Mobileye, a global leader in advanced driver assistance systems and autonomous driving technology, is planning to expand its commercial robo-taxi operations into key international markets. The company is conducting tests and deployments in cities including Los Angeles and Munich, with plans to enter other major mobility markets globally. This expansion is being pursued in close alignment through vehicle platform collaborations, regional regulatory frameworks and market conditions.

For further insights into Mobileye's strategy and technology integration, Owen Chen, Senior Principal Analyst at S&P Global, engaged with Johann Jungwirth (JJ), executive vice president, Autonomous Vehicles, who leads Mobileye's autonomous vehicle group, in a detailed Q&A discussion.

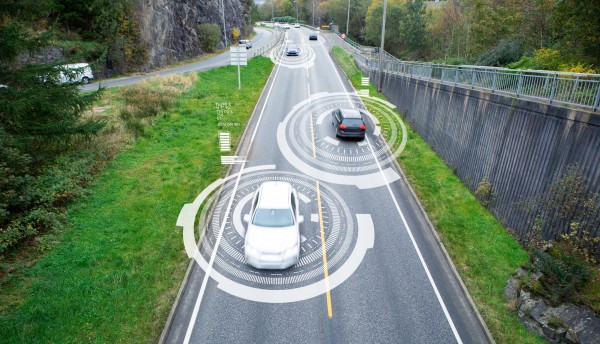

- Technology strategy: Mobileye is developing its Level 4 Mobileye Drive product, utilizing a vision-based primary subsystem and a secondary subsystem focused on imaging radar. The company incorporates lidar for surround sensing but plans to phase out side and rear lidars, concentrating on front lidar for redundant safety as part of its phased approach to deploying technologies in various generations.

- Market focus: Mobileye's initial market focus is the US, where it aims to remove drivers from operations by the end of 2026. The company has established partnerships with automotive manufacturers, including Volkswagen and Holon (a subsidiary of Benteler Group), to facilitate the deployment of robo-taxis and robo-shuttles in major cities such as Los Angeles. It has research and development locations with test vehicles operating in multiple geographies, including Austin, Texas; and Munich.

- Regulatory environment: Mobileye recognizes the importance of regulatory frameworks in different regions. While the US offers a self-certification type of legal landscape presently, Europe has varying regulations that limit vehicle deployments. However, there is a Type Approval process that Mobileye intends to meet in advance of EU-based deployments. Countries such as Norway are pushing for ambitious self-driving vehicle targets, which could influence Mobileye's strategies, where it also has a pilot project with Holo and Ruter.

- Future opportunities: Mobileye and its vehicle platform partners are exploring various transportation options, including robo-taxis, robo-shuttles, and potentially, robo-buses and trucking in the future. The company intends to adapt its reference technology stack for different vehicle types, particularly for consumer vehicles.

S&P Global Mobility: How does Mobileye determine the balance between using lidar and employing 4D radar, or potentially adopting a different approach similar to Tesla’s? Could you help us understand Mobileye's strategy in this regard?

Johann Jungwirth (JJ): As you know, we are a vision-first company with extensive experience, and computer vision serves as our foundation. For our Level 4 Mobileye Drive product, designed for driverless operation in robo-taxis and robo-shuttles, we have adopted a dual approach. Our primary subsystem is vision-based, while our secondary subsystem focuses on imaging radar.

Currently, we do incorporate lidar sensors in our secondary subsystem, primarily for surround sensing. However, we view our development in phases. In the first generation of our EyeQ 6-based self-driving system, we plan to utilize all three modalities: Surround vision, surround imaging radars (or 4D radars, of which are also Mobileye developed hardware and software), and surround lidars. Our strategy includes concentrating triple redundancy on the front sector, where we eventually plan to retain only a front lidar while removing lidar from the sides and rear.

This approach can be described in two phases. Safety is our top priority, which guides our decision-making process.

For context, our technology stack includes 13 cameras, similar in number to Waymo's 6th-gen setup. We utilize five imaging radars compared to Waymo's six, as they opted for two smaller radars in the front, while we employ a larger imaging radar with 1,536 virtual channels, complemented by smaller radars for the sides and rear. In the lidar domain, we currently cover the surround with both long-range and short-range lidars.

Is the lidar currently positioned only at the front?

In the second phase, we plan to remove the side and rear lidars. In the first generation, we utilize surround lidar, surround imaging radars and surround vision. The decision to eliminate side and rear lidars is based on several factors. For instance, imaging radars do not require cleaning solutions, while lidars do. Additionally, imaging radars have no moving parts, enhancing their reliability and durability compared to lidars, which typically do.

While lidars do offer certain advantages, our phased approach prioritizes safety, especially as we enter the market with our driverless self-driving system. We believe in maintaining triple redundancy for safety assurance, which is guided by data-driven decisions.

Our imaging radars are software-defined 4D radars that can switch between ultrashort, short, medium and long-range modes in real time, making them highly flexible and powerful. With 1,536 virtual channels, our front imaging radar produces a point cloud similar to that of lidar. We are excited to leverage advancements in system-on-chips (SoCs) and specialized antenna designs to achieve high resolution, sophistication, long-range capabilities and dynamic range, positioning us well for future potential.

Let me summarize to confirm my understanding of where Mobileye may be heading after the initial deployment of your Level 4 product called Drive. There are two main topics:

- Reliability: Initially, the corner radars used during early development will be replaced by Mobileye’s 4D imaging radar due to its advantages compared to lidar. The 4D radar does not require cleaning solutions and performs better in various environmental conditions, making it more dependable.

- Safety: Safety is a key concern, which is why Mobileye retain multiple sensor modalities for triple redundancy. Beyond sensor configuration, Mobileye are also deploying Safety Methodology that we call PGF, which stands for Primary, Guardian and Fallback. This is a perception logic sequence that, alongside our other intellectual property like open-standard driving policy framework RSS and mapping technology REM is designed to allow Mobileye to enhance safety.

Yes, I mentioned how we are thinking about technology phases earlier. Phase one encompasses all sensor modalities, including cameras, radars and lidars. In a future phase, as you correctly noted, we plan to maintain triple redundancy only in the front sector. Hypothetically, there may be another phase where lidar might not be necessary even in the front sector, but that decision will be made in the future based on data-driven insights.

Could you elaborate on your globalization and commercial plans?

Yes, first and foremost, we have established partnerships with automotive manufacturers, including Volkswagen (VW) with the ID. Buzz AD and Holon with what they call the Mover. Together with our partners in the automotive sector, we are executing an aggressive expansion plan for vehicle types such as robo-taxis and robo-shuttles.

For instance, VW has signed a public agreement with Uber to deploy Mobileye technology in Los Angeles. We currently have vehicles in LA undergoing testing and validation. Next year, VW and Uber intend to initiate closed user group testing to expand the fleet and onboard users, with a goal of going driverless by 2027, subject to regulatory approval.

In addition to Los Angeles, we have fleets operating in several major cities, including Munich and Hamburg, Germany; Austin, Texas; and Oslo, Norway. We also collaborate with Deutsche Bahn in Darmstadt, Germany. Furthermore, we have our own operational centers, for example in Tokyo, Japan, where we maintain a fleet of vehicles.

When analyzing competitors in the [mainland] Chinese robo-taxi market, it is evident that they prefer regions such as Singapore and the Middle East, where countries such as Dubai and Saudi Arabia make top-down decisions to adopt new technologies. These regions have clear regulatory plans aimed at implementing mobility solutions by 2030. From our interviews with these competitors, two main factors emerged:

- Regulation: The extent to which a city supports robo-taxi technology varies. For instance, London may be considered a secondary market compared to the leading regions in the Middle East and Singapore.

- Revenue potential: High taxi fares in cities like New York, London, Switzerland, Singapore, and Tokyo present significant revenue opportunities for robo-taxi services.

Our current primary focus is on the US, which we see as the leading market due to its self-certification process and faster time to market. Our goal is to remove the driver from operations in the US by the end of 2026, leveraging our relationship with Uber, particularly in Los Angeles, which is considered a significant opportunity. Successfully managing operations in LA represents a massive market potential, especially given the high rates for ride-hailing and taxi services.

In the US, the legal framework at the moment is based on legacy vehicle safety standards, and so there is a joint certification process that would need to be completed. Europe, on the other hand, is broadly divided into two parts: The European Union, where current regulations limit deployments to small series, and countries like Norway and Switzerland, which are not part of the EU. Norway, for instance, could see 30,000 self-driving vehicles in operation by 2030. Even if that target isn't fully met, Norway is establishing a regulatory framework that allows for self-certification, similar to the US.

Historically, Norway has been a leader in electric vehicle adoption, with over 50% of vehicle sales now being EVs, thanks to supportive regulations and incentives.

Additionally, we see promising opportunities in the Middle East, where our OEM customers, such as VW and Holon, are actively pushing for advancements. In Asia, particularly Japan, we are engaged in intense discussions with various parties on both the vehicle supply and operational sides. We also have a memorandum of understanding (MOU) with Marubeni that has been publicly disclosed, a major conglomerate in Japan, aimed at enhancing operations and deployment not only in Japan but also globally, including in the US. Our network encompasses both supply and demand sides, as well as fleet operation and deployment, which is quite robust.

How do you view the prospects for London in comparison, particularly regarding the introduction of autonomous vehicles in the city?

We've had extensive discussions about London, and the UK appears to be very receptive to new technologies. There is a market demand, and regulatory work is ongoing. The transportation system in London is unique and organized in a complex manner, often requiring top-down decision-making across various divisions and areas.

While there hasn't been a significant push for autonomous vehicles yet, we recognize the ongoing developments and remain open to opportunities. London is an intriguing market from both a transportation and demand perspective. However, we are currently awaiting final regulations and legislation.

I would certainly place London among the top 10 markets for autonomous vehicles. Although it hasn't yet ranked in the top three for our immediate customers and partners on the OEM side, that situation could change in the future.

Since Mobileye provides the driving technology, do you think the technology road map — the phases aforementioned — will vary by region? For example, Germany and the UK may have higher requirements, while the US has larger roads that simplify driving conditions.

No, we believe our technology stack will remain consistent across all regions.

What about the impact of weather?

Exactly. For instance, I recently spent several hours testing our Mobileye Drive self-driving system in both Jerusalem and Tel Aviv. The traffic in these cities is complex, with many e-scooters, bicycles, pedestrians and jaywalkers. This environment is similar to other dense urban areas like Hamburg and San Francisco. Even though we don’t experience four distinct seasons here, we do have a rainy season, which adds another layer of complexity to driving conditions. Our technology stack is designed to handle a wide range of environmental conditions and traffic complexities, including snow and road obstructions. We were the first company to operate a fleet of testing and development vehicles in New York City, where we tested our system in various conditions, including day and night driving, and through tunnels and bridges. This experience has provided valuable data for future development. Ultimately, we currently maintain the same technology stack everywhere.

Shifting to the go-to-market strategy and city selection, will you continue collaborating with Volkswagen in markets like Japan and the US, or are you seeking additional partners in other regions?

Yes, Volkswagen is a long-standing strategic partner, and we have a solid plan for cities and regions, including the US, Europe and the Middle East. We are currently in the execution phase, focusing on validation and self-certification to launch in the US next year. In parallel, we are working on homologation type approval for our planned European launches in 2027, which would involve going driverless. We are already operational in several cities with Volkswagen and other partners, including Holon, which offers different vehicle types for various applications.

Having Volkswagen as a long‑standing strategic partner is advantageous for scaling robo-taxi deployments. OEMs can provide vehicles that reduce costs and allow for adjustments before mass production, rather than retrofitting existing models. However, many taxi drivers operate independently or for fleet management companies, not OEMs. If Mobileye only supplies the driving technology, it may be easier to partner with platforms like Uber and Lyft. Is it feasible to collaborate with OEMs to fund fleet management companies that can provide vehicles for retrofitting?

While we see both approaches as viable, we are initially focused on integrating Mobileye Drive on OEM production lines as this offers significantly more scalable potential. Currently, we don't face a demand problem; our challenge lies in supply. OEMs typically engage when they see significant volume opportunities since they need to keep their factories operational. We see that Volkswagen is taking a strategic approach to mobility, particularly in autonomous driving and transportation as a service. They have a well-established financial services division that can help finance fleet operations. We view this as a win-win situation. We are also in discussions with other partners, including Marubeni in Japan, Uber, Lyft, and various operators in the public and private sectors, all of whom are ready to move forward as soon as vehicle supply is available.

We've covered safety and partnership topics, and I’d like to discuss route selection and traffic management. Are there specific routes you are considering, such as from airports to city centers, or will you focus on urban areas? What is your approach to operational design domains and map selection?

This is an important topic. One of our competitive advantages lies in our mapping technology, which utilizes crowd-sourced data through our Road Experience Management (REM) system. Unlike competitors who generally rely on static HD [high-definition] maps, we continuously receive millions of kilometers of data daily from over millions of vehicles worldwide. This allows us to automatically generate up-to-date maps for all public roads, including urban areas and connections to airports. Our focus on scalability enables us to expand rapidly, while our self-driving system operates efficiently, consuming only a few hundred watts of power — significantly lower than typical competing products, which generally consume tenfold at the multiple kilowatt level.

I’d like to ask about your strategy regarding robo-taxis versus robo-buses and robo-trucks. In Europe, there seems to be strong collaboration among companies like WeRide. Robo-taxis operate on fixed routes, which simplifies the process, while robust systems can provide more personal mobility. Given the potential for revenue in the US trucking industry, where driver salaries are high, why is Mobileye primarily focusing on robo-taxis? Do you see opportunities for robo-buses in Europe and robo-trucks in the US in the future?

Our collaborations offer both robo-taxis and robo-shuttles, covering passenger capacities from the single digits up to 15 and incorporates accessible mobility offerings. The demand for robo-shuttles is substantial, particularly due to high driver costs. Our strategy is to start with robo-taxis and robo-shuttles, while remaining open to expanding into smaller buses if demand increases. Our self-driving technology is compatible with larger vehicles, and we are developing capabilities to scale when the market demands it. Other form factors, like trucks, could follow as a subsequent focus.

Will last-mile delivery also be part of your considerations?

Yes, we are exploring this area, particularly in collaboration with vehicle OEMs and operators, but it is not a main focus. We see significant potential in consumer vehicles, particularly consumer autonomous vehicles. Our CEO has mentioned a target price of around $5,000 for the consumer eyes-and-hands off stack. If we can achieve this, it opens up a massive market opportunity for consumer AVs, which could eventually lead to vehicles designed without traditional controls, transforming them into versatile spaces like offices or lounges on wheels.

From Mobileye: Certain statements by Mr. Jungwirth are forward-looking and subject to risks and uncertainties. Actual results may differ materially from those indicated. For a discussion of factors that could cause such differences, please refer to Mobileye’s most recent Annual Report on Form 10-K filed with the US Securities and Exchange Commission.