Earlier this month, India-based Apollo Tyres took a major step towards increasing its international presence by opening a new plant in Gyöngyöshalász, Hungary. Though Apollo already operates a plant in in Enschede, the Netherlands, the new Hungarian facility is its first greenfield plant outside its domestic market India. The company invested EUR475 million (around USD502.8 million) and will have annual capacity of 5.5 million passenger car and light truck tires and 675,000 commercial vehicle tires. The facility will produce both Apollo and Vredestein brand tires for the European market.

Increasing competition in India

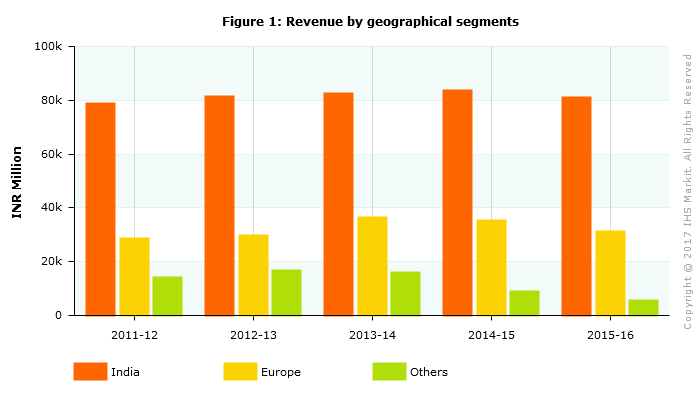

Rising competition in India’s tire industry, the company’s largest market, is believed to be one of the major factors behind Apollo’s heightened focus on its overseas operations. In FY2016, India accounted for around 69% of Apollo’s overall sales. Apollo has been unsuccessful in increasing its revenue in its home market in the past four-five years, because of increased higher competition from international brands such as Michelin and Bridgestone and rising imports of low-cost tires from China, especially in the truck and bus tire segment. The company has outlined this as one of the major threats in its annual report. According to the company’s annual report, sales in India have grown only marginally over the past five years, from INR78.9 billion in FY2011-12 to INR80.9 billion in FY2015-16. The weak Indian currency is another factor that is hurting the company’s margins, since the company is a net importer.

Source: Company annual report

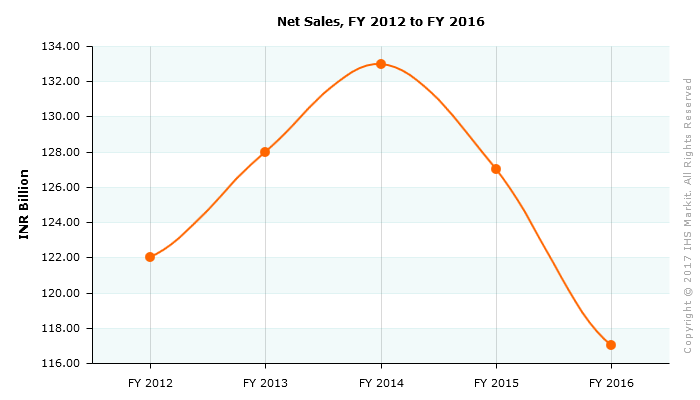

Apollo Tyres’ overall net sales have fluctuated over the past five fiscal years. The company’s sales increased from fiscal year 2012 to fiscal year 2014, but fell in the next two fiscal years thereafter. For fiscal year 2016, the company posted consolidated revenue of INR117 billion, a drop of 8% compared with fiscal year 2015.

What will help Apollo boost market share in Europe?

Europe currently accounts for around 27% of revenue. The company’s key strategy in the European market is to increase its market share in the OEM segment. In FY2016, around 70% of the company’s revenue came from the aftermarket, while OEM customers accounted for around 24%. Commenting at the importance of the new facility in Hungary, Onkar S Kanwar, chairman, Apollo Tyres, said during the plant’s inauguration, “This facility will help us further increase our presence and market share in Europe. From being a replacement market focused company in Europe, we would soon be starting supplies of our tires to all the leading OEs in Europe.”

Apollo’s sales in Europe, it’s second biggest market after India, has also shown a declining trend over the past couple of years, though the company is looking to turn this around with the new plant in Hungary and a renewed sales and marketing push. The acquisition of German tire distributor Reifencom GmbH will help the company establish a strong sales network in many key markets in Europe.

In 2016, Apollo launched its ‘Dealer Partnership’ programme in Europe and four new outlets were opened simultaneously in Belgium, Hungary, Italy and the Netherlands. The company aims to have 800 programme partners by 2020 throughout Europe. The company is also investing in enhancing is research and development capabilities in Europe. The company has opened a new R&D office in Frankfurt, Germany, to support its OEM business. This office is staffed with test drivers, OEM engineers, etc. with a focus on being closer to its customers in the region.

The Hungarian plant will allow the company to serve European market with a larger product portfolio. Presently, the company supplies mainly to the replacement market in Europe under the Verdestein brand, which it acquired in 2009. The Vredestein brand has an established presence in Europe, catering to ultra-high performance (UHP), winter and all-season passenger car tire segments. The tire-maker is also expected to push for larger market penetration for its Apollo branded passenger vehicle tires now.

Likely to stick to organic growth for now

Apollo is expected to focus on its organic growth strategy for now to drive sales. “Now our focus is Hungary, it is organic and you can see the magnitude of investment is USD475 million. I have to make this successful, I have to ramp up this as soon as possible,” Apollo Tyres' vice chairman and managing director, Neeraj Kanwar, told CNBC-TV18 in an interview. Also, last year, the company expressed its desire to enter the US tire market and reportedly put together a small task force to look into the business possibilities. According a report in Forbes India, Apollo is considering opening a plant in the United States in the next 4-5 years. “Our long-term plans include entering the US market for which we need to have the right products and the right distribution network in that market,” said Kanwar.

Indeed the biggest challenge for the company now is to increase its OEM business in the European market for passenger car tyres, which is expected to help drive its sales in the replacement market as well. "We would like at least 25 percent of tyres to be sold to original equipment makers in the next year," said Mathias Heimann, president, Europe and Americas at Apollo Tyres. Considering its enhanced production and distribution capabilities in Europe, we expect Apollo Tyres to be able to increase its revenues in Europe in the coming quarters and years, reducing its high reliance on the Indian tire market.

Source: Company annual report. The Company's geographic segments are India and Europe on the basis of Operating Locations. Indian segment includes manufacturing and sales operations through India and European segment includes manufacturing and sales operations through the plant at Netherlands along with its subsidiaries. The company's “Others” segment includes the subsidiary in UAE, South Africa, Thailand and other operating subsidiaries of the group.