Volvo’s announcement could set a precedent for other bigger automakers to follow with similar strategy

Volvo has set the ball rolling towards total electrification of vehicles with a significant announcement earlier this month. From 2019 onwards, all Volvo cars will have some level of electrification. This essentially means that Volvo will stop manufacturing purely internal combustion engine (ICE) powered vehicles in less than two years.

The company is set to introduce a range of electrified cars comprising battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEV) and mild-hybrid electric vehicles (MHEV), across its model range. Between 2019 and 2021, Volvo plans to launch five fully electric cars, three under Volvo brand and two under its high-performance car brand Polestar. All other cars from Volvo will be available as gasoline and diesel plug-in hybrid and 48V mild-hybrid models.

While many automakers have launched EV-only brands to show their commitment to electric vehicles (EV), this is the first time an established automaker has set a timeline in which it will completely do away with ICE-only cars.

Håkan Samuelsson, president and CEO of Volvo Cars said that the decision was reached looking at the increasing demand for electrification from its customers. “This is something that is coming more and more from the customers. So we are basically reacting to what the customers are seeking,” he said.

First step away from conventional vehicles

Volvo has been dropping hints of its ambitious plans for electromobility segment for some time. In April 2016, the Swedish carmaker set a target to sell 1 million electrified cars by 2025. At that time, the company’s plans included launching at least two hybrid versions of each model while releasing its first all-electric car by 2019. Most recent hint was its decision to turn Polestar, its high-performance brand into an electrified high performance brand. The brand is expected to make further announcements about its products, industrialization and commercial plans in autumn.

It has also been reported that Volvo is looking at phasing out its diesel engines and will not be developing new generation of diesel engine after the current one. According to Samuelsson, the cost of making diesel engine that can meet the current as well as future emission norms is increasing and that it does not make sense to continue to invest in a technology that is expected to sooner or later disappear. Instead, the investment will be routed towards developing electric and hybrid cars. The current generation of diesel engines from Volvo is expected to remain in production till 2023.

It is important to note, at this point that, not all cars produced by Volvo post 2019 will be electrified. It will be the new models only which will be launched from 2019 onwards, that will come with new electric powertrain options. The already homologated vehicles will continue to sell till the end of their lifetime and there will be an overlap of the new and the old powertrains for another five to seven years.

The impact

So how significant is Volvo’s announcement in terms of advancing electromobility? It certainly is a progressive step for Volvo as the move will help the Swedish brand to meet the target of selling 1 million electrified cars by 2025. However, one of the main reasons for Volvo’s decision to go all-electrified is not just to meet the sales target, but to meet the emission target as well. Samuelson has opined that while the emission standards till 2020 could be met with pure-ICE but extremely efficient vehicles, norms expected to come into effect beyond 2021 will be almost impossible to meet with pure-ICE vehicles. It is to meet those standards that Volvo is preparing to equip its ICE vehicles with electrified option.

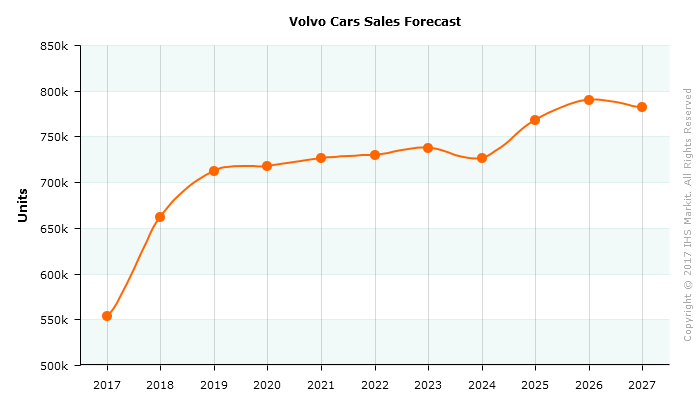

For the industry overall, the immediate impact is expected to be somewhat sedate, given the relatively low volume of cars Volvo sells globally in a year. Volvo cars sold 534,332 cars in 2016 compared to 2.08 million by Mercedes-Benz, 2 million by BMW and 1.8 million by Audi. According to IHS Markit forecast, Volvo is expected to sell 726,558 units in calendar year 2021 and 767,938 by CY 2025.

While a good number of these units would be electrified, among the three levels of electrification in the Volvo lineup, the 48-volt mild-hybrid models in all probability will be the most popular, at least in the few early years. The mild-hybrid version stores the energy generated during braking which is used to supplement the conventional engine, thus reducing fuel consumption, increasing fuel efficiency and performance. In the short run, the cost factor will also favor larger adoption of this technology, as against PHEV and BEV, which requires a bigger lithium-ion battery, thus a lot costlier than conventional vehicles and MHEVs.

“It’s mainly a transition from ICE to MHEV. But, it does mean that it is unlikely we will see any further new engine platforms of 4+ cylinders from Volvo again, which is a significant moment for them, or any automaker, know the transition towards sustainable mobility,” said Graham Evans, Principal Analyst, IHS Automotive.

In the long run, however, with the cost of the battery coming down and range going up faster than previously anticipated, the trend may turn towards higher-level electrified cars. It goes without saying that a robust and well spread out charging infrastructure will form the backbone of this shift.

What Volvo’s announcement does for the industry is set a precedent for other bigger automakers to follow with similar announcements. Compared to Volvo, competitors such as Mercedes-Benz, Audi, BMW, already have a strong electric portfolio and are in position to make the jump themselves. Considering Volvo chief’s opinion on ICE unable to meet the strict emission targets of the future, it is safe to assume that we would see other automakers to move ahead of pure-ICE vehicles soon to electrified variants. “Electrification is the only feasible way in this time window. But the mix in terms of how OEM’s split ICE/MHEV/HEV/PHEV/BEV based on their current fleet of powertrains, current and planned fleet of models, plus growth aspirations…..this is the big question for every OEM right now,” Evans opined.

Analyst: Srikant Jayanthan