In an exclusive interview, Amit Panday, Senior Researcher at S&P Global Mobility caught up with Ramesh Narasimhan, EVP and Chief Commercial Officer, Nyobolt, an emerging battery solutions startup, which spun off from the University of Cambridge. Founded by Claire Grey and Sai Shivareddy in 2019, the startup initially focused on advanced battery materials. Over years, it has evolved into a comprehensive solutions provider to demonstrate the capabilities of its innovative battery technologies. With a significant R&D presence in both the UK and the US, Nyobolt specializes in two unique anode chemistries: a graphite-dominant solution for automotive applications and a niobium tungsten oxide solution tailored for industrial uses. The company emphasizes fast-charging capabilities, achieving impressive charge times that enhance user experience and operational efficiency. Nyobolt’s business model centers on niche applications in collaboration with premium brands, aiming to transform customer experiences in electric vehicles (EVs). With an eye on expanding its market presence, Nyobolt is poised for substantial growth, projecting a year-over-year revenue increase of 50% to 100% in 2025. The following is an edited transcript of the conversation.

S&P Global Mobility: Please tell us about Nyobolt and how it came into being from a university campus?

Ramesh Narasimhan: Nyobolt has two co-founders — Claire Grey, who is a known scientist in the material science area, she's a Dame, and Sai Shivareddy, who has a PhD from the University of Cambridge. They came across this exciting opportunity in the material science domain, and set up this startup, which was spun off from the University of Cambridge. The university too, was involved in the initial stages of development.

So, we are about 6 years old now, as the company was established in 2019.

Initially, the thought process was that we would focus on the materials because that was our core competency, but as we evolved, it was very clear that it was hard to showcase what exciting things our innovative (battery) material can do.

So, we evolved into an end-to-end (battery) solutions company to actually prove the capability of our battery materials. In the process, we became what we are today.

We acquired the team of battery cell engineers in the US. We have a very big R&D center in US, located in Boston. In the UK, we focus on material research, power electronics, BMS (battery management system), software and (battery) pack design. So, that is our footprint. We have anode manufacturing plant here (UK). We also outsource from different parts of Asia, including China.

Our focus was always on [battery] anode because everybody, I think, was focusing on cathode, which is more popularly known for widely known chemistries such as NMC (nickel-manganese-cobalt), LFP (lithium iron phosphate).

But Sai and Claire thought the constraint is in the anode in terms of the energy density. And that was our initial focus. But as I said, that has evolved into providing an end-to-end solution because just the ability of pushing through that much current into the anode powder doesn't solve the problem by itself. Your cell design needs to have the ability to withstand all of that. Your power electronics needs to work in conjunction with that. Your pack design needs to be optimized. So, we learned the entire end-to-end solution as we found new challenges while we were evolving.

Nyobolt battery materials lab in Bedford, UK. Source: Nyobolt

I had realized that Nyobolt’s core expertise lies in battery materials. Are we talking about anode with graphite and silicon in it?

So, we have two unique chemistries. One is a graphite dominant chemistry, and the other one is niobium tungsten oxide. And both [anode chemistries] have different tendencies in terms of what it does. Both are fast-charging solutions.

Graphite-dominant solution is typically used in automotive applications, like electric cars, et cetera, where you still need fast charging to change the entire charging customer experience. To demonstrate the fast-charging performance of our battery chemistry, we developed our own concept car last year. We are not planning to sell cars. Our concept car is powered by a 35-kWh battery pack in it. We were able to charge it in 4.37 minutes from 10% to 80% state-of-charge (SoC). These results helped us figure that with our anode solution, an 80-kWh battery pack or a 90-kWh battery pack can be charged in under 10 minutes. That's the whole idea. Of course, you need a fast charger as well to fast charge an EV battery.

But let me share a key challenge when it comes to fast-charging batteries. When you put that much electricity through the cell, its shelf life deteriorates. I think the longest shelf life delivered by a battery cell that is fast-charged every day is about 500 cycles (so far). That said, a battery with our anode chemistry can deliver up to 4,000 cycles at 100% depth of discharge (DoD). Typically, customers charge their batteries when it reaches 20% SoC, when you do that, the life cycle of our battery solution can last over 12–13 years. At the end of that kind of life cycle, results have shown that our battery solution will still have an 80% DoD, which means it will still be useful. So that's the graphite dominant battery solution that we have developed.

Meanwhile, our second battery solution — the niobium-based solution — is more comparable to LTO (lithium titanate oxide) battery. It can offer about 20,000 to 25,000 charge cycles, and therefore is more suitable for industrial applications, including robotics and mining trucks. It's got a slightly lower energy density compared to our graphite-dominant solution but can charge with a faster rate — slightly faster than our graphite-dominant battery solution. The life cycle of our two solutions is fundamentally the big difference. We have got customers for both those applications at the moment.

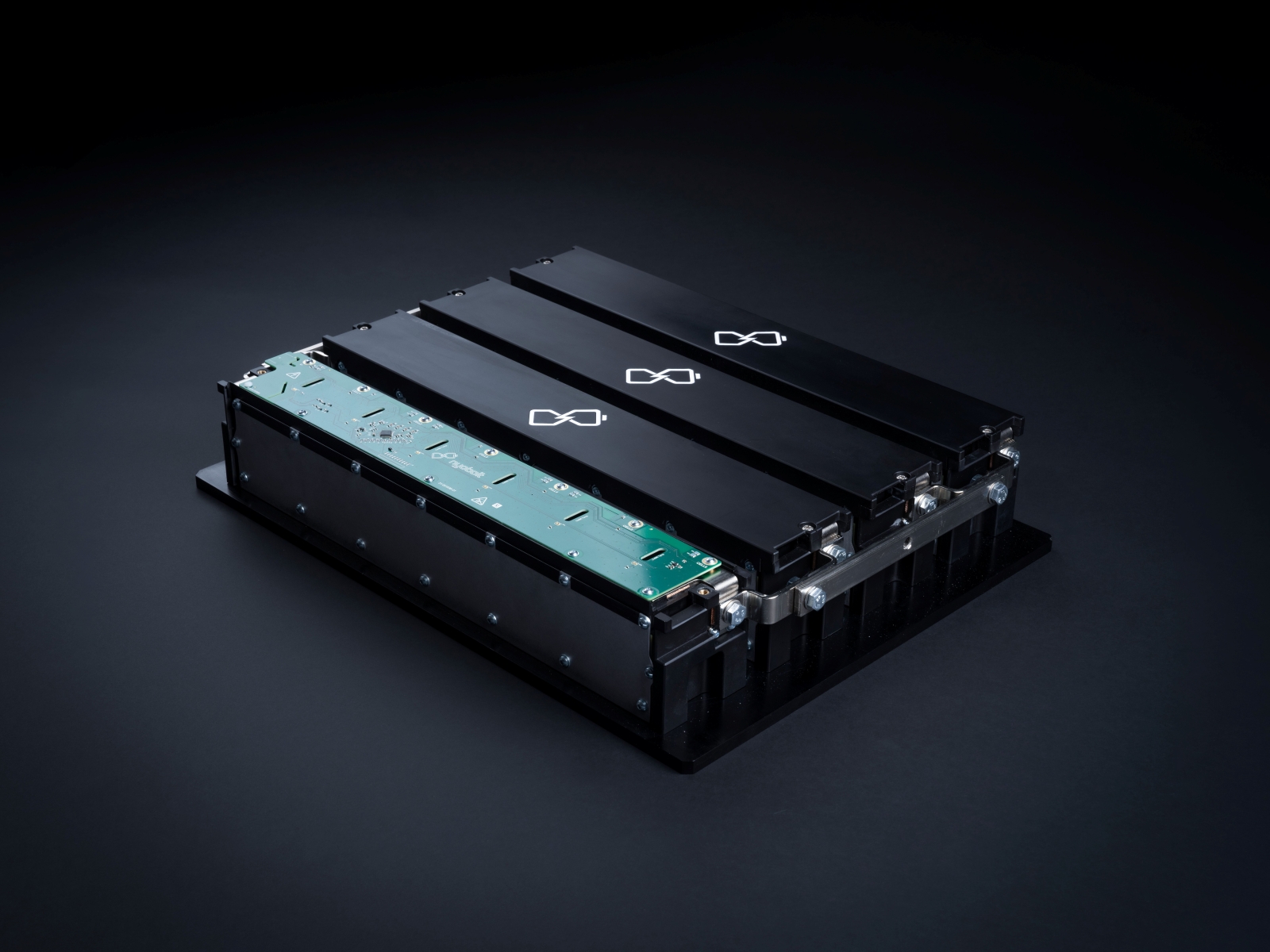

Nyobolt battery pack. Source: Nyobolt

We are beginning to see a significant push of electrification technologies in medium and heavy commercial vehicle (MCVs and HCVs) segments globally. Do you see an increasing interest from electric truck manufacturers for your niobium-based battery solution?

Yes, certainly. When we talk to customers, we present both solutions. What determines the suitability of our solution is really driven by the operating pattern of the customer. So, if you have a typical customer [who] is looking for a suitable solution for a vehicle that has to travel [a] limited distance, they prefer our graphite-dominant battery solution. They typically do not need a battery solution with 25,000 charge cycles, it will be an overkill for them.

Whereas, if there is a customer that is doing more frequent trips and needs a lot more charging, then they tend to look for our NW-based solution.

You also have to remember that vehicle manufacturers typically do not select two different chemistries and put both in development because that will make the development costs very expensive. So, they tend to gravitate towards one or the other battery solution. But certainly, there is an increasing interest in our NW-based battery solution in commercial vehicles.

Could you please elaborate on the chemistry of Nyobolt’s graphite-based anode? Is it 100% graphite, or is silicon added for increased performance? We are witnessing a lot of startups globally in the anode space wherein they have developed silicon and graphite-based anodes.

There is a secret recipe, but I cannot talk about the details of it. But having said that, our unique proposition has helped us in achieving a breakthrough in technology.

Please tell us about the charging solutions that Nyobolt offers.

We are also in [the] mobile charging space. There are two types of chargers — one that is fixed and stationary, and the other we call mobile chargers. You cannot have EV charging facilities everywhere. So, we have developed the capability to build a large charger or a small EV charger that can be moved. It's basically using the same concept but having a different application. Today, we are not catering just to the automotive industry but also robotics and mining sectors as examples. We are talking about power grids. So, there are multiple applications of this concept.

When you talk of mobile charging solutions, the battery energy storage systems (BESS) that you would use to draw power would be the proprietary battery that you develop but the charging hardware may not necessarily belong to you, that may be sourced from other suppliers. Is that correct?

Yes, exactly. For our battery technology to be effective, you need fast chargers. The 350-kW chargers are now more commonly seen in public charging spaces. Meanwhile in China, the 600-kW chargers are being rolled out for electric cars on a wider scale. These chargers can charge an 80-kWh or a 100-kWh battery pack in under 10 minutes. So, it’s at par with filling petrol in cars. You park your car for charging, go get a coffee, stretch your legs and once you're back, your car is charged.

What it enables is — one — of course, the customer convenience and adaptation, but more importantly, if you look at it from an EV charging station perspective, today, an EV occupies the charging space for about 40 minutes. So, an asset is used for 40 minutes to generate revenue from one car. If you can charge the same car in, let's say, 10 minutes, you can charge 4 cars in 40 minutes. That can generate higher revenue with lower number of assets, the EV charging infrastructure productivity improves, asset utilization improves dramatically. Customer convenience too improves dramatically.

Another important factor to note here is that because you have fast-charging capabilities, you do not need massive 1,000-mile battery packs because 99% of the time, you don't need it. If you don’t need large battery packs, you don’t need to dig up as much rare material to make these batteries. With our technology, you can have a much smaller battery pack. So, you don't need a 100-kWh pack, instead a 70-kWh pack can deliver better performance. In my view, a battery pack that can deliver 300 to 400-mile range and can quickly charge could be the potential sweet spot for large-scale adoption. However, as I said, fast-charging infrastructure becomes increasingly critical to achieve that.

I understand that Scania is associated with Nyobolt as an investor, and it invested in the company in its last funding round in April. Nyobolt had raised $30 million, and its total funding had exceeding $100 million. Typically, whenever a vehicle manufacturer invests in a technology startup, via its investment arm, they plan to test and develop the technologies originating from these startups and eventually integrate them in their product development processes. Can you please tell us about the projects Nyobolt is working with Scania?

Yes. I cannot disclose much as there are confidentialities involved. So yes, Scania liked our battery technologies and there are opportunities that you can speculate in terms of the discussions we are having. Those discussions are progressing, but I can't share what we are discussing and what the applications potentially can be.

So, will it be fair to assume that since Scania is in heavy commercial vehicles, they would be testing out your NW-based battery solutions? Please correct me, if I am wrong.

Yes. But as I said, remember, the battery chemistry is always chosen based on the operational requirements of a vehicle. So, all I am saying is that I would not naturally gravitate towards NW-based solutions for HCVs. There are customers in [the] HCV segment that we are talking to, some are preferring graphite-based battery solutions because that it more common and does not add extra costs.

Can you summarize the business model of Nyobolt? Are we looking at manufacturing or technology licensing?

Most of our focus has been on niche applications. On the contrary, the leading passenger carmakers focus more on the energy density and affordability of the battery technologies. We are more focused on fundamentally changing the customer experience with their electric cars. In my view, you will be able to drive growth in terms of ownership value. That’s our focus area.

And therefore, most of the conversations that we are having is with premium brands with very niche applications. And depending on the size of these organizations, some have their own pack manufacturing. So, we are engaging with them on supplying modules. Then there are some customers who want an entire battery pack because they make 5,000 or 10,000 cars.

Our focus is to provide solutions based on the customer requirements. Typically, it has either been at a module level or at a pack level. That said, we see ourselves as a technology company. Essentially, we produce our own anode materials and have close partnerships through the entire value chain where we are invested as well.

Let’s say we enter India tomorrow, which we think is a very strategic market for us in the future, we would establish a manufacturing base with some partners there. So, that would be the way to go because once you put bricks and mortar on the ground, tariffs seem to be changing every day, and you need to have that flexibility in your supply chain. We have a very diversified supply chain that enables us to be quite flexible in meeting customer needs.

So let me describe this, Nyobolt works closely with the carmaker and the battery manufacturer, integrating its proprietary solutions in the value chain for different customers. That would be right?

Yes. We have set up multiple partnerships through investments as well, including [a] cell-making facility at a third-party. You're right, we work very closely with the stakeholders. We design the battery pack. If there is a new cell that needs to be designed, we can do it, we do all the proof points, safety certification and all of that. So, we do the end-to-end design and the solution. And then it's just manufactured to print. In that, we make the anode, and we supply that. And most of the other materials are commercially available in volume. So that's how we keep the cost very competitive.

Can you please elaborate on this point that you said that you have invested in some cell-manufacturing capabilities at a third-party facility?

We have multiple partners in China. We've got our manufacturing lines there, et cetera. We have jointly invested in the [battery] manufacturing lines, and that way we have a control in the manufacturing as well. We would not disclose the names because we see those supply chain relationships as part of our strength and our competitiveness.

Nyobolt Cell Family. Source: Nyobolt

How do you plan to scale up your operations? Nyobolt had announced earlier in April that it would use the funding in scaling up operations.

Scaling up operations reflects on two areas — one is our anode manufacturing facility and our internal engineering capabilities, our test facilities and our presence across our diversified supply chain. Our supply chain partners are not just based in China but also across other countries. So, all of that is part of our plans to scale up our supply capabilities.

When you say you’re talking to multiple [automotive] customers, can you please tell us where are they based out of?

A lot of our customers, specific to the automotive industry, are based out of Europe. That said, there are a few we are engaging with which are based in the US too. However, Europe is where we are focusing more at the moment.

Let me share that we are also interested in the Indian market. But in India, more than the passenger car space, we are interested in the electric commercial vehicle segment. When I talk about commercial vehicles, like buses, for example, it's a highly tender-based business. So, what we would like to do is to showcase to the government what fast charging actually can enable, how it will enable electrification adaptation and get their support. If the government supports fast-charging technology and promotes building the fast-charging infrastructure, it can dramatically change the way commercial vehicles run across the subcontinent. It can surely fetch a massive environmental benefit.

Since we are talking about fast-charging batteries, it appears to me that there is a larger trend where battery-electric vehicles (BEVs) are moving from a 400-V platform to an 800-V platform just to be able to handle such capabilities. When you talk about your product(s), are these more relevant for 800-V platforms or more suitable for the 400-V architectures?

Our battery technologies support 800-V BEV architectures. Yes, we are seeing a number of car companies moving towards 800-V platforms already.

I’d like to understand your perspective on how difficult it is to manage a startup in an increasingly volatile world, where countries are placing tariffs on each other and deglobalizing their supply chains to establish better control on manufacturing. All this goes against the principles of managing businesses because a company will naturally favor collaborations that can offer the most cost-effective models or components.

This is a big challenge, not just in battery manufacturing, but the entire world is now impacted by all of the geopolitical challenges and policies. The beauty of the model that we have adopted, which is we are not investing billions of dollars in bricks and mortars and in building facilities.

China’s strength is in cell manufacturing. That is not to say that others are not making it. But the cost of making cells in China is very effective. But for us, we can make [battery] modules and [battery] packs closer to our customers. So, if we have a customer in Europe, although we would still prefer the cells to come from our established supply chain partners, we can certainly make the [battery] modules and packs closer to the customer base. However, all of this comes down to the volume.

If you say, “I want 2,000 packs a year,” then it just becomes impossible. But if you say, “I want batteries for 200,000 cars,” then of course it is possible. So, the adaptation to suit customer needs, to have the best cost possible, is much easier with our supply chain diversified model. We are having those discussions every day.

Nyobolt’s annual revenue stood at $9 million last year. What kind of revenue numbers are you looking at in 2025?

We are seeing a number of opportunities, especially in the industrial applications, the need for fast charging 24/7, operations don't stop because you want to be environmentally friendly.

I believe you don't need to compromise your economics while also continuing to invest in environmental-friendly technologies. We are seeing an increasing demand for our [battery] technology, especially in the industrial application.

Meanwhile, automotive has a much longer gestation period because you've got to fit into the product life cycle. It takes 4 to 5 years to get into any product. So those are much longer where we are talking about implementation in 2028 and 2029.

Whereas the industrial application, certainly is, much shorter term, the gestation period is much shorter. So, we're seeing more exciting opportunities. If I have to share an estimate, we look at a YOY [year-over-year] growth in the range of 50% to 100% in 2025. But as I said, it will all come down to how quickly we are able to ramp up. Certainly, CY2026 is expected to start off on a very strong note.