Nissan has said that its upcoming new vehicle assembly plant in Resende, near Rio de Janeiro (Brazil), will also include an engine plant, according to a press release. The Japanese automaker will invest BRL140m (US58.9m) in the new engine plant to be located in its Resende Industrial Complex. The engine plant will become operational later this year.

Carlos Ghosn, president and CEO of the company, announced the plan while making his maiden visit to the Brazilian plant site, which is in the final stage of construction and schedule to become operational this year. "The Engine Plant in Resende is an important pillar to strengthen our presence in Brazil, and further proof of our confidence in the potential of the Brazilian market,” Ghosn said.

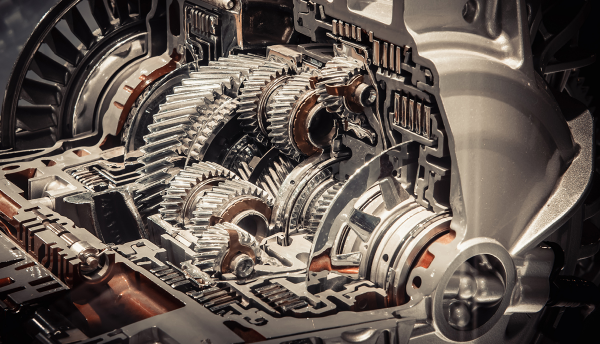

The engine plant will produce 1.6L, 16V, I-4 flexfuel engines for Nissan’s vehicles produced at the Resende plant. The Japanese automaker plans to begin manufacturing operations in Brazil with production of Nissan March and Versa models. The engine plant will have annual production capacity of 200,000 units. The new investment will create 200 direct jobs.

Significance: In 2011, Nissan announced a BRL2.6bn (USD1.4bn) investment in its first manufacturing plant in Brazil to boost its sales in the biggest automotive market in South America. The Japanese automaker aims to have 5% market share in the Brazilian vehicle market by 2016. Brazil has recorded strong growth in vehicle sales in the past few years. According to IHS Automotive, the country sold 3.6 million light vehicles in 2013, up from 2.7 million in 2009. IHS forecasts light vehicle sales of 3.7 million units this year and more than four million units in 2016.

Currently, Nissan is meeting vehicle demand in Brazil through imports from Mexico. The Brazilian government is encouraging automakers to invest in local production through new regulations. The South American country is also taking several measures to restrict import of vehicles and auto parts from Mexico, its biggest automobile import market. These two factors are expected to make Nissan’s vehicle exports from Mexico to Brazil uncompetitive.

In April 2012, Brazil announced a new plan, Inovar Auto, for automotive industry players for the period 2013-17. Under the new plan, automakers will be eligible for an industrialised products tax (IPI) rebate of up to 30%, depending on the level of local sourcing. Several automakers and suppliers are investing in production facilities in Brazil to meet localisation requirements. Most recently, Jaguar Land Rover (JLR) announced plans to invest BRL750m (USD315m) in the city of Itatiaia in the State of Rio de Janeiro (Brazil).