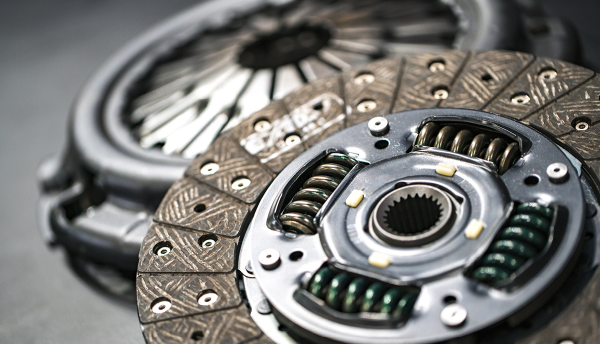

Many Japanese auto-parts manufacturers are entering Russia in a bid to tap the business opportunities offered by the country’s growing new-car market, according to a report by Nikkei. The increasing number of investments by suppliers is linked to the acquisition of Russia’s AvtoVaz by Renault-Nissan. For instance Japan-based Exedy Corp has partnered with Russian supplier VazInterService (VIS) to supply clutches for new vehicles from AvtoVaz. Under the pact, VIS will split off its clutch business and Exedy will invest RUB90m (USD2.9m) in the new joint-venture (JV) which will be 33% held by the latter.

Other Japanese suppliers are also strengthening their foothold in Russia. According to Nikkei, Hi-Lex Corp will set up an automotive cable plant in the southern city of Tolyatti (Russia); the plant is scheduled to commence operations in May 2015. Sanoh Industrial Co recently acquired the piping business of a local firm that has dealings with AvtoVaz, part of its plans to build a piping plant in Tolyatti by 2014. It aims to supply parts for 1.5 million vehicles a year. Calsonic Kansei will start assembling instrument panels and air-conditioning units at an AvtoVaz plant either in 2013 or 2014. By leasing the facilities, Calsonic Kansei aims to keep investment costs down.

Significance: Suppliers trying to increasing their presence in Russia makes sense considering the growth in the country automobile market, especially over the past four years. According to a Bloomberg report, auto sales in Russia jumped 11% year on year in 2012 to a record 2.94 million vehicles. However, car sales in December 2012 were almost flat compared with the same month of the previous year. In 2013, sales are expected to be between 2.8 million units and 3.1 million units, according to AEB. Renault-Nissan’s CEO Carlos Ghosn also sees growth opportunities in the emerging Russian market. “Russia is poised to become the largest auto market in Europe by 2015,” he said. Moreover, non-Japanese suppliers are also building/expanding operations in Russia. For instance, in December 2012, Continental opened a new manufacturing line to produce fuel supply units (FSUs) at its Kaluga plant in Russia. Bosch is planning to open a new automotive technology plant in Samara (Russia) to manufacture products including antilock braking systems and alternators.