- Traditionally, financing EV charging equipment has been difficult and an entry barrier for small businesses. XCharge plans to address this with its new financing program.

- XCharge’s leasing program aims to significantly cut the upfront installation costs of a DC charger, thereby helping to preserve much-needed cash flows for businesses.

- Sustained subsidies can often hurt, not help, businesses in the mid-to-long term.

- Tariffs applied on a product hurt everyone in the supply chain.

- Implementation of bidirectional charging technology on a wide scale will introduce many challenges including defining remuneration processes and consumer preferences, among other factors.

Patel and Urist discuss a wide range of topics including a new financing program aimed at making EV charging equipment more accessible for small businesses, reducing entry barriers for businesses to get into EV charging space, steering the business amid market headwinds, volatile policy environment and import tariffs. The following contains edited excerpts from the conversation:

S&P Global Mobility: Please tell us about the new financing program launched by XCharge North America in association with Ascentium Capital. We understand that setting up an electric vehicle charging facility is capital intensive with upfront costs and a lot of charge point operators (CPOs) are under pressure to generate appropriate returns, especially at a time when demand for battery-electric vehicles (BEVs) is slowing. How does your financing scheme work to make charging equipment more affordable for small businesses?

Aatish Patel: Basically, EV charging for the past three to five years has been heavily driven by government subsidies. These incentives have allowed people to take the plunge, investing into EV charging equipment and becoming hosts, among offering other services.

With the recent changes in administration and the strategy, all that has started to wither away. The incentives offered by the US government over the past two to three years really pushed EV sales, and that had a subsequent impact on the growth of EV charging infrastructure. With the consumer tax credits recently expiring (as of Sept. 30, 2025), basically every automaker saw record EV sales in the US across the board as people wanted to take advantage of these credits before they lapsed.

For all the BEVs plying on the roads, there is a need for a reliable EV charging infrastructure, and setting one is a significant investment. There is no set structure to encourage people to become hosts (of EV charging facilities) and become part of this growing market opportunity.

That said, traditionally, financing EV charging equipment has always been difficult, and small businesses find it very hard to enter this space. When you look at it from an economic standpoint, this is due to the lack of easy and straightforward financing.

Usually, entrepreneurs turn to the US Small Business Administration’s suite of programs to support in starting and building businesses. However, obtaining adequate funding for EV charging equipment is challenging because it is seen as an upcoming technology still gaining legitimacy, making it difficult for underwriters to understand the inherent risks of this asset class.

Alex [Urist] and I have been working over the past few months to gather the economics of the [EV charging] business. We are not only trying to justify it from a risk standpoint but also working with a group of lenders to basically get them to understand that this is actually a viable business to finance. From a credit risk standpoint, when you actually structure the deals of this kind, it is no different than the typical equipment financing or other ancillary financing schemes and that is what led us to the rollout of this leasing and financing program with Ascentium. This program aims to allow people, who can be a hotel owner, a coffee shop owner, a real estate operator to put EV chargers in their facility at a very reasonable rate. We are starting with deals from $800 a month and at that monthly value, considering the projections we are genuinely seeing with capacity utilization, it makes economic case to go forward with this investment when you factor in the monthly cost from an operating expenditure or expense (OPEX) standpoint, and the potential income-revenue generation, even on a very conservative basis.

We are rolling out this program from an original equipment manufacturer level so that the consumers/applicants do not have to go through hoops and hurdles to figure out financing.

Earlier, if someone were interested in purchasing our EV charging equipment, they would have to go through their own bank or find a bank who would want to finance this. The process itself is a long and tedious journey; not a lot of people understand the business, and that is the immediate barrier to enter the EV charging space. With our financing initiative, we have removed the barrier by making the process internal and having a white-labeled solution, similar to leasing a car. You do not need to go to a separate bank or entity to get a car lease through BMW or Tesla or any other automaker. It is all done at a one-stop shop at the dealership or through the OEM, making the process quite simple and making the approvals very easy.

In this leasing program, which party gets the ownership of the charging equipment that goes on lease?

Urist: The ownership goes to the financing facility. So, in this case, Ascentium would be the owner of the asset, and then they are leasing that out to the end customer.

What is the duration of these leasing programs? The EV charging equipment would see a lot of wear and tear through period, so what happens to it once the leasing ends?

Patel: Our current leasing structure involves terms of up to six years. The programs usually last between three to six years. Within this term, there are service and maintenance requirements, which are also factored into the cost of the lease.

So, for the lessee of our EV charging equipment, they will have maintenance and other services integrated into the leasing program to ensure that at the end of the duration of the program, the asset is in good state and in compliance. The lessee could also buy out the assets after the term ends or walk away from the lease.

However, it is important to note that our leasing program offers just the charging equipment or a program that also includes installation. This is because some people may prefer to just lease the charging equipment and oversee the installation on their own. Meanwhile, some people would like to finance everything altogether.

We rate the life of our charging equipment for 10 years. So, at the end of the six year term, there is still enough life left in the equipment to operate well. That said, we include the maintenance services, which ensures that the equipment remains in good operating health and order by the end of the term.

You mentioned about leases starting from $800 a month. Tell us more about that. Does this amount include installation? Is this on a per charger basis? Are we talking about an AC or a DC charger here?

Patel: Yes, that is for one DC charger but without installation. The package includes full maintenance for the six-year term.

To better understand how this program aims to cut the upfront cost of setting up a DC fast charging facility, can we compare this starting price of leasing a DC charger with the upfront cost of buying and installing a DC charger?

Patel: This is a good method for people who are trying to set up one to three DC chargers, I would say. If you are trying to set up a facility with seven or eight or more DC chargers, then usually utility coordination is needed because of the amount of power the facility will consume. So, let’s work out an example of one to three DC chargers.

A typical DC charging installation, we value our C6 equipment at an MSRP [manufacturer’s suggested retail price] of$65,000. Some of our more expensive products range from $100,000 to $225,000, depending upon the product capability and applications. On top of that, there are installation charges, which vary quite a bit from site to site; it is probably going to be $25,000 between installation and permitting work. So, adding that all together, you are looking at probably $90,000 to $100,000 of outright cost to get a DC charger set up and off the ground.

XCharge NA's EV charger range. Source: XCharge North America.

The CPOs are finding it particularly challenging to balance out unit economics amid high energy costs. Then there is pressure to integrate renewable energy in the charging mechanism. There is a lot of consolidation in the EV charging space because businesses are finding it very hard to make enough money. While this is a timely initiative, bigger challenges persist on a wider scale. What is your perspective on these market dynamics? Also, please tell us if you are increasingly talking to your customers, reaching out to the CPOs, or potential hosts of EV charging facilities.

Patel: Yes, we are reaching out. The EV charging equipment is not just an independent product, it is a product that can be used for a lot of different charging use cases. The financing scheme ultimately aims to help preserve cash flow in the company to allow for more efficient use of dollars in other areas.

The rates on these products are quite reasonable at market. For the independence, this model allows for an easy market entry by reducing the upfront cost barrier. For some of our fleet customers, or our CPO customers, this leasing model will allow them to preserve cash flow or preserve cash in hand and extend their operating leverage for their businesses, which rely on the operation of these assets.

Financing, in general, for EV charging equipment has been a challenge over the past few years because of the nature of the asset and BEV uptake. It is something that has affected a lot of hosts such as hotel owners, gas station owners and CPOs. It has also affected fleet operators who need EV chargers for electric fleets. The leasing model will allow people and entities to get in without having to jump through too many hoops and barriers.

For a property owner, financing is not necessarily going to be based off their usage [of EV charging equipment], it is going to be based off their financials, their history, the property and the business that will ultimately be the lessee of these assets.

For a CPO, it is going to be a business review criterion. It is also going to be their operations in terms of what they do in the field and their utilization rates, among other parameters. So, from an underwriting perspective, it also helps them there. We are seeing interest across the board.

The recently introduced US tax and spending bill (also referred to as the One Big Beautiful Bill Act) that canceled the consumer credits for buying EVs in the US, is expected to hurt BEV demand, which in-turn is not good news for EV charging facilities in terms of capacity utilization. Also, National Electric Vehicle Infrastructure (NEVI) funds for EV charging infrastructure were frozen until the courts intervened. How do you assess such a volatile policy environment? What approach do emerging businesses take to steer through these headwinds?

Patel: The way we have oriented the business for North America, it is designed to target the areas of opportunity with or without subsidies, and that is how we are continuing to do business. Subsidies, in our opinion, are good for spurring an activity. However, sustained subsidies often hurt more than help, especially when you look at it from the economic and efficiency standpoint associated with the industry being subsidized.

So, our pathway has always been to target those that do not rely much on subsidies, because, frankly speaking, the subsidies we have seen that have come and go over the past few years were quite targeted. To be honest, these subsidies did not make sense for many people who want charging. What that meant was we had to do a little bit more work with our customers to explain the process and walk around the subsidy discussion. It is also about maturity. We have grown our business 100% without subsidy involvement. We have never sold an EV charger that is NEVI-compliant or has been used in the NEVI project. We have never gone through various subsidy programs to get our chargers pushed, and it is not a way we have oriented ourselves in the market. We have positioned ourselves as a company that makes innovative products that are reliable, can be utilized for your charging needs, and has a service backing that can ensure that it stays that way for the long run. That is where we have been able to plant our seed and succeed. With our leasing program, we are continuing to push down that path innovatively, finding new ways to get to more people. We are not trying to differentiate ourselves through the acquisition of entities that may or may not be here or may not be achievable.

Fundamentally, it does not change the way we do our business. It is not an easy business. We still have to work hard to actively seek and acquire customers while educating landowners and potential hosts about the benefits of installing EV chargers for public use.

If we look at all the developments from a bird’s eye view, it is clear that we will see increasingly more EVs plying on the roads. If anything, there will be more EVs adoption, which will warrant the necessity of a robust EV charging infrastructure.

Our whole purpose as a company has been to provide EV chargers in a manner that allows for installation, usage or economic viability by hosting them. This means providing innovative solutions, which may not be the fasted charger in the world but a charger that can be easily installed and operated.

We have batteries now that dramatically reduce the complexities associated with the installation process for DC chargers, as well as reduce the operating expense (OPEX) associated with the charging business. The charging solutions that got us here, such as the C6 on the 208-V architecture that is a cornerstone of what makes us different. To this day, we still do not have any real competitors in that space, and it is something that you can also lease now for a very agreeable price. It will be easy to install the C6 at a property without having to jump through the same hoops you would to install a Tesla supercharger or another competing product because you are able to utilize the existing power at a site, instead of setting up a new meter for your charging devices. Therefore, your OPEX is also much more agreeable because you are pooling the demand, you are not having a separate meter and a separate service with its own demand curve. It is all consolidated into an already existing meter, which makes it a lot easier to digest and blend the cost with what you are already using.

So, essentially it does not change much for our operations, apart from the need to have a new tool to make the proposition more attractive, which the leasing program delivers. We will probably work to educate the customer to rely not on subsidies but on business fundamentals because hosting an EV charger is a business. There is a profit and could be a loss, and you must manage it. Subsidies may help for the initial years only, but if you are trying to build a long-term business in this space, you cannot be reliant on subsidies to achieve profitability.

Urist: That is exactly what I want to double tap on. I think setting up five to 10 EV chargers or more and building up such charging hubs to deliver the future of electrification in the US is what is inhibiting us from widespread adoption in some ways. When we think about building charging facilities or hubs with five to 10 or more chargers in one location, that is a single need-based approach to EV charging.

But what makes the most sense and what we are able to deliver as a solution with this new financing program is the ability for landowners to come in and have one or two EV chargers in a location, with much lower cost of capital, a much longer tail of revenue generation, with a more sensible business model (as far as a lower average charge per day) to break even or even turn a profit. And it is diversifying that risk across a portfolio of assets, as opposed to that being concentrated on one mega hub. If one day a third of your chargers [at a charging hub] is out because of some technical outage, or if you have power issues that shut down your hub for a day — one bad day is going to set your [business] model awry for the coming weeks to months. Whereas in a smaller set up, one bad day will not involve such huge risks and therefore makes for a more sensible business model.

The One Big Beautiful Bill Act will certainly have an impact as far as EV adoption rates go, but just to reinforce what Aatish was saying, in the long term, EV chargers make money, EV charging will grow, and EV adoption will grow in the future. This will be primarily driven by fleet operators as initial adopters, followed by rental fleets for travelers that are starting to test EVs. Once the second adoption curve hits, local transportation will begin to support EVs too, especially those that are in communities and that support the understanding the benefits of smaller charging facilities with one or two charger installations as opposed to large hubs. Once a charger is installed at a barbershop or café, EV owners will recognize that their regular hangout offers a consistent charging option, encouraging them to return.

XCharge's GridLink chargers. Source: XCharge North America.

When we last spoke, you were working to align with Buy America, Build America (BABA) requirements for your EV chargers. Can you provide an update on that, especially considering recent import tariffs implemented by the US administration?

Patel: Yes, we explored BABA requirements and compliant products. We spent a lot of time and energy on it but decided to put that on hold late last year because of the geopolitical instability we were seeing. We also made this decision because made-in-America products would have higher costs with very different economics associated with it. If there is no subsidy or support toward the product, does it really make sense to endure the overhead?

Many companies in the space went full-bore on the subsidy accommodation with the Made-in-America and Buy America acts, and they are struggling now. They have products that are quite expensive, and it is exacerbated by additional import tariffs associated with their components.

Tariffs applied on the product are going to hurt not just the people making them in Mainland China or in Europe but everyone in the supply chain.

Making the product here makes sense only if there is a supply chain to support it. However, with EV chargers, there is still no supply chain to support it, and most of the critical components are still reliant on importation, which is going to be subject to tariff.

So, we are still producing overseas. We have set up additional contract manufacturing in other regions in Asia-Pacific, to help mitigate the effects of tariffs. We have also had to increase pricing and absorb some of it, and we are taking a hit in margin to make sure things are still in line with market and are reasonable. However, essentially, tariffs have increased costs, and that is not a shocker. That is partially why we have gone down the route of getting the financing in place.

What is the technology roadmap for XCharge North America in the mid-term?

Patel: We are continuing to invest in charging solutions. I think innovation for us is really going to be oriented toward batteries. We are starting to make the foray into the battery space with products like our Gridlink, and we are seeing strong interest there. Further, we are working to find ways to incorporate [battery] energy storage systems (BESS) into EV charging, and we will continue in that direction.

Also, it is an investment in just making things more fluid, easier to use and install. We are concentrating our innovations around the ease of deploy-ability or ease of use in the infrastructure.

We are continuing to work toward the development of the 208 products [208-V chargers] and expanding that across the product line. We are exploring ways to further improve the reliability of the product by simplifying things from a core technology standpoint and the power modules among other areas.

We are also starting to work closer with some of the existing alternative players in the market, like third-party software or payment systems to address the issues that continue to plague the market.

So, we are going to be focused on refining products and features and improving reliability. On pushing the technology envelope, we are taking the feedback on the batteries that we are deploying.

Urist: As far as innovation goes, it seems simple, but after sales and service innovation, we are making sure that we commit to quality and uptime for chargers that are already deployed.

There are plenty of companies not taking the same approach or committing to ensuring that the EV chargers are functional, or not keeping the lines efficient, and that is causing many issues with uptime and reliability across the board. So, maintaining aftersales and service innovation remains significant as we move into the future; as long as we have new iterations of chargers and we have new batches and versions of chargers going out, we will continue to support those for customers into the long term.

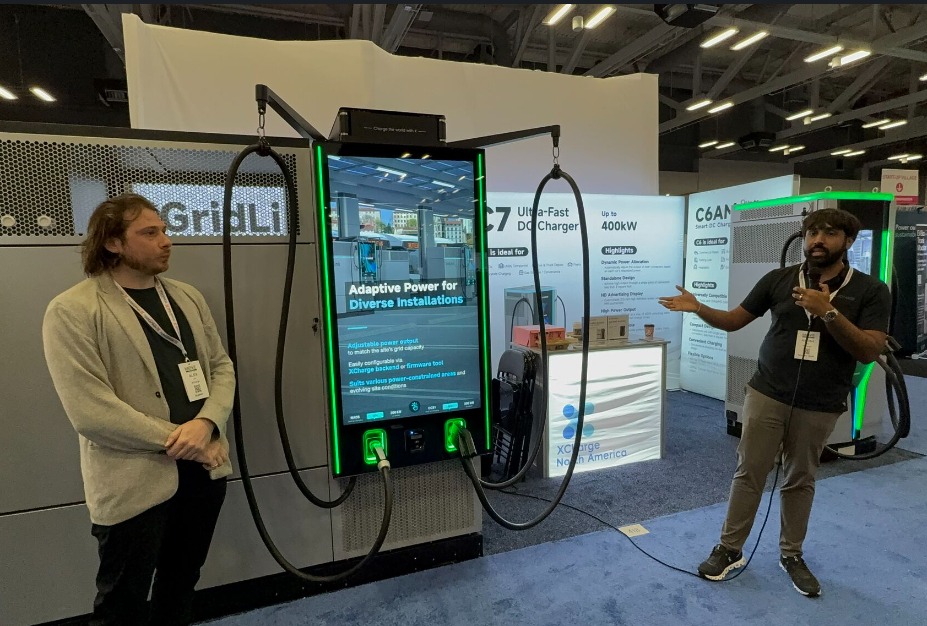

XCharge NA's Alex Urist and Aatish Patel demonstrating battery-integrated Gridlink range of fast chargers. Source: XCharge North America.

While CPOs continue to serve with their EV charging infrastructure, a number of carmakers are teaming up to form EV charging-focused joint ventures globally. We are also seeing energy companies foraying into this space by setting up their own network of EV charging facilities. How do you view this trend as an opportunity? Are you engaging with companies in those lines?

Patel: Yes, it is an ongoing discussion. I think a lot of companies have shifted their strategy from owning and operating the chargers to facilitating third-party partnerships to hybrid models.

We continue to stay engaged. We have cemented ourselves as a player in the space, and, with that, we continue to have discussions with the OEMs and the partners to help them drive their strategy on EV charging solutions.

However, these discussions are going to probably continue for the time being, until we get through this period of consolidation and turbulence. The situation in the space is still fluid and I think it is going to remain that way until supply reaches an inflection point.

That said, the direction is quite definitive. There is a need for EV chargers, there is a need for reliable EV solutions.

Urist: It is a continual process for us of talking with the OEMs, understanding where the capital is coming from, and then trying to understand what their strategy is for deployment too. There are different hardware strategies. Automakers often want the biggest and fastest chargers possible that their cars are compliant with.

But that said, I think where we are finding traction opportunities by understanding the value chain of automakers. For example, think about the dealerships and rental services, where people first experience an electric vehicle. Identifying how we can be part of that touchpoint is essential.

Lastly, what is your perspective on bidirectional charging technologies? In the US, the Department of Energy (DOE) has released its vision on the deployment of vehicle-to-everything (V2X) charging and expects it to become mainstream by 2030.

Urist: On V2X, I think we are seeing the greatest potential when we are integrating it with stable assets such as batteries.

Vehicle-to-grid (V2G) is great when you think about powering a home or a workplace, where you have stable assets that are parked there, and it can be a demand call that can be made.

However, the downsides as far as what still needs to be solved are: the remuneration process, how much money are you going to make when dispensing back to the grid on a need-based action? Who is going to be the custodian of that payment? And how much margin are they going to make from it to facilitate that transaction? That is a whole piece. Is it just a software line of code or an application programming interface (API) that is going to get plugged in to the overall stack, so that, a Level 2 EV charger provider can write this in under their open charge point protocol (OCPP) framework, that then there is a line of code, and someone is transacting and making the open automated demand response (ADR) call for demand response to dispense energy back. How are they getting paid out? Are you going get 10 cents for 1 kilowatt? You may be paid 20 cents for it at a public charging station.

How do you tailor that margin you are going to make? I think there are a lot of unanswered questions.

From the actual call of energy, absolutely, there is a huge amount of demand that is possible at your fingertips. But we think US consumers are entirely focused on the vehicle-to-home (V2H) case. In a natural disaster, where an EV owner has the option of feeding 10% of their battery back into grid to keep the grid on, versus having 100% of their battery to dispense that power back to their own house, I think they would pick the latter rather than the former.

So, I see a lot of constraints on the implementation of bidirectional charging technology on a wide scale.