Niron Magnetics, an emerging company with strong backing from the US government, has garnered a lot of attention over the last few years, thanks to the in-house developed iron nitride-based magnets, which can potentially replace the rare earth-based magnets. Several leading automakers and drivetrain suppliers are working together with Niron, strategically integrating its innovative technology into their core products to achieve sustainable, rare-earth-free solutions.

In this interview, Rowntree discusses Niron’s strategy of penetrating the automotive market, product roll out and scale up plans, state of engagement with clients, supply chain impact of China’s REE policy, funding requirements, among other areas. Edited excerpts:

S&P Global Mobility: Please give us an overview of how Niron Magnetics was set up and has become one of the most anticipated emerging companies in the US, especially amid the volatile geopolitical landscape and the growing focus on the rare earth material supply chain.

Jonathan Rowntree: We celebrated our 12th birthday recently and the timing is great as there are a lot of spotlights on Niron. It’s important to be in the right place at the right time. It has taken us 12 years to get to this point. The genesis of Niron was the US Department of Energy (DOE) grant back in 2010–11 timeframe, after the first world rare earth crisis when the Japanese impounded the Chinese fishing trawler. That sent a shockwave around the supply of rare earths globally.

The US DOE saw this coming. They commissioned 12 grants of $4 million each to a variety of research institutions. The University of Minnesota was granted one of those. Several years later, the work that Professor Jian-Ping Wang did to prove that iron nitride was the most powerful magnetic material known to science. That was the genesis of Niron Magnetics in October 2013. We wanted to make alpha double prime iron nitride (a specific crystal structure of iron nitride).

Iron nitride exists in multiple phases, but alpha double prime is the very magnetic phase that we wanted to make our product(s) in. It took us about five or six years to figure out how we're going to cost-effectively scale that, because magnet making is a cost-competitive business. Iron nitride is unique in that respect because it's the most powerful magnetic material known, but it also has very low raw material inputs, including iron, which is the most recycled material on the planet, and nitrogen.

Those are the properties that make it unique and compelling. Now we need to get to scale to really make an impact in the world, and that's the journey that we're on. So, at our current facility here in Minneapolis, we've already gone from the gram to the metric ton scale. So, it's an exciting time as we're building devices, motors, speakers, sensors with customers, and we are getting great feedback and results.

A few weeks ago, we programmed in our first manufacturing plant. We're building a 1500 metric ton facility, which will be about a 75-minute drive from our current location that will come online by mid-2027.

That said, we're also working on plant two, which will be a 10,000 metric ton facility. We're in state selection mode and we plan to down-select probably three states by the end of the year and then get into site selection early next year.

We have been very successful in partnering with the government. The genesis of Niron was the US DOE grant. We also received the $20 million scale-up grant here in 2023 to fit out our current facility.

We've also secured a number of Department of Defense or Department of War grants over the several years, and we will continue to do that here.

So, for plant one, we secured a 48C tax investment credit for $52 million back in January. We've also secured a commercial loan for that facility. That's why we've broken ground and started work on building that plant.

We're also in discussions with the current administration and have been here for several months to see what we can do to accelerate Plant 2. And so those discussions are ongoing to see how we can bring this online as fast as possible.

What we've done in Niron Magnetics has really changed the game. As you know, the West is in a crisis right now. Not only the US, but everyone in the West, because China has put these export controls in place for everybody. So, we need all the solutions to solve this problem.

It was great to see the government investing in MP Materials (rare earth materials company based in the US). I think that helps with the defense needs in peacetime, but it doesn't help solve the magnets needed for energy and economic security.

You very well know that the world runs on magnets, whether it's your cell phone or your gas-powered car. Electric vehicles (EVs) have many applications as well.

The US uses about 50,000 metric tons of those magnets a year. We don't buy that many; we import magnets, per se. We import cars, pumps, appliances, air conditioning systems, robots, you name it, we import those, and those articles contain those magnets.

That's why we're pushing hard to get to 10,000 metric tons to provide 20 to 25% of the domestic needs here in the US to really break the stranglehold that [mainland] China has on the global magnet supply chain.

Do you have automotive customers to supply to from your first plant, which is slated to have a capacity of 1,500 metric tons?

We’re engaged across all end markets, including consumer electronics and appliances. You might have noted that Samsung has invested in us. We are also [engaged with customers] in the industrial sector. So, there are many industrial motors, where about 40% of the world's magnets are used to build motors. Many of those in the industrial space for moving fluids or for other applications. If it's an electrified motion, it's got a magnet in it.

We're also engaged across automotive. In fact, we're already working to put our first products in cars. Those will be audio products, and shortly after that, accessory motors. So, think about powered windows, windscreen wipers, motors. Obviously, the EV drivetrain is the kind of the holy grail in terms of magnets used and the performance levels required. That’s the reason why General Motors (GM), Stellantis, Magna and Allison Transmission have invested in us. We are engaged with programs with them in not only accessory motors and audio [applications], but also EV drivetrain. And so, we're building those with our end customers and testing those.

We're also engaged across defense, wind turbines, among other applications. We're engaged in all end markets, but I'd say our focus right now is really on audio and small-to-medium-sized motors. Those will be what fills Plant 1.

That said, we want to make sure we're leaving a space there for EV drivetrain and other applications that we expect we will ramp up into as that plant comes online in 2027-28.

Niron Magnetics' headquarters and commercial pilot facility in Minnesota, US. Source: Niron Magnetics

That's an interesting plan to penetrate into the automotive segment. But how are the qualification stages going on with the OEMs? Can you please tell us about the stages Niron is engaged with these OEMs through its joint development programs?

Sure, it depends on the end market segment. So, for audio and small-to-medium-sized motors and industrial, where we're beyond engineering validation, we're into design validation.

Whether it's automotive or consumer industrial, they all typically have three different steps of qualification. The first one is engineering validation, where you're testing that the magnet does what it says on the tin.

Once you've gone past that with customers, they want to then find a specific product to target for your magnet to go into. That's design validation.

So, for many customers, we're at that point, where we are beyond the engineering validation, and we are into design validation across audio and small-and-medium sized motors.

For EV drivetrain, we are still at that engineering validation phase, which is the first step. Currently, I think we have more than 10 motor builds in our R&D. A number of those are in automotive, across accessory motors as well as EV drivetrain. We anticipate that we will move next year into design validation for a number of those programs.

But as you know, the design cycles are different. For consumer electronics, the design cycle goes up to 12 months. For industrials, the design cycle can go up a couple years. Then, for EV drives, the design cycles can go up to three to five years.

So, our first products in cars will be in speakers, then in accessory motors, and then in EV drivetrains.

That is an interesting strategy. I wanted to understand the impact of the rare earth export restrictions implemented by China on local supply chains. We understand that China has been doing this on and off over several years now, and therefore, it’s not a new story. But when you speak to your customers, let's say the senior executives at GM and Stellantis, do you feel the pressure of accelerating the development phases for critical magnets?

Yeah, absolutely. We already had a very strong customer pipeline before April, but the export controls they put in place in April made a step change in both customer and investor interest. And then that stepped up again on Oct. 9.

Essentially, the Oct. 9 export controls were closing a lot of the loopholes that customers have used after April 4.

So, this license process is very onerous. You have to provide a lot of information that customers don't like sharing, and now they feel like they are being forced to.

But for some customers, they got around that by buying motors out of China, where you didn't need an export license, rather than buying magnets out of China. Obviously, on Oct. 9, they closed that loophole.

So, we saw shutdowns in May here, like Ford shutting down their Explorer line. I suspect we're going to see more shutdowns than we did after May.

Obviously, Trump has been in Asia recently and there's talks about delaying the October 9th announcements on export controls by 12 months. We'll see if that happens, but they're not talking about taking the April 4 announcements off the list. So, what you're going to see here is it's not going back to normal.

If you look at the number of magnets that the world needs, it needs almost three times in the next 10 years. So, this is just the Chinese making sure that they can control those magnets supply and have them for their own needs, ahead of the rest of the world, if needed.

A vial containing iron nitride powder used in Niron’s rare-earth-free permanent magnets. The image demonstrates how the powder reacts to a magnet. Source: Niron Magnetics.

Can you briefly run me through the development process of the iron-nitride-based magnets built by Niron Magnetics. Also, give me a performance comparison of these magnets with the conventional rare-earth-based magnets.

The iron nitride in its pure phase form has a magnetic strength of 2.4 Tesla. If you look at the neodymium boron magnets that are in high volume, they're typically around 1.4 Tesla.

If you look at the magnets that we're making here at our pilot plant in Minneapolis, these are our latest magnets that are being tested into EV drivetrain motors. We're already above 1 Tesla, and by the time Plant 1 comes online, we'll be at neodymium iron boron performance levels, at around 1.4 Tesla.

Now, one of the other great properties of our materials is it's temperature stability. So, rare earth materials lose about 30 to 40% of their strength between room temperature and 150C. Especially, where a lot of EV drivetrain motors operate at that kind of temperature range, which is 120C to 150C. So, already our temperature performance levels are approaching similar to the neodymium boron magnets.

By the time our plant one comes online, we'll be exceeding that. So, temperature stability is very good; we're less dense, which means you've got lightweighting possibilities for the inside motors themselves.

Where magnets are a little bit different is in coercivity, which is the resistance to de-magnetism. We have more moderate coercivity and we need a very high level of coercivity. But that’s not a problem for us. We design motors all the time, and you just have to make sure when you design that motor that they're not exposed to higher levels of magnetic forces inside that motor. It's very easily obtainable to design your motor, so that doesn't happen.

So, while our customers are excited about the security supply of our material and performance, I would say more recently we've started to collaborate with them on designing different motor topologies. We recently announced a partnership with Stellantis, where we're developing variable flux motors for EV drivetrain, which essentially allows us to develop an efficient motor design. Iron nitride is the goldilocks material for variable flux designs where you can pulse the windings of the motor and basically change the magnetization of the magnets. So, for EVs, this is a great use case.

What we're showing our customers is the available flux designs can achieve 1 to 2 percentage point motor efficiency improvement over the drive cycle. That's very significant. And I would say our automotive OEM and tier-one customers are most excited about that at the moment here as we're designing these motors with them.

I recall reading a paper comparing the iron nitride-based magnets with the rare-earth-based magnets. It pointed out that typically the resistance to demagnetization is relatively higher in rare-earth-based magnets, and lower in the iron nitride-based magnets. While you can use external factors to ensure that the efficiency of the iron nitride-based magnets is not lost, what is the impact on the overall life cycle of these magnets and of the motors in which these are used?

It's not different to a neodymium iron boron-based motor. What is different, though, is the end-of-life treatment. For that motor, right now, you need to separate those magnets out of the waste stream and put the motor into the scrap iron waste stream and pull the magnets and put them elsewhere.

Meanwhile, [in motors] without magnets, you can just put them back in the iron waste stream. And what we'll do is pick that scrap iron again and be able to use that as a starting point of our process. So, right now our source of iron is iron salts, which is a byproduct of steel making. We use that of our sources of iron. But we're also a proven and good development capability here, which shows that we can take scrap iron in as part of our input raw material and use an electrochemical process to make those iron salts before we then precipitate out the first part in our process. So, we offer a pathway to true full circularity of magnets.

You probably had heard the phrase mine-to magnet. We are really more mine-to-motor.

So, we're doing actual work with our OEM and tier 1 partners to really design and get the best out of these magnets in those end-use applications. And that's what sets us apart. We're really a magnet company, while a lot of the Western players trying to get into making magnets are actually rare earth or mining companies.

So, I would say that we have the best magnets team in the West. We have a lot of magnet capability and that's what sets us apart. We're excited right now because we are designing these with customers and they're getting excited about the performance that they're seeing in those applications.

Given that the iron nitride-based magnets have poor thermal stability, can you elaborate on the challenges involved in large-scale manufacturing?

I can say that precise temperature control is an important facet of our manufacturing process. We're using industrially proven equipment to make our product. We have very large-scale, scalable processes on the front end of our process.

Our process is split into two parts. We make magnetic powder in the first part of the factory. It's more like a chemical plant, to be honest. What we’re doing is chemical synthesis or chemical work to produce iron nitride in the phase and form that we wanted. And in the second half of the plant, we take that pattern, we squish it into different shapes and sizes. It's much more of a discrete manufacturing model where we're making widgets, which are magnets with essentially different sizes and shapes.

In the front end, we're using scalable equipment, and we continue to go up the scale curve on that. On the back end of the plant, we're already using fully commercially sized equipment. We have two very large magnet alignment presses, which is the same way that rare earth magnets are made today.

Our process is a little bit different in the back end, but the squishing of the powder into different shapes and sizes is the same thing they do in rare earth magnets as well. So, we'll just have more of those presses in Plant 1. We've already proven our processes.

What's different here is we don't need to have the different steps in the rare earth value chain, where you dig it out of the ground, you crack it, you leach it, you separate the oxides, you make those oxides into metals with metallization, then you create the alloy, and then you create the magnet.

What we're doing is rolling all those activities, but for our material, under one roof. We're going from raw materials all the way through to finish the magnet under one roof in a few steps, not in five or six steps.

Given all the sophisticated manufacturing equipment and processes for iron nitride-based magnets, focused especially for electric cars, how are costs expected to play out when compared to the cost of traditional rare earth-based magnets?

At scale, we'll be competitive with those. I mean, we are born, raised and developed to compete head-on with the Chinese, even at their subsidized prices. And that's still the plan.

We've got to get to scale to be competitive. Our 10,000 metric ton factory is a world-scale magnet factory. If you look at magnet factories in China, they're typically between 8,000 and 15,000 metric tons. That's why we're working with the administration to accelerate that as much as possible.

But iron nitride is unique. It's got this very high magnetic performance, and then it's got these lower-cost inputs, iron and nitrogen. That's why we're the only alternative out there. There are others that have been looked at, but they don't have the combination of the two; either their magnetic performance isn't high enough or their raw material costs are too high. It needs to have both elements to be successful, and that's really what Niron has done; we've changed the game. We've done what the US does best. We've innovated out of the problem. We're not playing the Chinese at the same game.

That's the real challenge with the Western rare earth players is that they need to compete with 30 years of benefit or advantage and 90% market share they have to compete against. The Chinese continue to make it more difficult for them to be able to come online. And that’s not even then thinking about dysprosium and terbium, where China controls 99% of the supply chain. To make any magnet that's going to be used in an EV, it's got to have dysprosium and terbium in there today.

While it’s a desirable sweet spot when you have an emerging technology, which his increasingly getting validated by customers, prioritizing a specific customer or one industry may get challenging. This situation is similar to how the consumer electronics industry got prioritized during the infamous semiconductor crisis and the automotive industry suffered an unprecedented chip shortage. Do you discuss similar possibilities with your automotive clients or internally?

We have two ways that customers can get our attention, or we prioritize those customers: the first one is to invest in us, and you've seen a number of investments, especially in the automotive space right across OEMs and tier-ones.

The second way is by signing collaboration agreements, which is very important in our process to [launching] our first products in the market. We have a range of those collaboration agreements that far exceed what we need, and we'll continue working across all these end markets to develop these use cases.

The good news for us is that these end markets have different design cycles. So audio is going to ramp first, since it has the shortest design cycle. That will be followed by appliances and industrial motors, then into EVs, and finally into defense and wind turbines.

That's why we're engaged across all the end markets as we expect that they're going to ramp over a different time period. So, we are fully planning to accommodate that.

We expect to be fully sold out for the first five years, which is why we're working with the administration to try and find a way to overlap and to bring that capacity online even more quickly, instead of building these sequentially.

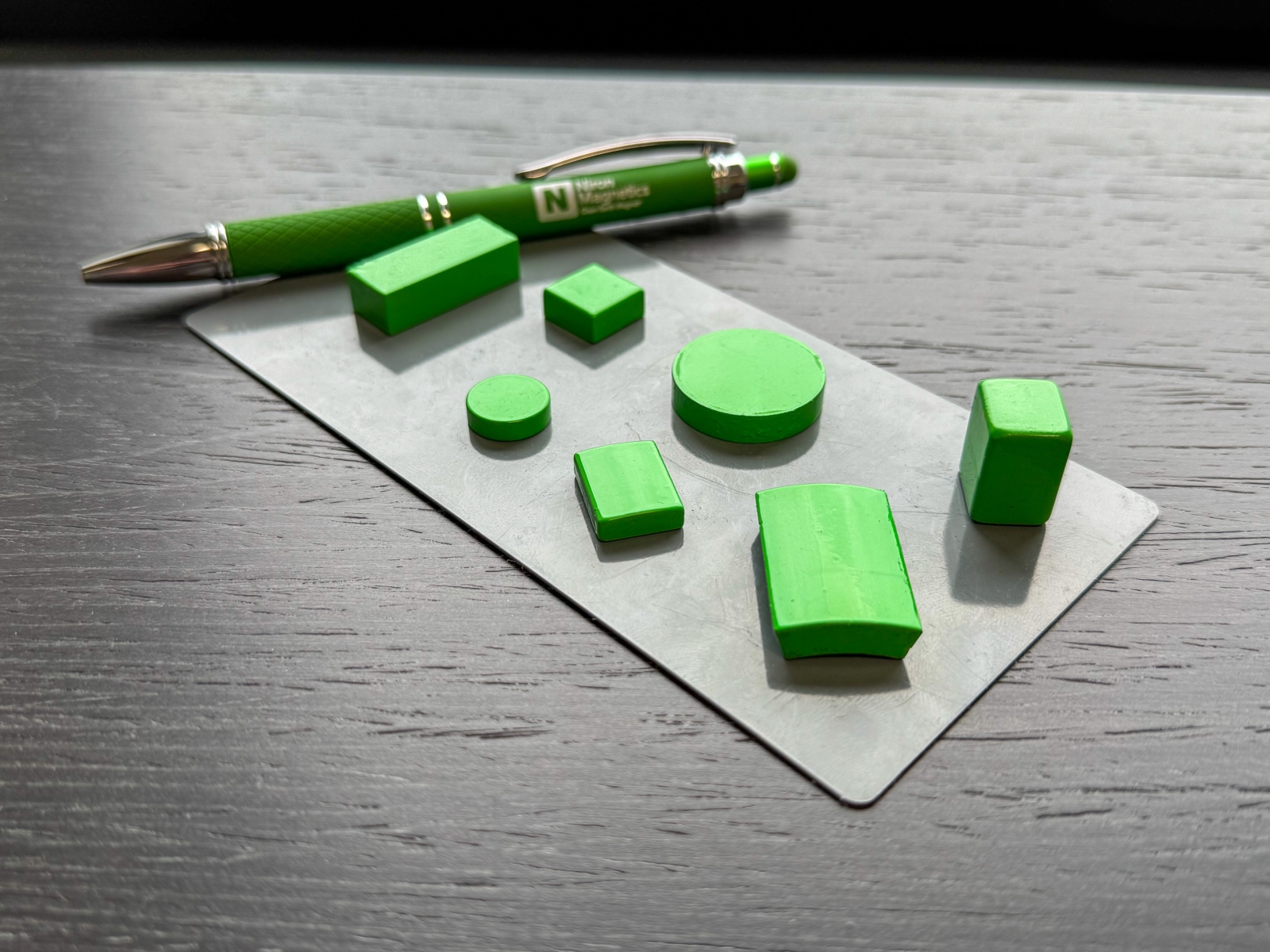

Different form factors of rare-earth free magnets produced by Niron Magnetics. Source: Niron Magnetics

What is the slice of automotive orders look like in your overall order book?

In terms of our collaboration agreements, it's a good chunk. I don't have the exact number, but it's probably in the 20 to 30% range.

To reiterate, Niron’s first automotive product will see market launch in 2026–27?

In consumer products, we expect market launch next year, but for automotive audio, I expect it will be the following year as we bring our Plant 1 online. We can do the engineering and design validation out of this facility, but for automotive and even for audio, we're going to have to do production validation out of Plant 1. That's going to take a few months to do when Plant 1 comes online. So, I anticipate that will happen for automotive audio applications in late 2027.

What are your top priorities in the near- to mid-term?

We are focused around designing and qualifying products end-to-end applications that will help us fill plant one. That’s our focus right now. That's why I mentioned audio and small-to-medium-sized motors across industrial and automotive at the same time.

We're working on more design-intensive applications like EV drivetrain, light wind turbines and light defense applications in parallel. But in the short-term, we are really focused around building those motors and getting feedback, sensors and speakers with customers and building our Plant 1.

Are you well-funded for setting up and beginning operations at plant one or will you be seeking some more funding anytime soon?

We are part funded for Plant 1, and we do anticipate doing another raise early next year. We're gearing up and preparing for that. There's a tremendous amount of investor interest we've seen, and a lot of appetite to deploy capital to solve the rare earth magnet crisis that we're in. But, we'll most likely be doing another raise to finish up the raise for Plant 1 and potentially even covering some of Plant 2.