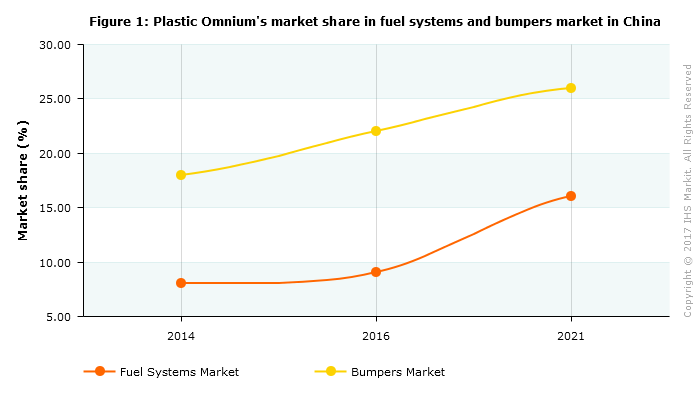

China, being the largest automotive market globally, is taking the center stage in Plastic Omnium's broader plan to expand its business and revenues in Asia. The France-based supplier recently announced its aim to double its revenue in China to EUR1.3 billion (USD1.4 billion) in 2021, from EUR634 million in 2016. In the Chinese automotive market, Plastic Omnium expects its market share in the ‘bumpers’ segment to grow to 26% in 2021; its market share in the ‘fuel systems’ segment is seen growing to 16% in that year. The company is a major supplier of exterior body parts in China. In 2016, the company had 22% market share in the bumpers segment, and ranked second in fuel systems segment, with a 9% market share, according to the company. "At this rate, Plastic Omnium will grow much faster than Chinese automotive production, which is set to hit the 30 million vehicle mark in 2021, up from 26 million in 2016," the company said in a statement. IHS Automotive expects light vehicle production in China to go up from nearly 27 million units in 2016 to more than 31 million units in 2021.

Source: Company website

Financial performance in China

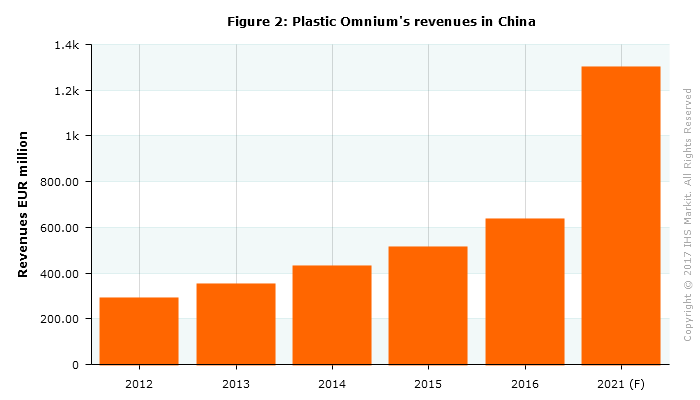

In China, the company posted approximately 23% y/y growth in revenues in 2016. The company benefited from high investment made over the past three years to expand its capacity in the region. Currently, the company has 26 plants in China, serving Chinese carmakers – 18 local brands at present – that account for a growing share of its Chinese revenue (14% in 2016).

The company’s performance in China has been improving over the years, with revenue growing at a compound annual growth rate (CAGR) of 17.2% over the past five years to EUR634 million in 2016. In order to expand its revenue in China to EUR1.3 billion in 2021, the company will have to grow at a CAGR of 15.4% over the next five years.

Source: Company annual report

What will drive company’s growth in China?

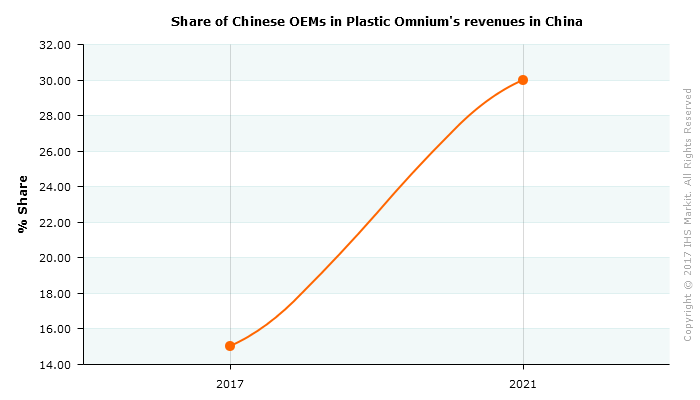

Plastic Omnium is currently focusing on diversifying its customer portfolio in China by increasing business with local carmakers, which represent 46% of the Chinese market. To this end, the company has been expanding its manufacturing presence in China to better serve local Chinese customers and increase economics of scale by encouraging localization. The company provides automotive parts for 18 Chinese carmakers. Plastic Omnium expects these customers to account for 30% of its Chinese revenues in 2021, double from expected 15% in 2017 (see Figure 3). The company also expects significant growth in sport utility vehicles (SUVs), with 40% of revenue from this segment, accounting for 36% of the market share.

Source: Company website

The company is also ramping up its research and development (R&D) capabilities in the region with an investment in a new fuel systems R&D center and test lab in Wuhan, which is set to open in the second half of 2018. In addition, Plastic Omnium’s new plant in Chongqing is scheduled to come on stream in June this year to produce fuel systems for Hyundai. The company says the loading rate in its installed industrial capacity will increase significantly from 80% in 2016 to over 95% in 2021 to absorb this substantial growth in the near future.

New emission and fuel economy standards in China are one of the main factors that will drive Plastic Omnium's growth in China, considering the company is investing in its facilities dedicated to producing light weight components. The company has five programs in production and eight more in development for tailgates and aerodynamic spoilers. The company expects to start production of the first high-pressure tank for rechargeable hybrids at the end of 2017.

Consistent focus on growing its strength in China

Plastic Omnium has presence in seven major Chinese production areas – Shenyang, Beijing, Yantai, Shanghai, Wuhan, Guangzhou and Chongqing. The company’s Chinese customers include BAIC, Brilliance, GAC, Geely, Haitec, JAC, Luxgen, NextEV, Qiantu Auto, and SAIC. Plastic Omnium has significantly grown its presence in China over the past decade. In 2007, the company launched auto exterior joint ventures in China with Yanfeng Visteon. In 2012, the company established a majority-owned fuel system joint venture in China with BAIC. The company opened five new plants in the Asian in 2013 and commissioned four new plants the following year. Plastic Omnium bagged various significant orders in China in 2016. For instance, it secured first contract with NextEv in China for electric vehicles to supply bumpers, fenders, tailgate and spoiler.

In the coming years, China will remain the most important market for the company in its strategy to increase its revenue in Asia. Asia, with 16% share in company’s revenues last year, is the third largest region for the company in terms of revenue after Europe/Africa and North America, which accounted for 57% and 24% of the company’s total revenues, respectively, in 2016. With the company’s growing focus on expanding contracts with local Chinese automakers and its rising investment in developing products to meet the new environment norms in the country, IHS SupplierInsight expects Plastic Omnium to report revenue of close to EUR1 billion in China in 2018.

Analyst Details: Arti Anand