Schaeffler’s net income more than doubled to EUR226m (USD290.5m, 30 September 2012) in the third quarter (Q3) of 2012 compared with EUR102m (USD138.6m) recorded in the corresponding period a year ago, says a press release. Sales stood at EUR2.77bn (USD3.6bn), up 2.5% y/y from EUR2.70bn (USD3.67bn). The company reported EBIT of EUR364m (USD467.9m) compared with EUR466m (USD633.6m) a year ago.

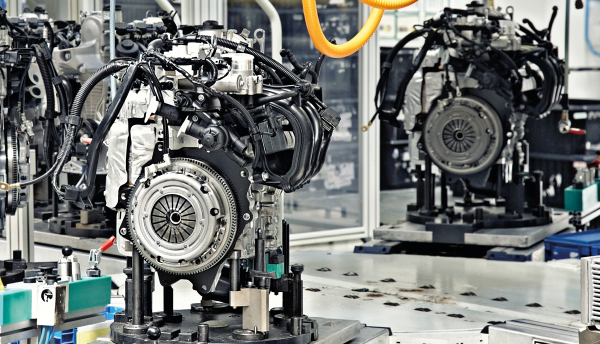

Segment-wise, Automotive reported sales of EUR1.9bn (USD2.4bn) compared with EUR1.8bn (USD2.4bn) in the corresponding period a year ago. The increase in sales is due to robust markets in Asia and North America. However, sales declined in South America due to a slowdown in truck markets. Also, Schaeffler witnessed high demand for products such as dry double clutches, continuous variable transmission and camshaft phasers. Also, ball screw drivers experienced high growth rates. EBIT stood at EUR260m (USD334.2m) versus EUR294m (USD99.7m) a year ago.

For the nine months ended 30 September 2012, Schaeffler’s top line increased 4% y/y to EUR8.4bn (USD10.7bn) from EUR8.08bn (USD0.9bn). The largest growth markets for the company remained the Asia Pacific region and US. While revenues in Europe increased slightly, South America revenues declined. EBIT stood at EUR1.14bn (USD1.4bn) versus EUR1.3bn (USD1.7bn) in 2011. The company reported net income of EUR731m (USD939.7m), down 1.6% y/y from EUR743m (USD1.01bn). Segment-wise, the Automotive division’s sales increased 6.6% y/y to EUR5.7bn (USD7.3bn). EBIT totaled EUR764m (USD982.1m) versus EUR857m (USD1.16bn) a year ago.

Significance: Schaeffler does not expect a revival in the global economy in the fourth quarter of 2012. The company is mindful of uncertainties in the European region and lower growth in Asia. “We currently expect the volatile and challenging environment in key market sectors to continue. We are forecasting a further decline in demand in the fourth quarter, which will result in a temporary adjustment to our capacities,” said Juergen M. Geissinger, CEO, Schaeffler. The company intends to focus on improving business processes and maintain a leading position in patent applications with a 2012 target to invest approximately 5% of sales in R&D. To this end, Schaeffler has reduced its sales growth target from more than 5% to 4%. “Our expectation of generating an EBIT margin in excess of 13% for 2012, thus meeting the target for the year as a whole, remains unchanged,” emphasized Geissinger.