Every major OEM is producing this type of vehicle as they recognise the CO2 saving benefits from the enabling technology. Ben Scott, analyst with IMS Research explains, “The benefits of stop/start systems are clear. Depending on driving profile, the reduction in CO2 emissions can be up to 5 percent.” OEMs are producing this type of vehicle as they look to comply with regional legislation on CO2 emission.

Whilst ICE: Stop/Starts are not strictly hybrid vehicles, the proportion these vehicles represent of the total hybrid and electric vehicle production market is expected to increase from 77 percent in 2010 to 89 percent in 2022. Sales to date of ‘true’ hybrid and electric vehicles have not performed as expected. Stubbornly low consumer interest has resulted in poor sales, exacerbated by the current global economic situation. “There is still the issue of range anxiety with a lack of charging infrastructure and battery technology that needs to evolve further and reduce in price,” says Scott. These issues are definitely in the minds of OEMs, which is why they are choosing the ‘safe’ option of ICE: Stop/Start. Not only is it a less complex solution than a plug-in hybrid, but it is also a much quicker and cheaper way of meeting emissions legislation.

While the short to midterm belongs to the stop/start system, longer term hydrogen might represent the best ‘fuel’ solution. In an effort to re-engage consumer interest and ‘shake-up’ the ‘true’ hybrid and electric vehicle market, some OEMs are introducing hydrogen fuel cell vehicles e.g. Hyundai’s ix35 fuel cell SUV. Sedans and SUVs are most likely to adopt hydrogen fuel cell technology for two reasons. Firstly, these vehicles are physically large enough to store large quantities of hydrogen. Secondly, sedans and SUVs are typically the most profitable models so some of the extra cost associated with a fuel cell powertrain could be absorbed into the vehicle’s margin. Toyota recently announced that they will be producing a fuel cell sedan in 2015.

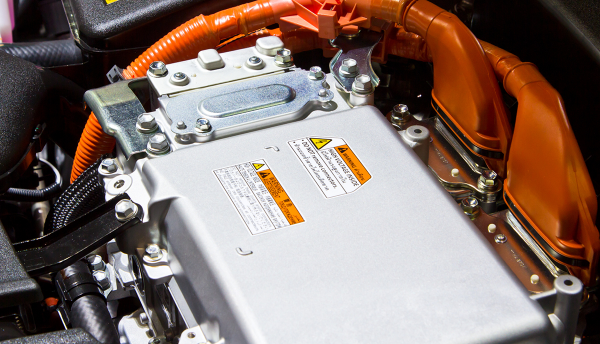

In terms of the powertrain systems involved for a hydrogen fuel cell vehicle, they are very similar to that of a hybrid or electric vehicle, apart from the energy source. The high voltage battery in conventional hybrid or electric vehicles is effectively replaced with a hydrogen gas storage tank and a hydrogen-to-electricity conversion unit. For battery management system suppliers and the associated semiconductor companies, this is a concern as the high voltage battery management is negated for hydrogen fuel cell vehicles.

For more information please contact:

IMS Research: Ben Scott, Ben.Scott@ihs.com, +44 1933 402 255

Alternative Contacts:

Europe, Ann Ruff', Ann.ruff@ihs.com Tel: +44 1933 402 255

US, Stacy Hackenberg, Stacy.hackenberg@ihs.com Tel: +1 512 302 1977

Asia Pacific, Yvonne Zhang, yvonne.zhang@ihs.com Tel: +86 21 6720 1823

About "Opportunities for System and Semiconductor Manufacturers in Hybrid and Battery Electric Vehicles – 2012 Edition"

The report presents market forecasts for different types of hybrid and electric vehicle by region from 2010 to 2022. Market share estimates for OEM production of hybrid, plug-in and battery electric vehicles is presented for 2011 and 2012.The study goes on to provide forecasts up to 2022 for different systems used in hybrid and electric vehicles, followed by a detailed analysis of the market for semiconductors in the drivetrain by system and semiconductor type. The report is highly statistical in nature, containing almost 60 tables and figures. The market statistics include units (k), average selling price ($) and revenues ($m). All tables are accompanied by narrative explaining trends and assumptions.