Prices of raw materials such as natural rubber and butadiene have fallen since the beginning of this year bringing some respite to tire producers, and IHS Markit does not expect any sharp rise in the prices in the remaining part of this year in the absence of any strong demand trend

Global tire-makers such as Goodyear, Cooper Tire, Hankook, and Kumho reported lower operating income year-on-year (y/y) for the April-June 2017 quarter citing high raw material prices as one of the main reasons. Among US-based tire-makers, Goodyear Tire & Rubber’s segment operating income declined 51.6% y/y to USD361 million and Cooper Tire’s operating income fell 31.9% y/y to USD75 million in the quarter ended 30 June. German tire-maker Continental’s said raw material prices impacted earnings by EUR300 million in the first half 2017. South Korea’s top tire-makers Hankook and Kumho also reported lower operating profit in the second quarter. Hankook Tire said its consolidated operating profit in the second quarter totaled KRW203.7 billion (USD179.5 million), down 34.4% on year. Kumho Tire reported a 34.4% y/y decline in operating profit to KRW204 billion.

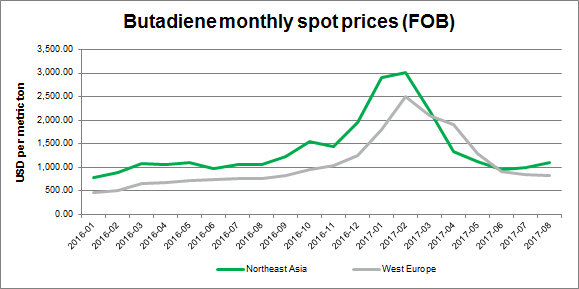

Natural rubber, butadiene and carbon black are some of the key inputs used in tire manufacturing. Natural rubber prices were as high as USD2,099 per ton in the first quarter, nearly double compared with a year ago. The price of butadiene rose threefold to USD3,005 per ton in the same period. Prices of carbon black have also moved in tandem with other tire raw material prices.

.png)

Source: Association of Natural Rubber Producing Countries

Source: IHS Markit database

Tire-makers increasing prices to recover high production cost

Tire-makers have increased tire prices in many markets in an effort to offset the higher material costs they are paying. Goodyear was the first to announce a price increase in 2017. In April, the company raised prices for a second time this year. The tire-maker initiated an increase of up to 8% on its consumer and commercial brands effective 1 February. Last month, Yokohama Tire said it will raise prices up to 4% on all of its commercial and off-the-road (OTR) tires sold in the United States, effective 1 September. Continental Tire also raised prices of Continental, General and AmeriSteel-brand truck tires effective 1 July. In June, Bridgestone Americas Tire Operations increased prices of its commercial tires in North America. "We are impacted by those input cost increases and have, or will, take pricing actions as an offset while also maintaining a competitive market position," said Bill Caldwell, vice president of sales and marketing for Continental Tire the Americas.

Rubber producers plan to boost prices

On 3 August, senior officers of the International Tripartite Rubber Council (ITRC) and the International Rubber Consortium (IRCo) held a meeting in Bangkok (Thailand) to discuss concerns on falling rubber price and market factors that have affected natural rubber prices. The officials were of the view that the current rubber price is not reflective of the economic fundamentals. The ITRC is made up of the world's top producers of natural rubber – Thailand, Indonesia and Malaysia. Southeast Asia is the world’s leading natural rubber exporter. In 2016, Southeast Asia accounted for 92% of global trade. Thailand alone covers about 44% of regional exports, followed by Indonesia (30%) and Vietnam (11%), according to IHS data.

ITRC/IRCo said they will continue to monitor and analyse the market trend as well as explore other possible measures towards strengthening rubber prices. “In addition, focus will also be given by the three Countries towards long term balancing supply and demand. In this regard, member countries were encouraged by Thai Government’s plans to remove permanently 240,000 ha of rubber area. This will permanently remove supply of 360,000 MT of NR per year,” ITRC said in a press release.

The ITRC/IRCo officials expect rubber output from Thailand and Malaysia to decline this year due to low rubber prices and bad weather, including heavy rain and floods in northern Thailand. According to the Association of Natural Rubber Producing Countries (ANRPC), there would be a deficit in global supply-demand of natural rubber in 2017.

Softening input cost to improve tire-makers’ earnings

Compared with the peak level of 2017 so far, the price of natural rubber has plunged about 30%. In the absence of any sharp revival in demand, IHS Markit does not expect any sharp upward movement in the prices of the raw material in the remaining part of 2017 and in the coming year. Asian butadiene prices are expected to remain between USD900 and USD1,000 per metric ton FOB Northeast Asia basis in the coming months. The fundamental demand will remain soft because tire operating rates are low in China and tire producers are maintaining low feedstock inventories. Wolfgang Schäfer, Member of the Executive Board, Continental, said during the second quarter earnings conference call, “We have lowered our expectation for the [raw material] headwind from EUR500 million to EUR475 million because our expectation is now that the natural rubber should average USD1.90 in '17. Before, we expected USD2.25. And the same for synthetic rubber, down from USD2.45, our prior expectation, to now USD1.60. Raw material burden, I mentioned this already, now expected to be EUR 450 million, EUR 500 million in our last guidance.” The company says decrease in raw material prices in the last weeks will further support profitability starting in Q4. Goodyear too expects margins to improve in the quarters ahead on the back of stabilizing input cost. “In addition, at current spot prices, raw materials will be a significant tailwind in 2018 as well. We also anticipate our fourth quarter exit margins to be very strong as our raw material headwinds begin to subside in the fourth quarter.” Said Rich Kramer, chairman and CEO, Goodyear Tire & Rubber.