomous driving and connected cars. After the spin-off, Delphi’s other two business segments, Electrical / Electronic Architecture (E/EA) and Electronics & Safety (E&S), will continue to be part of Delphi, accounting for the majority of the company’s total annual revenue.

Slowing powertrain business

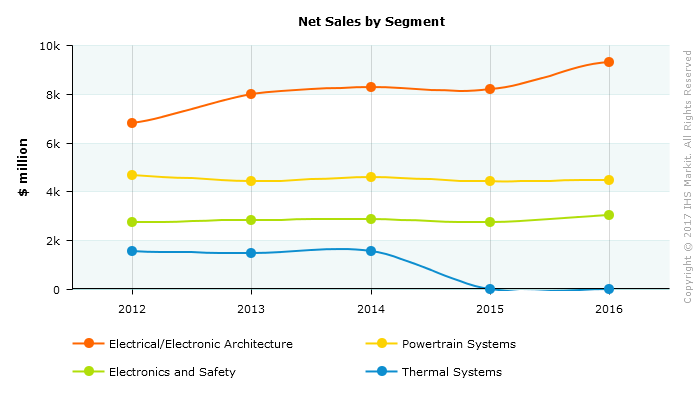

Though the Powertrain Systems has been the second biggest sales generator for Delphi after E/EA, of late its contribution to overall Delphi sales has seen a decline. In 2016, revenue from powertrain segment stood at USD4.48 billion compared to USD4.65 billion in 2012. Net sales from E/EA segment stood at USD9.3 billion and USD3 billion from E&S in 2016. From 29% contribution to Delphi revenue over the last few years, it has come down to 27% in 2016.

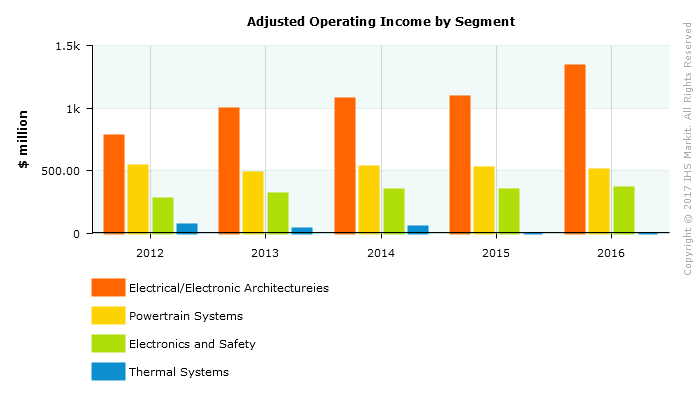

Not only has its revenue remained flat in the last five years, its adjusted operating income too has not seen a growth and gross margin has fallen. From USD541 million in 2012, operating income has come down to USD511 in 2016. In comparison, its other two segments have performed far better. E/EA segment has seen its operating income climb up from USD781 million in 2012 to USD1.3 billion in 2016, whereas E&S division has increased its adjusted operating income from USD281 million to USD368 million.

Gross margin for powertrain division has fallen from 19.20% in 2012 to 17.8% in 2016 which is in contrast to both E/EA and E&S segments where gross margins have increased from 17% to 22.30% and 16.3% to 22.7%, respectively, between 2012 and 2016.

Tough business environment

Delphi has been assessing and restructuring its various businesses for a few years now in a bid to concentrate more on its core strengths. In 2015, Delphi sold its thermal business to Mahle for USD727 million. It is interesting to note that the company’s thermal business was facing flat sales growth and falling gross margin before it was offloaded. Despite its net sales remaining stable, thermal division’s gross margin fell from 10.2% in 2012 to 8.6% in 2014 and adjusted operating income fell from USD68 million to USD53 million.

Powertrain segment has become a tricky segment for many auto component suppliers with the ever increasing focus of the industry on electrified engines, leaving the fate of ICEs uncertain in the long run. Many of the companies have invested heavily on conventional engines in a bid to improve their efficiency and reduce emission, and at the same time are required to make investments towards electrified engine technology, which is not expected to give strong returns in the short term. Even major players like Continental have openly said that they are expecting to make losses from electric vehicle (EV) component business at least until 2019.

Focus on strengths

The tough road ahead foreseen in the powertrain segment, it seems is pushing companies towards other new businesses such as electronics and self-driving technologies, whose prospects are bright. Delphi has technologies such as the 48V mild hybrid modular system to make a strong business case in the changing powertrain segment, but is also looking to spread its risk into other baskets as well.

“Delphi has sold a number of business units (for example thermal went to Mahle Behr in 2016) and has been focusing on power electronics (wiring harness, junction boxes, etc) and has presented its own 48V mild hybrid modular system. Its modularity (Delphi providing the power electronics and focusing on parts integration) is a clear advantage over its competitors that offer scalability but no true modularity. The Delphi system allows the use of parts from different suppliers. It is also still one of the major wiring harness makers indicating to us that this is a core business for them. There is still some business in central body control modules but the focus lies on power distribution systems (junction boxes and such),” said Christian Müller, manager, Supplier Solutions at IHS Automotive.

“Focusing on EVs and Autonomy is following all the buzzwords of the industry right now. I think there is a real show of success on the EV side of things with Delphi’s power electronics and distribution expertise. For Autonomy Delphi is using Mobileye sensor technology and has shown a self-driving concept vehicle. Delphi has a clear advantage over some of its competitors as it is able to show already near production ready tech from a packaging point of view,” added Müller.

New opportunities

Delphi is already investing to stay ahead of its competitors in the autonomous driving segment. Automotive News reported this week, citing Delphi chief technology officer (CTO) Glen De Vos, that Delphi is plans to start a new self-driving taxi service in the United States this year. Delphi was also the first supplier to be selected by Singapore Land Transport Authority (LTA) last year, to test its fleet of self-driving cars in Singapore which is also expected to happen sometime this year. “We are going through the final application process, and we expect approval in the next four weeks or so," Glen De Vos, chief technology officer (CTO) of Delphi told Automotive News this week. “In the US, we'd like to kick off the service in September,” De Vos said. The US supplier also intends to announce plans for launching self-driving taxi service in Europe next month. According to De Vos, in Europe, the service will most likely be introduced in Luxemburg or France.

Delphi is also gaining strength to bolster its electronics and connected car products portfolio. In this regard, this year the company partnered with Germany-based Rosenberger to improve high-speed data transmission capability. Rosenberger specializes in radio frequency (RF) connection system for various applications including automotive. Additionally, Delphi has announced strategic investment in Valen, an Israel-based company specializing in signal processing capability. Valens is a developer of HDBaseT, a global standard for transmission of ultra-high definition video, audio Ethernet and controls data. Delphi has also invested in an Israel-based company, otonomo, which specializes in connected car services. Earlier in January this year, Delphi, AT&T and Ford announced collaboration to develop a new capability to enhance vehicle-to-anything (V2X) communications. The platform is designed to help vehicles communicate with each other and with smart cities infrastructure to improve safety, vehicle security and reduce traffic congestion.

Delphi’s ability to restructure its business operations according to the fast changing automotive landscape is a marked difference from times when it struggled through a four-year long bankruptcy between 2005 and 2009. The separation of powertrain business may open up new possibilities for the new company, including merger or acquisition. In fact, there have been few unconfirmed reports suggesting that Delphi tried selling its powertrain business to Continental earlier in the year, before settling for a spin-off. It is difficult to forecast whether Delphi will be able to create more value for its powertrain business after the spin-off – shareholders seem to have given it a thumbs up considering the company’s stock rose over 10% after the announcement – but there is a possibility that the company might eventually put it up for sale should the margins from the business continue to remain weak in the years after the spin-off.

Srikant Jayanthan

Research Analyst