Visteon continues to see strong growth in orders, sales and profit since completing sale of all but automotive electronics business

Over two years ago Visteon exited its climate system business by divesting its 70% stake in subsidiary Halla Visteon Climate Control (HVCC) to an affiliate of South Korea-based private equity (PE) firm Hann & Company and Hankook Tire. The divestment left the US-based supplier with only one segment – automotive electronics – and positioned the company as pure technology-focused supplier of cockpit electronics and connected car solutions. Prior to divesting its climate business, Visteon had sold most assets of its automotive interiors business in 2014 and lighting system business in 2012.

At the time, many believed Visteon was taking a big risk by selling off most of its businesses and concentrating on only one segment. This was against the general industry trend of an automotive supplier operating in more than one business segment. Presence in multiple business segments helps a supplier spread its risks, given that any sharp decline in one or two business segments is partially offset by strong performance in other segments. However, Timothy D Leuliette, who was appointed president and CEO of Visteon in October 2012, vigorously pursued comprehensive restructuring with strong backing from the company’s board and chairman Francis M Scricco. One month before Leuliette joined Visteon, the US-based supplier announced a strategic plan which called for exit from its struggling interiors business, consolidation of climate business and optimization of electronics business.

Visteon exited the interiors business by selling assets to several buyers. The company initially pursued consolidation of climate business with plan to gain full control of its South Korean joint venture Halla Climate Control (HCC) in which it had 70% stake. However, the company had to change the plan after its tender offer to acquire outstanding shares in HCC failed to generate a favorable response from investors. The company merged its own climate business with HCC and formed another JV, Halla Visteon Climate Control (HVCC), which was eventually sold to Hahn & Co and Hankook. Amid all these divestures, Visteon strengthened its presence in the automotive electronics business by acquiring the automotive electronics business of Johnson Controls.

Comprehensive presence in cockpit electronics

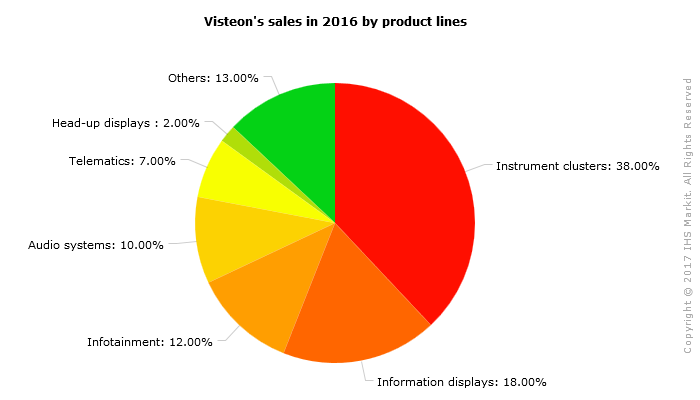

Visteon’s automotive electronics business is highly diversified with the product line comprising instrument clusters, information displays, cockpit domain controllers, audio, infotainment and telematics. In 2016, the company generated 38% of its total sales (USD3.1 billion) from instrument clusters, 18% from information displays, 12% from infotainment, 10% from audio systems, 7% from telematics solutions, 2% from head-up displays (HUD) and 13% from others.

Source: Visteon

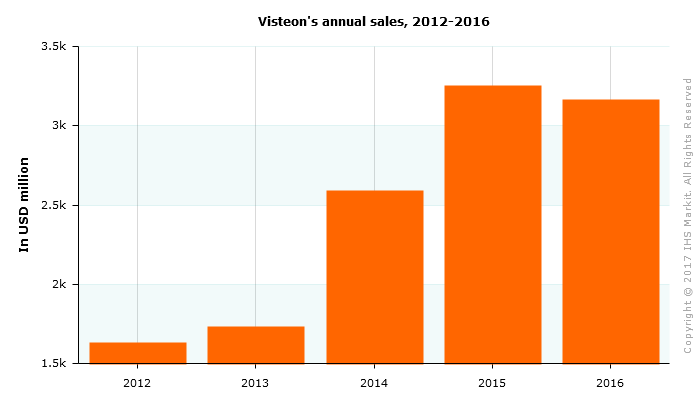

Visteon continues to see strong growth in both sales and profit in its automotive electronics business. This is reflected in Visteon’s financial performance over the past five years. According to its five-year restated annual financial statement, Visteon’s sales almost doubled from USD1.62 billion in 2012 to USD3.16 billion in 2016. Net income from continuing operations between these two comparable period has more than doubled to USD131 million over USD56 million in 2012. The company’s strong growth in profitability, especially in the past three years, is also reflected in adjusted EBITDA which increased to USD337 million in 2016 compared with USD177 million in 2015. For 2017, the company expects sales in the range of USD3.1 billion to USD3.2 billion and adjusted EBITDA in the range of USD355 million to USD370 million.

Visteon sales from continuing operations have nearly doubled between 2012 and 2016

Source: Visteon

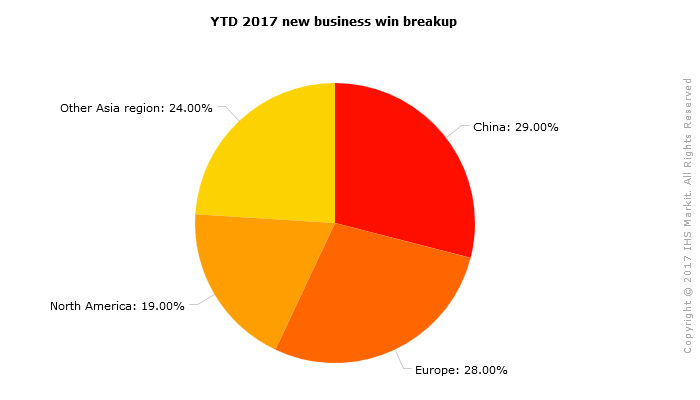

The company’s order book is healthy too. In the past five successive quarters, the US-based supplier has seen an average growth of 9% in backlog, reaching record USD17.3 billion, Sachin Lawande, current CEO of Visteon disclosed last month while discussing the company’s second quarter results with analysts. In the first two quarters of this year alone, Visteon secured new business worth USD3.1 billion.

Fast growing cockpit electronics segment

Within the vehicle cockpit electronics segment, all-digital instrument clusters and display audio are the fastest growing product segments. According to Lawande, in instrument cluster segment, the industry demand is shifting from mostly analog and hybrid clusters with display sizes of less than 5 inches to mostly digital cluster with display size of 8 inches or more and also towards all digital cluster. Earlier automakers were offering digital clusters in premium vehicles but the technology is gradually finding its way into the mass-market vehicle segments. Visteon expects this trend to drive faster adoption of digital clusters. The company predicts three-fourth of all clusters to be digital by 2021.

As a major supplier of instrument cluster technologies, Visteon is well positioned to benefit from this trend. The company offers full line of instrument clusters, from standard analogue to all-digital, fully reconfigurable 2-D, 3-D devices. According to Lawande, all-digital and large hybrid clusters require significant computing resources in terms of silicon and software. This is expected to drive demand for domain controller technology such as ‘SmartCore’ in the future, especially in conjunction with new trends in infotainment. In 2015, Visteon launched SmartCore cockpit domain controller (CDC), which uses an electronic control unit to operate both instrument cluster and information display. According to the company, apart from instrument cluster and information display, SmartCore is designed to integrate infotainment, HUD, advanced driver assistance systems (ADAS) and connectivity and thus offer significant consolidation potentials for automakers. Visteon has so far secured four customers order for its SmartCore CDC, including two in the first six months of this year.

In the area of infotainment, Visteon is gaining from increasing use of smartphone integration technologies such as Apple CarPlay and Android Auto to bring smartphone-based apps to infotainment display. Global demand for such infotainment systems, also referred to as display systems, is projected to grow at a CAGR of 29% between 2017 and 2022, according to IHS Markit forecast. Visteon is leveraging expertise of AllGo Systems, an Indian company that the US supplier acquired in 2016 to improve its competitiveness in smartphone integration technologies.

In infotainment, there is also an industry shift from traditional closed embedded infotainment system to open systems based on new technologies such as HTML5 and embedded Android for Automotive. IHS predicts global demand for embedded infotainment systems to grow at a CAGR of 7% between 2017 and 2021. In the embedded infotainment system, Visteon is seeing growing customer interest for its HTML5-based Phoenix infotainment platform launched last year. In the base audio system that enables radio and Bluetooth media and telephone connectivity, Visteon expects global demand to shrink in the coming years, though such systems are still expected to remain relevant in emerging markets for many years.

Expanding into autonomous driving

While Visteon is a major supplier of instrument clusters, infotainment, information display and audio systems, the company is also leveraging its expertise in automotive electronics and software to develop solutions for ADAS and autonomous driving. Last year, Visteon appointed Matthias Schulze, a former senior executive of Daimler, to lead its ADAS development efforts, which included a centralized approach to domain controller and platform development. At Daimler, Schulze headed the automaker’s group research and advanced engineering activities in areas including ADAS system development, environmental perception, autonomous driving and vehicular communications.

During the year, Visteon established a new technical center in Silicon Valley that is focusing on development of artificial intelligence (AI) technology for autonomous vehicles. The company is using machine learning technology to accurately detect and classify objects in vehicle path and planning the vehicle movement. Apart from using AI for object detection, classification and decision-making in autonomous vehicles, the other major focus areas for Visteon in autonomous driving vehicle include creating a fail-safe, centralized domain controller hardware leveraging its expertise in SmartCore CDC, and on unlocking potential of algorithms developers through an easy-to-access open framework and test/simulation environment.

Strong focus on Asia, especially China

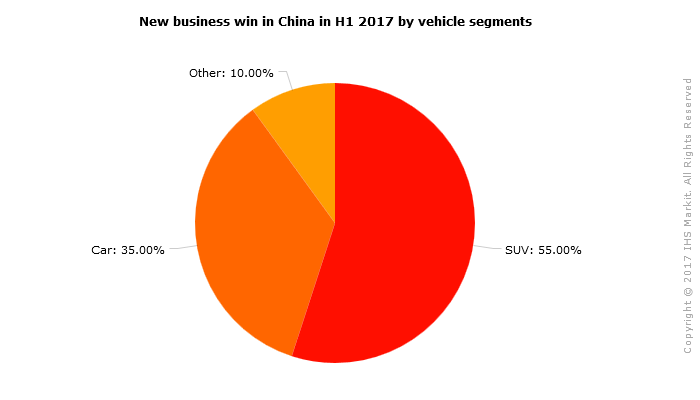

One of the key factors which has driven Visteon’s growth in the past few quarters is its robust performance in China. In 2017, Visteon sales in China increased 17% y/y in the first quarter and 38% y/y in the second quarter, driven primarily by a series of new product launches in the past six quarters. Visteon says it has launched 47 new products over the past six quarters. The strong performance is also reflected in new business wins worth USD900 million in the first six months of the year, equivalent to 29% of the total. In the first half of 2017, Visteon secured two OEM orders for its high-value SmartCore CDC. A further analysis of new business wins reveals that more than half (55%) of the new business wins is from the SUV segment, which is recording the highest growth in sales in the light vehicle segment. The new business wins are also balanced in terms of customers with 63% coming from international JVs and 37% from the local Chinese OEMs.

Visteon secured new business contract worth USD900 million from China in first six months of 2016

SUV accounted for more than half of new business win in China in first six months of 2017

Source: Visteon

The company is expected to record increased revenues in China this fiscal year on the back of increasing contracts with Chinese automakers, which have seen their market share rise over the past year vis a vis foreign automakers. “Looking forward beyond this year, I still am very optimistic about our situation in China. China today represents still a much lower portion of revenues than what it represents as a share of the global vehicle production. So we have a long runway ahead of us. We have started to gain traction with domestic OEMs. Most of our business in the past used to be focused on international joint ventures. We have made a very targeted effort at growing our business with domestic OEMs, which is starting to show results,” Lawande said during the second quarter earnings call.

The massive restructuring at Visteon over the years, which also included a reorganization under Chapter 11 bankruptcy, has transformed the company into a niche player in the automotive cockpit electronics industry with a more diversified customer base and international presence. Visteon is expected to remain on the growth trajectory given its strong presence in the fast growing cockpit electronics business and firm focus on expanding its business with Chinese automakers. Cockpit electronics is one of the fastest growing segments in the automotive industry currently. According to IHS Markit, cockpit electronics segment is projected to see revenue growth at a compound annual growth rate (CAGR) of 7.7% between 2015 and 2022, higher than any other automotive segment.

Analyst: Om Sharma

Visteon generated nearly two-fifth of 2016 sales from Instrument clusters