Q&A with ZYT

ZYT began as a promising incubator project within DJI, the Shenzhen-based drone giant, with a focused mission: To explore innovations in automotive technology. However, as DJI reevaluated its strategic priorities, the trajectory of ZYT shifted. Backed by a wave of investments from major original equipment manufacturers, ZYT officially spun off to operate as an independent subsidiary — positioning itself for greater autonomy and strategic growth.

The separation marked more than just a change in ownership. As a stand-alone entity, ZYT sharpened its focus on long-term objectives, including ambitions for a public listing and deeper partnerships with global OEMs. ZYT is now aligning its operations with the evolving demands of the automotive industry.

In the time since, ZYT has made safety and compliance cornerstones of its business. It has secured A-SPICE Level 2 certification, underscoring its commitment to quality in software development processes — a critical requirement for automotive systems. The company has also taken steps to grow its global footprint, establishing a branch in Germany to better serve the European market.

To learn more, Owen Chen, Senior Principal Analyst, S&P Global Mobility spoke with Eva Yu, vice president of ZYT.

Eva Yu

Source: ZYT

Key takeaways:

- Separation from DJI: ZYT has transitioned from being part of DJI to operating as an independent subsidiary. This separation allowed ZYT to focus on its own strategic goals, including plans for a future listing and collaboration with various OEMs.

- Focus on safety and compliance: ZYT emphasizes safety and compliance with industry standards, such as A-SPICE Level 2 certification. The company integrates hardware and software to enhance safety in its advanced driver assistance system solutions and ensures that its products meet European regulatory requirements.

- European market strategy: ZYT has established a presence in Germany to better address the needs of European customers. The company plans to develop localized solutions and collaborate with European automakers to offer cost-effective intelligent driving technologies while also ensuring that its products align with local standards.

- Understanding customer needs: ZYT recognizes that European customers may have different expectations compared with Chinese customers, particularly regarding technology adoption and safety standards. The company aims to educate European clients about the benefits of its technology and provide hands-on experiences to build trust and acceptance.

The following is an edited transcript of the conversation:

S&P Global Mobility: What strategic considerations drove the transition from the “DJI Automotive” team to ZYT?

Eva Yu: The history of ZYT began as an incubator project by DJI. Over time, DJI analyzed its investment strategy and received significant investments from various OEM players in the market. As a result, ZYT has officially separated from DJI and now operates as a subsidiary brand. We also have plans to pursue a listing in the future; being an independent brand and entity will facilitate our actions in the capital market.

Currently, DJI's Venture Capital arm is still invested in us, but the companies are completely separate. We are pleased to collaborate with leading OEMs in the market.

Compared to Chinese competitors (such as Momenta, Huawei and Horizon Robotics), what are ZYT’s core differentiating advantages?

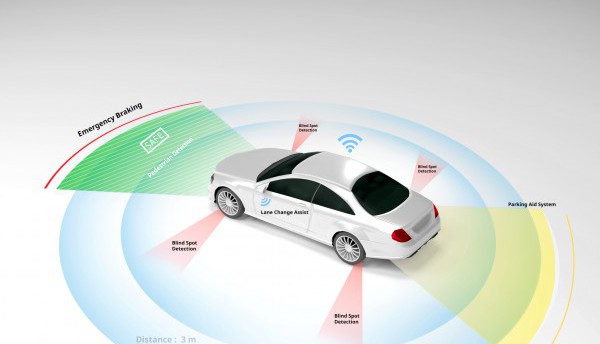

ZYT operates in the market with a focus on ADAS solutions, including the Integrated ADAS & Cockpit System, ADAS & AD Software stack, and hardware components like ECUs [electronic control units], cameras and lidars. We can function as a software tier 1, hardware tier 1 or integrator based on customer needs. We prioritize safety and certification, demonstrated by our compliance with A-SPICE Level 2 requirements.

Detailed elaboration

Differentiator 1: Development and production capabilities

ZYT has capabilities for ecological development and mass production across various computing power chip platforms. Our offerings include mid-compute platforms like the TDA4-VH for Volkswagen's IQ.Pilot system, high-compute platforms such as the Qualcomm SA8650P chip for City NOA and Parking-to-Parking functionalities in Hongqi models, and ultra-compute platforms with the NVIDIA DRIVE THOR chip for End-To-End World Model and VLA (vision-language-action) technology. For future L3/L4 [Level 3/Level 4] technologies in R&D, we will implement a triple-redundancy architecture with a main system, monitoring system and backup safety system, using chips from different suppliers.

Differentiator 2: Integrated hardware-software development

ZYT has capabilities in integrated hardware-software development and model deployment. We have the ability for hardware-software integration, making us one of two domestic intelligent driving suppliers in China with this capability.

This integration is evident in our key perception hardware. For instance, we have developed in-house solutions like inertial-aided stereo and trinocular cameras, as well as lidar-camera fusion systems, which enhance the design of the intelligent driving stack. Additionally, we have created an end-to-end model that combines perception, prediction and planning into a single neural network. This model performs trajectory planning for various scenarios, including complex intersections, obstacle avoidance, lane changes and speed control.

ZYT's VLA Driver Agent supports the following functions:

• VLA — general environment understanding:

○ Recognizes construction zones, school zones, accident areas, etc.

○ Identifies non-standard traffic lights, special traffic signs, special lanes (bus lane, tidal lane, non-motor vehicle lane), speed bumps, etc.

○ Detects special vehicles and pedestrian/traffic police hand signals

• VLA — decision and trajectory planning for long-tail scenarios:

○ Plans routes around obstacles like construction zones and special vehicles

○ Adjusts speed in school zones or occluded areas

○ Selects appropriate lanes such as ETC, bus lane, tidal lane or non-motor vehicle lane

• VLA Driver Agent — voice interaction for driving:

○ Allows voice control for driving styles and behaviors

○ Supports voice-controlled route and lane selection

○ Provides Visual-Language Navigation (VLN) for locating parking spaces or exits

Differentiator 3: Certification endorsement

ZYT is the only ADAS supplier in China to pass Volkswagen's A-SPICE CL2 audit. On Aug. 1, ZYT's IQ.Pilot enhanced driver assistance system received A-SPICE CL2 certification from Volkswagen, making us the first domestic supplier to pass the joint audit for A-SPICE CL2 certification by Volkswagen Group, FAW-Volkswagen and SAIC Volkswagen. This certification allows ZYT to be exempt from software access quality audits in the next four years when collaborating with brands within the global Volkswagen system.

What specific plans and initiatives does ZYT have for the European market?

ZYT has established its German entity in Braunschweig, a significant automotive industrial center, and appointed Nils Oldemeyer as the head of its European region. The German branch is focused on creating a localized operational system and has begun forming a multifunctional team that includes R&D, testing, business development and other functions to effectively support the European market.

With its German branch, ZYT aims to strengthen cooperation with leading European automakers, addressing the demand for cost-effective intelligent driving solutions from both European original equipment manufacturers (OEMs) and Chinese automakers expanding into Europe. The company plans to deploy scalable advanced driver assistance systems (ADAS) and autonomous driving solutions in phases, ranging from L2 driver assistance to L3/L4 autonomy, while ensuring compliance with EU regulatory requirements through redundant safety architectures.

Additionally, ZYT will introduce integrated ADAS & Cockpit systems, multimodal interaction platforms and next-generation perception modules, such as lidar-camera fusion systems, to the European market. Within the next year, ZYT's test vehicles and testing scenarios will be deployed across Germany, with plans for ongoing investments in computing power and infrastructure development in Europe.

In terms of resource allocation, technology localization and partner selection, what differentiated strategies will ZYT adopt for the EU market?

To provide the best autonomous driving solutions to European customers and fulfill our company mission of “safe and effortless travel for everyone,” we will ensure that our solutions are developed in accordance with European customer requirements and meet all relevant European standards.

How do European consumers and automakers differ from Chinese ones in terms of adoption, demand or safety standards for intelligent driving technologies?

The average European customer is slightly older than their counterparts in China. As an ADAS & AD software and hardware supplier, we, along with our OEM partners, need to clearly explain the technology and its benefits, such as safer and less stressful driving, to our European clients. We believe that European customers are interested in this safe and affordable technology, but they need to experience the product firsthand.

What technologies or solutions are specifically designed for the European market? Are there features or standards that differ from the Chinese market?

The key differentiation lies in driving behavior and the ability to handle complex situations. We aim to deliver a European driving style to our customers, allowing them to experience the safe and effortless travel that our brand promises.

What role do local European teams play in R&D, sales, and service? How much influence do they have on strategic decisions?

As the European team, we serve as a bridge to convey our European customers' demands to the organization, align on technical targets, and develop solutions specifically for Europe. To achieve this, we work closely with our global headquarters.

What are the main opportunities and challenges for Chinese suppliers entering the European market, and how does ZYT plan to address them?

We believe the European market is ready for safe and affordable driving solutions. We see significant demand from our OEM and tier 1 partners, which gives us optimism about the potential in this market. Of course, these exciting products must be fully compliant and meet European customer needs. We have entered Europe at a pivotal time for the automotive industry.

Over the next three to five years, what are ZYT’s expectations or goals for the intelligent driving landscape in Europe?

We believe that autonomous driving regulations will be established and that customer demand for autonomous driving is high. Therefore, we are optimistic about the future of bringing this safe and innovative technology into mass-produced vehicles.

How does ZYT balance end-to-end approaches such as VLM with safety-focused modular architectures in autonomous driving?

At ZYT, safety is a core part of our DNA. Our commitment to rigorous certifications, such as A-SPICE Level 2, demonstrates that safety, processes and certification are essential to us. Even with our end-to-end architectures, we implement various safety mechanisms and control points.

Do you see conflicts between end-to-end approaches and modular safety architectures, and if so, how does ZYT address them?

We see no conflict in our end-to-end architecture, as it consists of a safety evaluation framework that ensures safe and reliable driving. Additionally, various control points and quality checkpoints are implemented.

Might different regions adopt different strategies — for example, more end-to-end adoption in China versus stronger safety-oriented approaches in Europe?

There is no difference in safety expectations between European and Chinese customers; both seek the best performance and the latest technology. Additionally, safety and affordability are key priorities for them. At ZYT, we are committed to delivering advanced technology with the highest possible safety ratings to our customers.