The Chinese vehicle market grew in September on a month-on-month basis but sales were down 1.8% year-on-year (y/y). The CAAM has stated that there were three main reasons for the y/y sales decline in September. First, the escalating tensions between Japan and China regarding ownership of the uninhabited but mineral-rich Diaoyu Islands in the East China Seas have led to rising nationalist sentiment in China. This resulted in riots in September and led to a sudden drop in demand for Japanese-brand vehicles, which dampened overall sales during the month. Japanese brands' sales dropped 29% y/y in September, the CAAM states.

The sudden drop in Japanese OEM brand sales in the country has hit Japanese automotive parts suppliers in China. In the immediate aftermath of the riots in China last month, Japanese automakers have seen plummeting sales and have reduced production as suppliers adjust production at their Chinese plants. The Nikkei reports that Topre Corp, which makes car bodies, has cut production at its plant in Foshan in Guangdong province by half. Meanwhile, transmission parts-maker Musashi Seimitsu has reduced the number of hours of production per day at its plant in Guangdong province.

IHS Automotive contacted auto-parts supplier Denso and spokesperson Goro Kanemaso said, "We are adjusting our production based on our customers' production." Denso has plants across China in which it will adjust production accordingly. Despite Denso having expanded its customer base beyond just Japanese OEMs, its major customers are still Japanese automakers. In China, Denso's customers include Guangzhou Toyota, FAW Toyota, Guangzhou Honda Automobile, Dongfeng Honda, Shanghai GM, and Changan Ford.

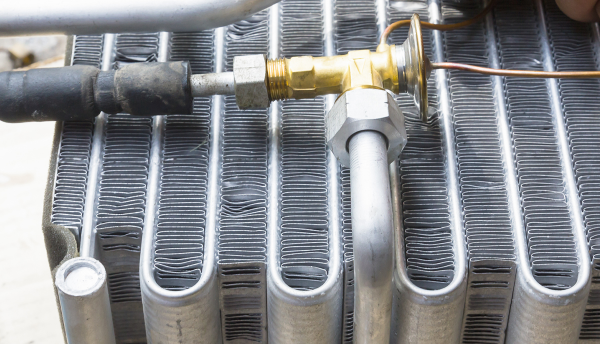

Japanese auto-parts suppliers in the southern Chinese province of Guangdong will likely be the hardest hit from the sudden drop in production as the province is a hub of Japanese-brand vehicle production plants. Many Japanese parts suppliers in the region solely rely on orders from Japanese automakers. With Toyota expected to reduce production by half in October 2012, its suppliers are immediately affected. The Nikkei reports that Japanese auto-parts suppliers have more than 440 production bases in China, mainly for supplying Japanese automakers. In 2011 Japanese suppliers were hit by supply chain disruptions due to the tsunami and earthquake of March that year, prompting many suppliers to accelerate plans to expand in China to limit future supply chain disruptions, but the situation this year will again affect these Japanese suppliers. In 2011 Denso, for example, expanded and relocated an HVAC plant in Guangzhou in China's Guangdong province. Japanese supplier Toro has recently decided to reconsider its Chinese expansion.

Market expectations

The sudden decline in Japanese brands' sales in the Chinese passenger vehicle market has seriously dented overall market growth this year. The political tension between Japan and China regarding ownership of the Diaoyu Islands resulted in riots in China last month targeting Japanese-brand goods and in particular Japanese-brand vehicles. The result was that Japanese automakers suddenly stopped production and closed their plants in late September, resulting in a dramatic drop in production and darkening the outlook for the months to come. Japanese OEMs have now reopened their plants following the week-long National Day holiday in China that lasted from 1 to 7 October, but all are running limited operations as inventories at dealerships pile up.

IHS Automotive forecasts that Japanese automakers will lose around 20% of their annual sales in China this year, but it is difficult to predict how fast other automakers will be able to steal their lost market share. Hyundai, for example, has already ramped up its production capacity in China and has expanded production of its best-selling Elantra model to 20,000 units per month from 15,000. However, German and US brands are most likely to benefit from the woes of the Japanese brands thanks to their better positioning in China in terms of brand awareness. Thus the passenger vehicle segment is still forecast to see sales growth this year of around 7% as the market share lost by the Japanese OEMs is likely to be taken up by the likes of Volkswagen (VW) and General Motors (GM), says Lin Huaibin, IHS Automotive's China light-vehicle sales forecast manager. Ford and South Korean automakers Hyundai and Kia are also strengthening their brand images and product line-ups in China and they too will take some of the sales lost by the Japanese OEMs.

It is less easy for production levels at plants to suddenly be increased and this may result in some lost output in China in the coming months. In order to produce models OEMs need to finalise their component volumes well in advance so that their tier-one suppliers and the entire supply chain can adjust accordingly. The tensions between Japan and China have only recently escalated and the sudden reduction in production by Japanese cannot necessarily be offset by increased volume production at other OEMs.

In 2011 automakers ramped up production in China, specifically Japanese automakers, which had seen dramatic parts shortages hampering production levels in China as a result of the tsunami and earthquake that hit Japan in March last year, causing damage to a long list of suppliers and therefore disrupting Japanese OEMs' supply chain. This high base of comparison is one reason why production and sales in September suffered a y/y decline. All Japanese OEMs reported lower sales in September and suppliers to these automakers are now looking at their production levels and adjusting them in line with the reduced demand.