Honda has announced an investment of INR25bn (USD459m) at its Tapukara facility in Rajasthan (India) to set up a new vehicle assembly line, a diesel engine component production line, and a forging plant. The investment is set to double Honda's production capacity in India to 240,000 units once fully operational in 2014. Honda currently operates an assembly plant in Greater Noida in the state of Uttar Pradesh. The investment will facilitate production of Honda's diesel vehicles – starting with the entry-level Amaze sedan, which is expected to be launched next week. "So far, Honda has operated in only about 10% of the Indian passenger-car industry, but now we are all set to expand our business in the country with our line-up of diesel cars," said Hironori Kanayama, president and CEO of Honda India. Kanayama indicated that the automaker plans to introduce at least four more diesel cars over the next three years. "With the addition of diesel power, the universe in which we operate will increase to around 50% of the total passenger vehicle market over the next few years," he added.

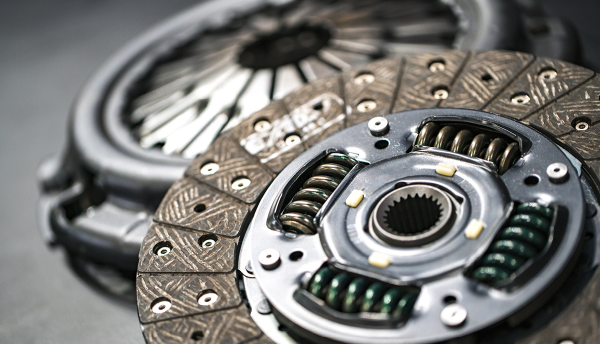

The vehicle assembly line is complemented by a separate line for producing diesel engine components. In a press statement, Honda India said the component line has started mass production of parts for the i-DTEC engine, such as cylinder heads, cylinder blocks, crankshafts, connecting rods, clutch cases, and transmission assemblies. The parts are supplied to the automaker's Greater Noida plant in Uttar Pradesh, which currently produces the Amaze sedan. In addition to domestic markets, the plant will supply transmission parts to the European market. The Tapukara facility is to be an integrated manufacturing plant and will therefore house functions such as forging, stamping, and painting. Honda also unveiled its 1.5-litre i-DTEC diesel engine, which will be first offered on the Amaze but then subsequently feature on other models as well. The engine, specifically developed for the Indian market, will offer a fuel-efficiency of 25.8 kilometres per litre on the Amaze, the automaker claims.

Outlook and implications

Honda, understandably, has high hopes for the Brio platform-based Amaze sedan, for which it has started taking orders. Honda has not disclosed the pricing of the model but has indicated it will be priced competitively. The model will be pitched against Maruti Suzuki's Swift Dzire. Ahead of the launch, the company is also expanding its dealership network to smaller towns, where it expects substantial demand. A diesel variant of its flagship sedan City, a compact car Jazz, a compact utility vehicle, and a sports utility vehicle (SUV) are among the models the automaker plans to launch in India. All these cars will be powered by the new 1.5-litre diesel engine.

The strategy to launch all new models with diesel options marks a departure for Honda, who has remained the only major automaker in India without a diesel. "We will now have an offering for whatever the customer wants. If he wants diesel he can have a Honda. If he wants petrol, then he too can have a Honda," said Kanayama. After falling for two consecutive years, Honda's sales grew in India to 73,051 units during 2012, largely because of its Brio small car.

Honda's announced investment comes at a time when vehicle sales are under pressure as a result of high inflation, high fuel costs and slowing economic growth. While these factors have caused many automakers to put the brakes on their investment plans in India, Honda has decided to move ahead with its expansion agenda after sitting on the sidelines for a long time. The decision comes after losing significant market share over the past couple of years simply because Honda had no diesel model in its portfolio. Buyers have been shunning petrol (gasoline) vehicles in India recently in favour of vehicles powered by diesel, which is subsidised by the government. Investing in diesel capacity is, therefore, a step in the right direction; however, it has been somewhat delayed. With the government now moving to a deregulated fuel-price regime, the benefits to Honda in terms of winning back market share may be marginal at best.

Anil Sharma

Senior Analyst, IHS Automotive

anil.sharma@ihs.com