Enedym’s switched reluctance motors (SRMs) are expected to not only reduce the dependence on rare earth metals, currently used in a majority of propulsion e-motors produced worldwide, but also significantly reduce the cost of development and production of e-motors in general.

Enedym is tackling one of the industry’s most pressing challenges: reducing reliance on rare earth elements (REEs), which are costly, environmentally taxing, and largely sourced from [mainland] China. Dr. Emadi explains how his team overcame longstanding technical barriers to develop advanced switched reluctance motors (SRMs) that match or surpass conventional permanent magnet motors in performance, but without the need for REEs.

Enedym’s innovation extends beyond motors to a proprietary AI-enabled design and rapid manufacturing platform, positioning the company to serve global markets from two-wheelers to passenger cars and commercial vehicles. Strategic partnerships in India and collaborations with major OEMs, including Honda, underline Enedym’s global ambitions and commitment to building sustainable supply chains. Following are the edited excerpts of an exclusive interview.

S&P Global Mobility: Please tell us about how Enedym came to life as a university spinoff. What went behind the scenes for Enedym to emerge as one of the key electric motor startups that is innovating to reduce the dependency on rare earth elements (REEs)?

Ali Emadi: I was at Illinois Institute of Technology … when in 2011, I was recruited at the Canada Excellence Research Chair in Hybrid Powertrains by McMaster University (Hamilton, Canada) and the Canadian government to drive research and innovation in the areas of electric motors and electrified vehicles.

Since 2011, I have been a professor and chairholder at McMaster University in Hamilton. We are about a 45-minute drive from Toronto and about a 3-hour drive from Detroit.

Ontario is the heart of the automotive industry in Canada. At McMaster University, we have built one of the largest university programs globally in transportation electrification over the past 14–15 years. We have a very large research group focused on electric motors, power electronics and transportation electrification, focusing across vehicle categories ranging from two-wheelers to cars and commercial vehicles.

One of the main focus areas for us at McMaster University has been electric motors. This is strategic as there are about 15 million electric motors manufactured worldwide every single day. It is a massive market. Anything that moves with electricity, at the heart of it, is an electric motor. The propulsion unit is the motor.

If you think about electric cars or hybrid electric cars, in a majority of them, the electric motors are the permanent magnet motors, and a majority of those permanent magnet motors need rare earth metals. We are talking about the rare earth metals like neodymium and dysprosium and other heavy rare earth metals. The problem here is that while they are expensive (accounting for 40% to 50% of the cost of the permanent magnet motor), a majority of these REEs come from (mainland) China. More than 80% of REE metal supply is from mainland China. They are either mined or processed or both in China.

While it’s not about just the mining, but also about processing, the processing of heavy rare earth metals is not a clean process at all.

So, we understood this long back, and since 2011, we have had a goal to basically develop switched reluctance motors or SRMs.

SRMs have been around for a few decades, but they have always suffered from some problems such as acoustic noise, torque quality and low power density, because of which they have not been able to compete with permanent magnet-based motors in terms of performance metrics.

I believe research groups around the world did not put in the necessary energy and resources into solving the problems of SRMs because effectively permanent magnets were not too expensive. Moreover, solving the problems that SRMs posed were not easy problems to solve.

At the McMaster Automotive Resource Centre (MARC), we have been focusing on SRMs as a reliable and efficient motor technology for over 14 years now. We went exceptionally deep into the science of solving the problems of SRMs, and we have, once and for all, solved those problems.

So now, we have developed tremendous technologies for SRMs that ensure that these motors are not noisy and can compete with the permanent magnet motors effectively in terms of power density and torque quality. The SRMs are reliable and offer a significantly low relative cost of production.

We established Enedym Inc. after many years of significant [research and development] and technology development at the university. Enedym officially began operations in 2018. It is a university spinoff, which means it is a private and independent entity. McMaster University has shares in it. So far, we have mostly received strategic investments from investors.

In addition to significant SRM technology, [intellectual property] on the motor and control software, we also have developed a very comprehensive digitization platform. It's a multi-objective, multidomain, multiphysics, AI-enabled design platform that allows us to design SRMs at a fraction of the time and cost than others.

So, we have a very wide IP portfolio, we design really fast, and we have a rapid prototyping and manufacturing facility; we call it FARM, which stands for “facility for advanced rapid manufacturing.” We can go after multiple markets. We have the IP, we design fast, we prototype fast, and when it comes to manufacturing, we plan to have these innovative electric motors manufactured by us in-house, some of them through joint ventures, and some of them through licensing arrangements. We are targeting electric two-wheelers, three-wheelers, small delivery vehicles, passenger cars, commercial vehicles and other vehicle categories.

India is a very strategic market for us. From the beginning, we have been deliberately focusing on India. We have an existing partnership with Napino Auto, which is also a strategic investor in Enedym. We have a licensing agreement together, and it's for powering specific electric two-wheelers. We have another licensing agreement with Sona Comstar from India. We are very pleased with our partnership with both entities.

We are also talking to and collaborating with other companies in India. We plan to set up a ‘GigaFARM’ facility (electric motor development and manufacturing plant) in India, and we are currently looking for local partners. I cannot disclose more about it. That said, over the next five to seven years, we expect to be doing a lot of manufacturing in India. What we will manufacture there will also be exported to other markets worldwide. This is also strategic for India to reduce the dependency on permanent magnets coming from mainland China.

Please tell us more about this advanced manufacturing plant for SRMs that Enedym is planning to build in India.

We have a licensing deal with Napino Auto and Sona Comstar. The manufacturing frameworks under those licenses are defined. I'm talking about a separate Enedym ‘GigaFARM’ in India. This will focus on electric motors for applications that are not covered in the other two defined agreements (with Napino and Sona Comstar).

We are currently in discussions with potential partners for this planned e-motor manufacturing plant in India. We are looking at e-motors (SRMs) for automotive, passenger cars, industrial vehicles, commercial vehicles and some other applications.

When you say that your intent was to basically remove the rare earth content in making electric motors, so why choose SRMs? You could have also picked up induction motors because they also do not use rare earth magnets. What defined your preference for doing research and development on SRMs?

We chose SRMs because they have the simplest and lowest cost motor configurations, in comparisons to other motor types. In a motor drive system, there is an electric motor itself, power electronics/semiconductors and control software.

In my view, the best motor system is where you have the simplest and lowest cost hardware and electromechanical system, and you shift the complexity from the motor to the software and controls.

Our SRM motors are simple, offer lowest cost, and are easiest-to-manufacture motors. In comparison, the induction motors and other form factors are not as simple.

Electronics for SRMs with especially wide band gap (WBG) devices such as the silicon carbide devices make power electronics more efficient and lower cost as well. Our control systems and software are complex though.

Therefore, the reason why we chose SRM is that this is the toughest motor to crack in terms of reducing the acoustic noise and increasing power density, but it's the simplest one. Remember, in 2011 we had resources, and I had an 8-year runway and a very large research group. So, we decided to go after the most difficult but most rewarding e-motor technology.

Now that we have taken our time in developing the technology and the software digitization platform, we plan to empower several industries, where we’ll do licensing arrangements, joint ventures and manufacture ourselves too.

Enedym's rare-earth free switched reluctance motor. Source: Enedym Inc.

On your website, I came across the design concepts of interior magnet (IPM) motors, where you claim that your designs can reduce the amount of rare earths in IPM motors. Please tell us about that. Was it an industry project for which you developed those designs that can reduce the rare earth content in IPM motors?

I wear two hats — I'm a university professor at McMaster University, and there I have a very large research group, which is very applied and industry oriented. We don't do anything for the sake of research. The research projects are either worked upon for early commercialization or we have industrial sponsors. So, that's the university piece.

Meanwhile, at Enedym, we are focused on SRMs and digitization.

At the university, we have several large industry-sponsored projects, where we are designing multiple motors, and we work closely with the [original equipment manufacturers]. These are more Western OEMs with whom we have worked, with some of the products we jointly developed in volume production. Under this arrangement, we push the innovation across all kinds of e-motors. Here, the overarching goal is to continue improving the performance while reducing the rare earth content and the costs of e-motors. For example, we have worked with one OEM where we have reduced the heavy rare earth content significantly in their motor design, and they really appreciate us for those efforts.

That’s a great example. Can you please give us a percentage by how much the team under you managed to reduce the rare earth content?

We have reduced the REE content by up to 60% to 70%. This is huge for an IPM motor used in a vehicle. I know a lot of companies developing electric motors, but they design electric motors in conventional ways. They are not fully using the advanced computational power of optimization because when you prepare a motor design, you work on electromagnetic, thermal, noise, vibration, harshness, mechanical, control, semiconductors, electronics and software.

What I’ve seen is that companies usually don't develop many new motor designs. They do very few and stay with them for multiple applications. They do so because they cannot afford to develop new designs, again because they cannot afford to have many top-notch engineers in so many different fields. We have digitized that. So, our design optimization capabilities are mind boggling. For IPM motors, we have done a lot of different magnets. We have also done induction motors, six-phase motors, multiphase motors, multilevel converters for them and axial flux motors.

Can you tell us which vehicle manufacturer did your team work for to reduce the rare earth content by 60%?

I’d like to avoid mentioning specific names, but at McMaster University in different projects, we have been working with Stellantis, GM, Ford, BorgWarner, Dana, Schaeffler, Eaton and several others. We work with many major OEMs and tier 1 suppliers on electrified vehicles and powertrains engineering.

Can you please tell us about Enedym’s engagement with Honda? What is the kind of conversation you had with the executives at Honda? What's the broad timeline of deploying SRMs into the Honda EVs?

One of the strategic investors in Enedym is JFE Shoji. JFE is a Japanese company. JFE Steel is part of them; it supplies electrical steel, and JFE Shoji supplies stamped parts. As you know, electric steel is used in producing components for the electric motor such as the rotor core and the stator core.

JFE Shoji invested in Enedym in 2021 as a strategic investment. They have a massive footprint in North America. They have a big facility near ours here in Ontario, Canada. JFE already is a big supplier of electrical steel and motor core to car companies and tier 1 suppliers. They introduced us to Honda three to four years ago when our discussions with Honda began.

Japanese companies — whether it is an OEM or a supplier — they are exceptionally methodical. They look at every aspect of the product design and development before making any investment. The amount of due diligence that they have done in Enedym, I don’t think that any venture capital would do that. So, the fact that they have invested in Enedym tells a lot.

We have been working on product development. I cannot talk about those activities. That started way before this investment was announced. While a lot of companies are interested in Enedym, why Honda is strategic for us is because Honda has a vast product portfolio, ranging from micromobility, two-and four-wheelers, lawnmowers, marine engines, jets and robotics. I think Honda is one of the largest internal combustion engine (ICE) manufacturers in the world in terms of absolute volume. In my view, Japanese OEMs understand this rare earth problem better than most.

We absolutely love working with the Honda team, they have been truly amazing. That said, we are also in several stages of ongoing discussions with several other OEMs.

While you’re currently operating out of the R&D and pilot facility in Canada, can you elaborate on the expansion plans for Enedym?

Enedym headquarters and offices are next to the MARC and R&D facilities at the McMaster Innovation Park in Hamilton. The current manufacturing facility that we have is called Enedym FARM (facility for advanced rapid manufacturing). The capacity at this facility is a few thousand units per annum. We plan to expand our operations within the next 18 to 24 months to about 10,000 units per annum. This will include production of up to 25 different motors. This volume will be dedicated to our pilot runs and applications that are not higher volume yet.

We are planning to build a ‘GigaFARM’ (e-motor production plant) in Hamilton. I cannot share more details about it at the moment. We are also planning to build a ‘GigaFARM’ in India as well, but I won’t be able to disclose any timeline for it. But we do plan to execute these two facilities over the next few years.

In parallel, the licensing that we have provided to our partners is moving forward. In addition, we are also looking at forming joint ventures (JVs) with companies willing to strategically invest in our technologies.

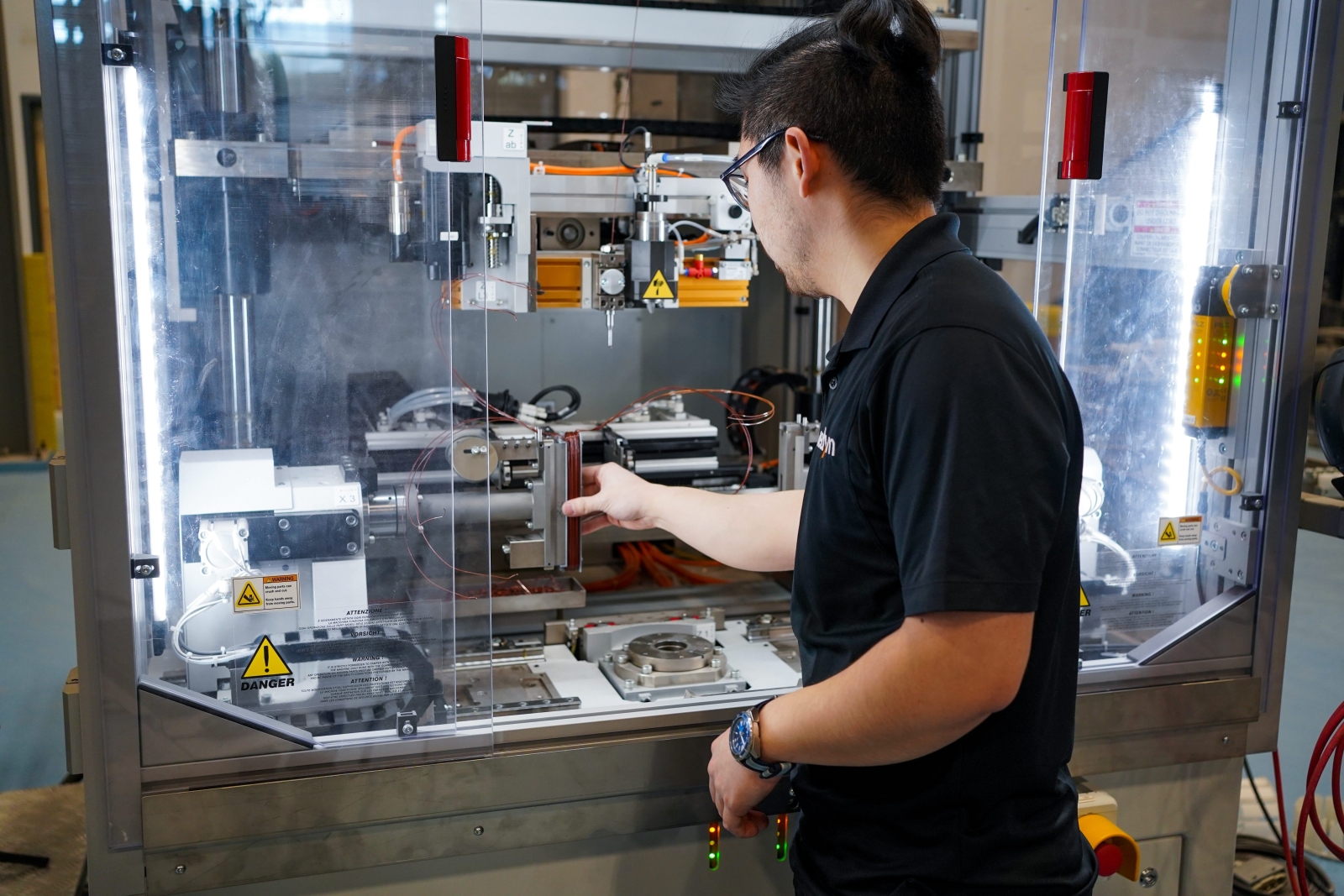

Enedym's pilot manufacturing facility in Hamilton, Ontario, Canada. Source: Enedym Inc.

What will be your strategy on motor subcomponents such as stators and rotors? While for the licensing arrangements and planned JVs, the sourcing strategy for subcomponents would depend on a case-to-case basis, for your in-house production plans when you try and scale up in the future, are you looking to source stators and rotors, or would you want to produce key motor components on your own?

Our main partner for stator and rotor cores is JFE Shoji. We work with them very closely. They are involved in our current plans, and if not directly through them, through their partners. So that's for the motor cores.

For motor winding, we have an amazing relationship with Marsilli. They are a motor winding equipment manufacturer. We use their equipment to produce our motor windings.

For power electronics, we have very strong links with the top semiconductor companies. For printed circuit boards (PCBs), we have some partners, and we are in the process of forming more partnerships. In the software and control area, it is 100% developed in-house by Enedym. That's an extremely important area for us.

Is Enedym well-funded at the moment or are you looking to raise funds to execute your scale-up plans?

When it comes to finances, we are extremely disciplined. So, we are well-funded right now. For the current FARM and the expansion of FARM projects, we are all set.

For our activities in Canada, we are well-supported by the government of Canada. For our ‘GigaFARMs’ (motor manufacturing plants) in Canada and India, our approach is to secure more strategic partnerships and OEM customers.

When you have a big OEM already wanting to work with you, then financing the factory becomes a lot easier. Conventionally, we explore government opportunities. We are very familiar with them here in Canada. We need to do a lot more in India, and we have great collaborators there. However, the bulk of those tasks will be carried out by our strategic partners, which could be a major OEM or a tier 1 or a tier 2 supplier.

I believe building an ecosystem is important. This is something I see a lot of VC-backed start-ups lack. They usually don't go deep on building the entire ecosystem with multiple strategic partners and instead focus more on financial investors and having an exit sooner. We are not into this to have an exit or make an IPO soon.

Scaling up is a critical process and startups often lose their core focus while managing several stakeholders involved in scaling up operations. How do you look at this phase while maintaining your sharp focus on product development? Can you also share Enedym’s technology roadmap for the future?

We have tremendous IPs because we took time to build them; we spent a lot of resources. Probably, we are commercializing only 10% to 20% of the IPs that we have. We plan to go a long distance. You have a very valid point, but how do we address that? We have a dedicated team at Enedym, and they keep their focus only on the new innovation and product development. The idea is to ensure that those innovations at Enedym are a lot more practical in terms of ability to scale up across various industries.

Let me share an example of our approach. We have our motor in a Cadillac Lyriq at MARC led by the EcoCAR team at McMaster University. We have also used our e-motors in Toyota and other tow tractors. I believe it is important that our advanced team develops a novel control now on top of what we have, and we go and apply that to both.

Enedym also sponsors a few projects at McMaster University. For example, we have a project that is focused on power electronics, another one on advanced controls. So, we keep investing in core R&D projects.

That said, we are continuing to innovate to ensure our long-term competitiveness. It’s great that the interest of our investors is aligned with ours. What we are doing with JFE Shoji on motor cores is an interesting example. While I cannot disclose more details, I can say that we are trying to push the benchmarks. Further, they cater to a number of industries and therefore the ecosystem of a strategic private sector is a great opportunity.

The image above depicts an ongoing e-motor testing and calibration process at Enedym's pilot facility in Hamilton, Canada. Source: Enedym Inc.

How do you see the imposition of tariffs and trade barriers amid rising geopolitical tensions between the US and other big economies?

At Enedym, we are apolitical. Our focus is deep tech and innovation. We believe solid technical innovations are the answers to many of our existing problems.

I would argue for North America, especially the US, there is a lot of interest in doing rare earth mining and magnet processing. These processes are expensive, they are long term. However, I would advocate for a little bit more focus on the alternative technologies that's actually a very competitive edge for North America. Moreover, at the end of the day, if we reduce dependency on rare earth metals, it's good for the environment too. Innovation and production of rare earth free products and technologies can help in creating new jobs in India, Canada and the US. So, we are focused on what we can do and what we can control.

What kind of technology evolution do you see in electric motors 10 years from now? Do you expect extremely lightweight, small-sized motors to take the center stage? Do you see electric vehicles use more of SRMs than IPMs, given the latter’s dependency on rare earth elements?

The biggest evolution I can see is that the dependency on heavy rare earth metals will reduce significantly. I am not saying that everyone will use a REE-free motor in the future, but surely the dependency would dramatically reduce because the world just cannot sustain providing rare earth metals. So, that's one key trend. In this trend, I can see that SRMs have a great opportunity.

That said, interior permanent magnet-based motors or IPMs with lower heavy rare earth metal content is another form factor that I expect will pick up going forward.

The second big trend is the need to reduce costs. I think companies are currently chasing power density, weight reduction, among other key parameters but once the reality sets in, lower cost will take precedence over most other points.

Then I also see integration of subcomponents in propulsion systems such as motors and power electronics. A subset of this trend will include integration of motor and inverter via X-in-1, which stands for 3-in-1, 4-in-1 and other forms of integrating several components in an integrated unit.

I also expect a trend on the utilization of next generation semiconductors in power electronics. This will take precedence among the OEMs. For example, I am not suggesting that everyone will start using silicon carbide or gallium nitride; instead, I am suggesting the practical aspects of hybrid switches for lower costs. To say, can I get the advantage of silicon carbide without paying the full cost of it?

Lastly, I believe digitization and AI will continue to be a very important priority area for all OEMs. The companies need to be able to design better and faster, and this is possible using artificial intelligence and state-of-the-art digitization techniques. This anticipated trend is in line with our own digitization platform at Enedym. Let me also add, we at Enedym and McMaster University are working on innovations around each of these trends.