The robo-taxi sector is gaining momentum as Chinese autonomous vehicle companies prepare to deploy their technologies globally, bolstered by growing consumer acceptance and supportive governments.

Recent advancements in AI and machine learning are improving the capabilities of autonomous vehicles. WeRide is using technologies such as closed-loop and large-scale simulation engines to enhance fleet performance and safety.

Regulatory support is also evolving, particularly in the Middle East and Europe, where governments are promoting driverless solutions. For example, Dubai aims for 25% of its transportation to be autonomous by 2030, and Saudi Arabia has similar goals for goods transport. This regulatory environment is crucial for Chinese firms seeking to enter these markets.

To capitalize on these opportunities, early movers are forming partnerships with established mobility platforms. For example, WeRide's collaboration with ride-hailing platforms enables rapid scaling by leveraging their existing user bases and operational infrastructure. This strategy is particularly effective in regions like the Middle East and Southeast Asia, where demand for autonomous transport solutions is growing.

Despite the potential for growth, challenges such as data privacy, cybersecurity and public acceptance remain. Companies must implement strong safety measures to build consumer trust and meet regulatory standards.

To learn more, S&P Global Mobility analysts Owen Chen, senior principal analyst and Daokuan Lu, senior research analyst engaged with Jennifer Li, CFO and head of international of WeRide.

Key takeaways:

- Current robo-taxi operations: WeRide's robo-taxi fleet in Abu Dhabi has tripled since the company’s partnership with Uber began in December 2024. The service now covers half of Abu Dhabi's main areas; driverless testing is ongoing with plans for a commercial driverless launch in the coming months. In Dubai, road tests are ongoing, and a pilot is expected soon. In Riyadh, Saudi Arabia, the first robotaxi pilot has launched, while in China, fully driverless services are already available in major cities such as Beijing and Guangzhou.

- Growth strategy: WeRide focuses on early entry into markets in Europe and the Middle East, partnering with local platforms like Uber and Grab to expand quickly. This strategy allows for scaling operations and reducing costs by sharing resources and expertise with local partners.

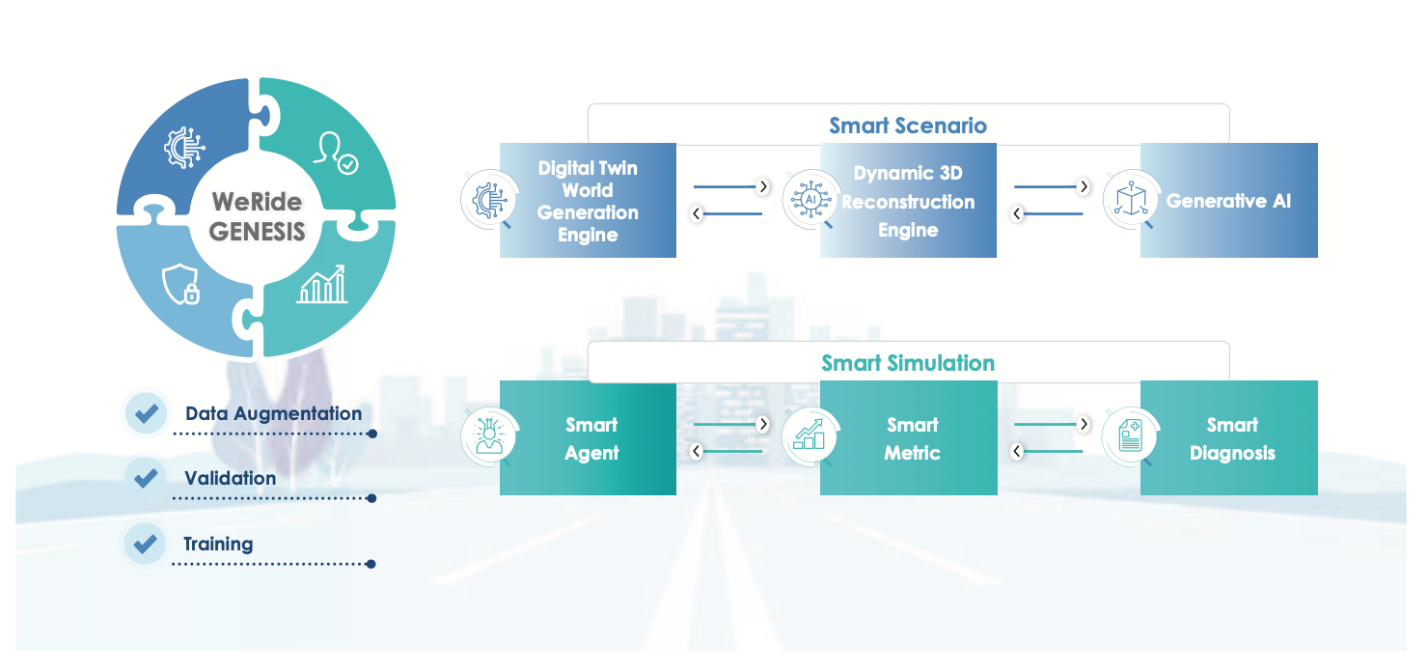

- Core technology competence: WeRide uses advanced computing platforms and simulation engines to improve performance and reliability. Its latest HPC 3.0 computing platform features dual NVIDIA DRIVE Thor X chips and delivers up to 2,000 TOPS of AI computing power, making it one of the most powerful computing platforms for Level 4 autonomy. Its proprietary, all-in-one, and closed-loop simulation engine, GENESIS, generates intelligent scenarios and high-fidelity simulations that replicate real-world driving environments.

- Regulatory environment and market strategy: Support for autonomous vehicles varies by country. For instance, the Middle East actively promotes the technology, while other regions are more deliberate in their approach. WeRide works with regional partners to navigate these challenges and facilitate deployment at a pace that suits each local ecosystem.

The following is an edited transcript of the conversation:

S&P Global Mobility: What is the current operational status of the robo-taxi fleet in each unlocked country? What is the growth strategy of your company?

Jennifer Li: In Abu Dhabi, the fleet has tripled since the Uber collaboration began in December 2024. In July, WeRide and Uber expanded services to AI Reem and AI Maryah, partnering with the Abu Dhabi Integrated Transport Centre. The service now covers about half of Abu Dhabi's core areas, including Yas, Saadiyat, highways and the airport, with ride volume expected to double. Each robo-taxi is projected to complete numerous rides, averaging 6 kilometers. The fleet has also begun fully driverless testing, aiming for a commercial launch soon.

In Dubai, road tests have started with a safety driver onboard. We plan to roll out driverless service in 2026.

In Riyadh, we launched Saudi Arabia’s first robo-taxi pilot with AiDriver, covering key areas like King Khalid International Airport, major highways and selected city center destinations. Full commercial operations on the Uber platform are anticipated soon.

In China, we operate a sizable fleet in Beijing and Guangzhou, where we provide fully driverless services.

We implement different strategies for domestic and international markets, choosing between direct operation and fleet co-management based on local dynamics.

In overseas markets, first-mover advantage is vital. We adopt an asset-light model to accelerate expansion and reduce risk, partnering with local platforms like Uber, TXAI, and AiDriver in the Middle East, and Grab in Southeast Asia. This integration with local infrastructures allows for efficient scaling and high safety standards.

For the domestic market, we operate fleets directly. Since 2019, we have provided services through our app, WeRide Go. We plan to expand our outreach via AMAP and WeChat and explore strategic partnerships to enhance coverage in cities like Shanghai.

What is the core technology competence of your company to make it dominant in the industry? What is the road map of your technology?

We developed WeRide One, a universal technology platform integrating our proprietary technology stacks. These include a closed-loop and large-scale simulation engine, hybrid algorithm architectures and high-performance computing. The platform uses a hybrid approach that combines a deterministic overlay with an end-to-end model, prioritizing safety while at the same time balancing adaptability, reliability, and transparency.

Earlier this month, we introduced HPC 3.0, our latest computing platform co-developed with Lenovo. HPC 3.0 features dual NVIDIA DRIVE Thor X chips, delivering up to 2,000 TOPS of AI computing power, making it one of the most powerful platforms for Level 4 autonomy. It’s fully automotive-grade, tested under extreme conditions, and designed for a 10-year lifespan. HPC 3.0 is integrated into our GXR robo-taxi, the first mass-produced Level 4 autonomous vehicle using the NVIDIA Thor chip.

Another key innovation is WeRide GENESIS (Generative Engineered Neural Environment for Simulated Intelligence in Self-driving), an all-in-one simulation engine. GENESIS replicates and proliferates real-world driving environments with high fidelity, powered by generative AI, smart agent, smart metric and smart diagnosis.

Source: WeRide

WeRide has commercialized both L4 autonomous driving and L2+ ADAS for mass production, positioning us uniquely in the industry.

On the L2+ side, we built a one-stage end-to-end model encoded with general world knowledge and trained on diverse driving data from human drivers and high-quality simulations. It helps us build our engineering expertise. Our adherence to rigorous standards (such as ISO26262 ASIL-D, ISO/SAE 21434, and ASPICE CL2) ensures the consistency and reliability required to successfully transition from prototype to high-volume commercial production.

Advancing our L4 and ADAS technologies in parallel creates a powerful synergy. Our L2+ solutions generate invaluable real-world data that helps to accelerate the development of our L4 technology.

What is your perspective on the regulatory environment in different countries? In Europe, the first deployment of L4 driving seems to be robo-bus and robo-shuttle; is this due to governments’ preference? How do you estimate the regulatory mission that you need to overcome during future massive deployment of Robotaxi, like data security, labor protection and vehicle homologation?

Local government support for autonomous vehicles is critical. Each market has its own strategy, with some, like the Middle East, pushing aggressively for driverless solutions. Dubai aims to make 25% of its transportation autonomous by 2030, while Saudi Arabia targets 25% of goods transport vehicles by 2030. Other markets take a more gradual approach. For example, we deployed Robobus and Robosweeper in Singapore to demonstrate our technology before introducing Robotaxi in 2025. Our Founder and CEO, Dr. Tony Han, has been invited to join Singapore’s steering committee on autonomous vehicles. WeRide and Waymo are the only two international [autonomous vehicle] enterprises represented on the committee. As an early mover, we assist local stakeholders in shaping responsible adoption roadmaps. This allows us to gain valuable experience while easing our responsible entry into new markets.

WeRide’s products are granted autonomous driving permits in six countries: China, the US, the UAE, Saudi Arabia, France and Singapore.

We prioritize data privacy and cybersecurity. We have not engaged in any cross-border data transfers that would violate applicable laws and regulations.

Addressing demographic and labor challenges, we have over three years of experience in global markets. In regions and countries like Europe and Japan, where aging populations and labor shortages affect the service industry, autonomous driving applications such as Robobus offer an efficient mobility solution.

Through these adaptations, we continue to expand our global presence while delivering solutions tailored to each market’s needs.

Commercialization is no doubt the target of the robo-taxi business. What is the major approach of your company to expand fleet size and cut costs in parallel? Cost can be roughly divided into vehicle cost and operation cost; what are your ideas to decrease both costs and ensure security at the same time?

Technological advancement drives cost reduction. With the launch of our automotive-grade HPC 3.0 high-computing platform, we achieved a 50% reduction in autonomous driving kit costs while improving performance. This advancement accelerates large-scale commercial deployment by making our solution more affordable and capable.

Our competitive edge lies in scalable technology and operations. We aim to cut operation costs by achieving economies of scale by leveraging our adaptable solutions and operator partners’ networks. With our execution, we can complete pre-operational deployment in a new city in as short as just a few weeks.

What is the primary reason that most Chinese robo-taxi companies choose the Middle East as their initial entry point into the global market? Given that regions like the EU, EMEA, and China have distinct characteristics, what specific strategies do these companies employ when launching robo-taxi services in these areas?

Each market has unique features.

The Middle East offers opportunities driven by government’s openness to innovation. Local authorities actively support autonomous mobility initiatives. For instance, our products received the first national autonomous driving permit in the UAE.

In Europe and Japan, there is high demand for autonomous mobility solutions to address driver shortages caused by an aging population, especially for public transportation.

In China, high-density urban data enhances AI for complex traffic environments, making it an ideal testing ground for diverse scenarios. One example is our cold-weather testing in Heihe at -25°C, which has prepared us for snowy climates in Japan.

Our robo-taxi strategy in international markets focuses on partnerships with top mobility players with significant local presence. We develop L4 autonomous driving technology while our partners offer leading marketplace and operational expertise. This cooperation allows us to scale faster and adapt to local conditions.

“End-to-end” technology seems to be the industry consensus to realize full autonomous driving. But the E2E model is a black box that is not well-interpreted. How can we deal with this?

We have launched a one-stage, end-to-end ADAS solution called WePilot AiDrive. Unlike the traditional two-stage process of sensing followed by decision-making, WePilot AiDrive integrates both steps, allowing vehicles to "see and act" simultaneously — like a skilled human driver. This results in faster responses, shorter driving routes and greater fault tolerance.

For instance, one of the key advantages of WePilot AiDrive is rapid daily iteration. It uses extensive driving data to automatically generate training labels, continuously improve performance in a cost-effective manner, which strengthens the system's ability to handle edge cases and long-tail scenarios.

While we continue to build the state-of-the-art end-to-end solution for ADAS, we keep in mind its limitations, especially its “black-box” problem, which makes it insufficient for L4 autonomous driving at this stage.