General Motors (GM) plans to increase usage of turbocharged engines

General Motors (GM) is planning to equip half of its 2018 vehicle lineup with at least one turbocharged option according to reports last week. The turbocharged portfolio will also include a 2.0L, 4-cylinder engine available in the Chevrolet Traverse and standard on the Buick Regal and Regal TourX. "Turbocharging is really an important technology. It's enabling smaller, really smaller engines, without sacrificing peak power or peak torque," Dan Nicholson, GM's vice president of global propulsion systems, was quoted as saying. However, he added that the technology will not be used across the board at once, instead GM will go segment by segment.

GM has started expanding its turbocharged lineup and is already close to having half of its vehicles run on a turbocharged engine. Compared with just 5% in 2010, currently 49% of GM vehicles are turbocharged. Many automakers are in the process of switching to smaller engines, which are equipped with turbochargers.

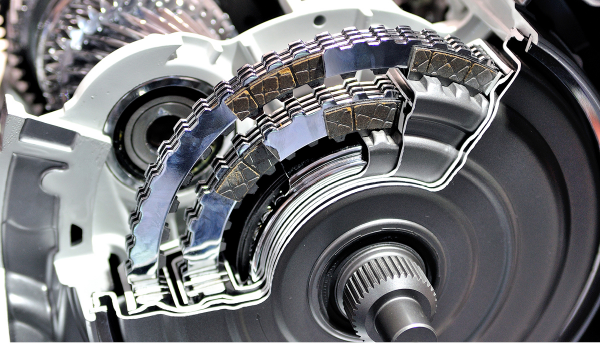

Turbochargers increase the engine's power and efficiency by forcing air into the combustion chamber using a turbine driven by the vehicle's exhaust gas. Such engines improve fuel efficiency without compromising on the overall power and torque output. The use of a turbocharger or supercharger can typically enable engine downsizing to around 70% of the capacity of a naturally aspirated (NA) engine with the same power output while providing about a 25% increase in fuel economy. According to IHS Markit forecast, annual production of vehicles featuring turbochargers is expected to increase from 33.5 million units in 2015 to 62.5 million units in 2022, representing a CAGR of 9% during the period.

The major turbocharger suppliers – Honeywell, BorgWarner, Mitsubishi Heavy and IHI – are looking to capitalise on the growth opportunities as other big suppliers look to make a move into the sector. New players Bosch-Mahle and Continental are together expected to take around a 6% global market share for turbochargers in 2017.

IHI Corporation is planning to invest JPY6 billion (USD54.1 million) in turbocharger production capacity expansion, especially in China and North America. IHI is planning to increase annual production at its plant in Illinois (the United States) by 100,000 units to 400,000 units. Close to JPY2 billion will be invested in Thailand and JPY1 billion in Europe to enhance manufacturing facilities. It will also invest over JPY1 billion in testing facilities. BorgWarner has also announced that it is supplying its regulated two-stage (R2S) turbocharging technology for Great Wall Motor’s new 2L 4-cylinder diesel engine. The diesel engine with the R2S turbocharging technology is being used in Great Wall’s Haval H8 and H9 sport utility vehicles (SUV), the first time that the technology has been used in a Chinese passenger car.

Engine Downsizing Potential in Superchargers

To ensure performance is not compromised, automakers usually use an exhaust-driven turbocharger, which has an inherent challenge of a delayed boost response, called turbo lag. To mitigate the turbo lag issue, twin-scroll turbochargers or smaller turbos are used; however, it still does not serve as a perfect solution. Simply put, it is difficult to ensure that a turbocharged engine delivers an immediate response of a naturally aspirated one.

In case of an electric supercharger, the main advantage is reduced turbo lag, which allows power to be used at lower rpm, thus paving the way for improved fuel economy. Since a turbocharger is driven by exhaust gas, it has a time gap between accelerator-on and turbocharger rotation starts. An electric-supercharger helps reduce this time gap. Therefore, it makes control of air-flow more flexible. This is good for fuel economy. The conclusion is that chasing performance and fuel economy at the same time is the biggest driver.

Engine downsizing is a critical technology for meeting future fuel economy standards because it offers reduced friction and lower weight. Furthermore, it is critically important that the engine operates at a higher speed (RPM) and efficiency point for fuel economy and CO2 reduction. Smaller turbos will be the largest part of the turbocharger market. Through 2017, IHS Markit forecasts the highest market growth for turbo- or supercharged engines in the 1.1L to 2.0L displacement range. Compared with 2011, global production of forced induction engines of this size is expected to almost double to 26 million units.

Copyright © 2025 S&P Global Inc. All rights reserved.

These materials, including any software, data, processing technology, index data, ratings, credit-related analysis, research, model, software or other application or output described herein, or any part thereof (collectively the “Property”) constitute the proprietary and confidential information of S&P Global Inc its affiliates (each and together “S&P Global”) and/or its third party provider licensors. S&P Global on behalf of itself and its third-party licensors reserves all rights in and to the Property. These materials have been prepared solely for information purposes based upon information generally available to the public and from sources believed to be reliable.

Any copying, reproduction, reverse-engineering, modification, distribution, transmission or disclosure of the Property, in any form or by any means, is strictly prohibited without the prior written consent of S&P Global. The Property shall not be used for any unauthorized or unlawful purposes. S&P Global’s opinions, statements, estimates, projections, quotes and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security, and there is no obligation on S&P Global to update the foregoing or any other element of the Property. S&P Global may provide index data. Direct investment in an index is not possible. Exposure to an asset class represented by an index is available through investable instruments based on that index. The Property and its composition and content are subject to change without notice.

THE PROPERTY IS PROVIDED ON AN “AS IS” BASIS. NEITHER S&P GLOBAL NOR ANY THIRD PARTY PROVIDERS (TOGETHER, “S&P GLOBAL PARTIES”) MAKE ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE PROPERTY’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE PROPERTY WILL OPERATE IN ANY SOFTWARE OR HARDWARE CONFIGURATION, NOR ANY WARRANTIES, EXPRESS OR IMPLIED, AS TO ITS ACCURACY, AVAILABILITY, COMPLETENESS OR TIMELINESS, OR TO THE RESULTS TO BE OBTAINED FROM THE USE OF THE PROPERTY. S&P GLOBAL PARTIES SHALL NOT IN ANY WAY BE LIABLE TO ANY RECIPIENT FOR ANY INACCURACIES, ERRORS OR OMISSIONS REGARDLESS OF THE CAUSE. Without limiting the foregoing, S&P Global Parties shall have no liability whatsoever to any recipient, whether in contract, in tort (including negligence), under warranty, under statute or otherwise, in respect of any loss or damage suffered by any recipient as a result of or in connection with the Property, or any course of action determined, by it or any third party, whether or not based on or relating to the Property. In no event shall S&P Global be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees or losses (including without limitation lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Property even if advised of the possibility of such damages. The Property should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions.

The S&P Global logo is a registered trademark of S&P Global, and the trademarks of S&P Global used within this document or materials are protected by international laws. Any other names may be trademarks of their respective owners.

The inclusion of a link to an external website by S&P Global should not be understood to be an endorsement of that website or the website's owners (or their products/services). S&P Global is not responsible for either the content or output of external websites. S&P Global keeps certain activities of its divisions separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain divisions of S&P Global may have information that is not available to other S&P Global divisions. S&P Global has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P Global may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P Global reserves the right to disseminate its opinions and analyses. S&P Global Ratings’ public ratings and analyses are made available on its sites, www.spglobal.com/ratings (free of charge) and www.capitaliq.com (subscription), and may be distributed through other means, including via S&P Global publications and third party redistributors.